One Bob is out. An old Bob is in.

Over the weekend, The Walt Disney Co. (NYSE: DIS) surprised everyone by firing CEO Bob Chapek and appointing former CEO Bob Iger to the job.

It’s been less than three years since Chapek replaced Iger, who was Disney’s CEO for 15 years.

What does that mean for Disney’s stock?

We’ll break down DIS using Chief Investment Strategist Adam O’Dell’s proprietary six-factor Stock Power Ratings system.

Its rating tells us whether this stock is one to buy … or one to stay away from.

Sluggish Growth Spells Doom for Disney’s Chapek

In June, the Disney board of directors voted to extend Chapek’s contract through 2025.

At the time, the board said Chapek’s leadership was key to helping the company through the COVID-19 pandemic.

But the latest quarterly report was the death knell for Chapek. Revenue growth struggled.

The chart below shows Disney’s quarterly revenue going back to 2020:

Coming out of the COVID pandemic, revenue started moving higher.

But it stagnated again in recent quarters.

DIS Stock Struggles Post-Iger

DIS is a well-diversified company with media and entertainment (Disney+) revenue streams alongside its parks and recreation division (Disney parks around the world).

Since the start of the pandemic, the company leaned into its Disney+ streaming service.

That paid off with more than 164 million subscribers as of November 2022.

The company’s bundle (Disney+, Hulu+ and ESPN+) has 235 million paid subscribers.

Streaming led to a 20% increase in direct-to-consumer revenue.

However, the streaming business continues to lose Disney money … to the tune of $1.5 billion last quarter and $4 billion for the year.

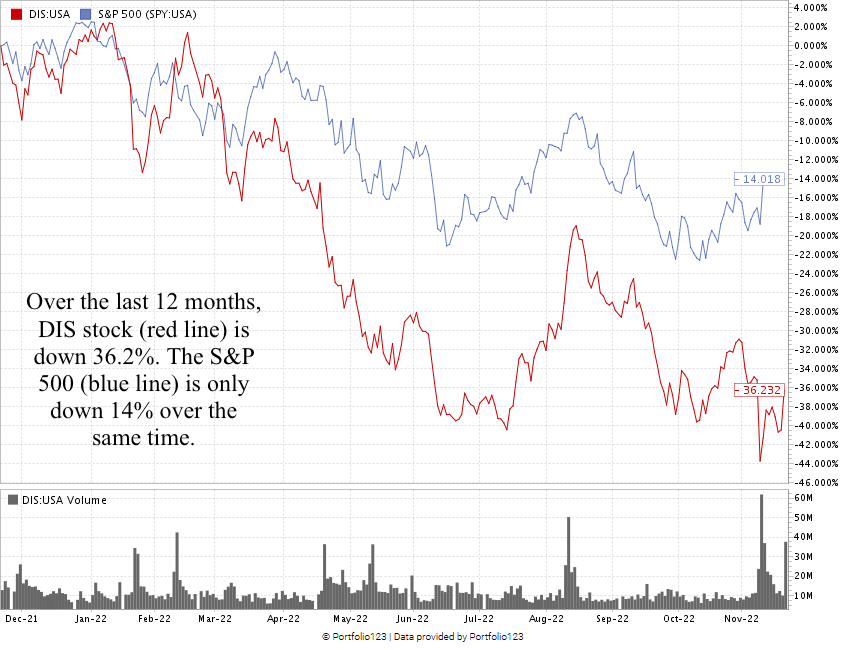

The cost-to-revenue downslide has translated to a sluggish stock performance:

DIS Stock’s Rough 2022

As I write, DIS stock is down 36.2% over the last 12 months.

The S&P 500 is down 14% over the same time.

DIS Stock Rating

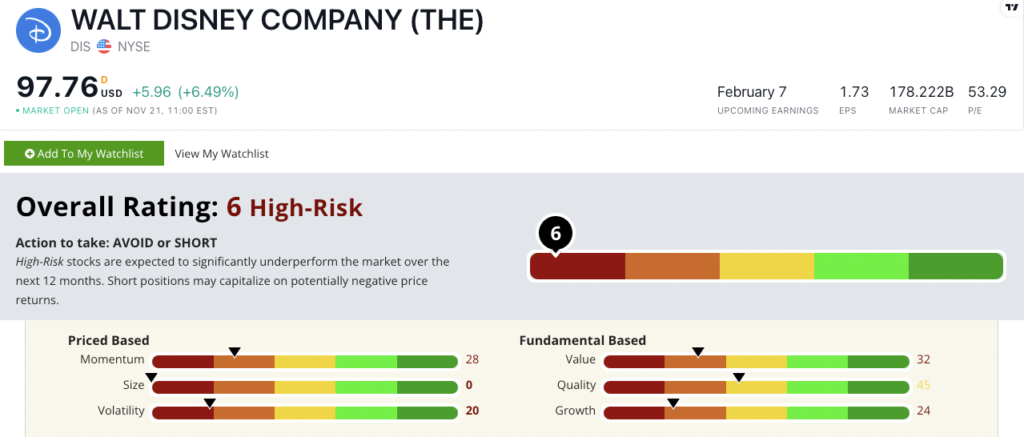

Using Adam’s six-factor Stock Power Ratings system, The Walt Disney Co. stock scores a 6 overall.

That means we consider it a “High-Risk” stock and expect it to significantly underperform the market over the next 12 months.

DIS rates in the red on five of our six factors:

- Size — With a market cap of $178.5 billion, DIS stock is one of the largest stocks we track. Don’t expect an outsized price bump based on its size. It scores a 0 on size.

- Volatility — DIS stock has encountered a lot of ups and downs over the last 12 months. It scores a 20 on volatility.

- Growth — DIS scores a 24 on growth with only 8.7% growth in sales over the prior quarter and a 2.2% growth rate in earnings per share.

- Momentum — DIS stock is down 36.2% since the same time a year ago. It scores a 28 on momentum.

- Value — Its price-to-earnings ratio is a massive 52.3, while its peer average is 12.5. DIS is extremely overvalued compared to similar companies. It scores a 32 on value.

One small bright spot is Disney’s stock quality.

Its returns on assets, equity and investment are in line or slightly above the industry average.

That earns it a 45 on our quality metric.

Bottom line: Bringing in former CEO Bob Iger to lead the business may turn around The Walt Disney Co.

To realize that turnaround, it’s going to take time and patience.

This is why DIS is a stock to avoid in your portfolio now.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist/editor for 25 years, covering college sports, business and politics.