A lot is riding on the successful rollout of COVID-19 vaccines. Much of Europe is already back under partial lockdown, as is a decent bit of the United States. We’re a year into this, and life is still thoroughly disrupted. Things won’t get back to normal until cases fall to more manageable levels, and that isn’t going to happen until a sufficiently large proportion of the population is given the jab.

This brings us to today’s stock, Big Pharma giant Pfizer Inc. (NYSE: PFE). As the maker of one of the first marketable vaccines, Pfizer would seem to be in a strong position to really do humanity a solid — while also enjoying windfall profits. With a price of about $19 per dose, Pfizer will reap several billion dollars in revenue. For every 26 million people vaccinated, Pfizer will gross about $1 billion. Pfizer is contracted to sell 200 million doses in 2021 in the U.S. alone and should generate anywhere from $8 billion to $14 billion in global sales this year. To put that in perspective, Pfizer generated about $48 billion in total company-wide sales over the past year.

The COVID-19 vaccine ought to be a big deal. But let’s take an objective look at Pfizer using Adam O’Dell’s six-factor Green Zone Ratings system to see how it stacks up.

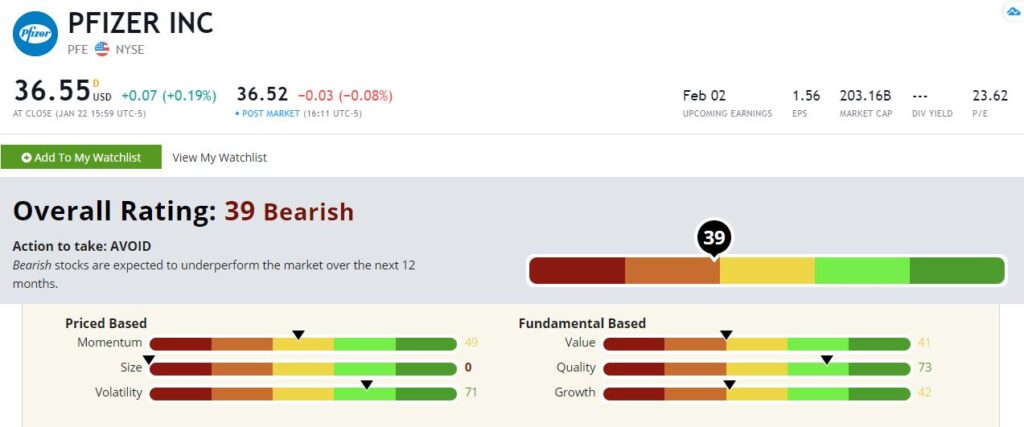

Pfizer’s Green Zone Rating on January 22, 2021.

Perhaps surprisingly, Pfizer sports an overall rating of just shy of 40, pushing it ever so slightly into bearish territory for us. Let’s take a look at the details.

Pfizer Inc.’s Stock Rating

Volatility — Pfizer scores well on volatility at 73 — meaning that Pfizer’s stock is less volatile than all but just 27% of the stocks in our universe. All else equal, low-volatility stocks are better performers over time. This is one of the secrets Warren Buffett figured out decades ago.

Quality — Pfizer also scores well based on quality, scoring a 73 on that metric as well. In our model, quality is measured primarily by profitability, efficiency and balance sheet strength. Pfizer outrates all but 27% of the stocks in our universe.

Momentum — Alas, from here, it drops off. Pfizer is very much in the middle of the pack in terms of momentum, with its rating of 49. That’s not bad, per se. It puts Pfizer more or less at the level of the broader market. But the basis of momentum investing is that buying begets buying as investors are attracted to shares in a strong uptrend. Pfizer’s score here, while not awful, just isn’t inspiring.

Value — Pfizer also sports a middling value score at 42. We rate stocks based on several value metrics and over varying time frames, preventing our numbers from being skewed by any single metric. Alas, no matter how you slice it, Pfizer isn’t particularly cheap.

Growth — Likewise, PFE’s growth hasn’t been much to write home about in recent years. The company rates at a 41 on our model, putting it firmly in the bottom half. Pfizer will get a growth bump this year due to the COVID-19 vaccine. But (un)fortunately (depending on your angle), that income stream won’t be recurring. Once the adult population is vaccinated, demand for Pfizer’s vaccine will drop off.

Size — Pfizer is a large-cap with a market value of over $200 billion. It rates a big, fat 0 based on size.

So, there you have it. While the headlines might suggest owning Pfizer is a no brainer, our Green Zone Ratings system tells a loser’s story. It suggests Pfizer will actually underperform the market over the coming year.

To safe profits,

Charles Sizemore is the editor of Green Zone Fortunes and specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.