Editor’s Note: LIVE on November 4, Adam O’Dell will prove that there’s no better time to start trading than right now, during a once-in-a-lifetime Perfect Trading Window. He’ll also reveal a simple strategy that’s ideally suited to exploit this market anomaly (It already crushes the market by 6X, but things are about to go ballistic!) Click here to reserve a VIP spot to this game-changing live event.

I often think of how important it is to pay attention to bonds. Some of the smartest people on Wall Street are involved in these markets.

The bond market requires a lot of math. For stocks, if we know the earnings and the current market price, we can generate an opinion of the stock’s fair value. For bonds, there aren’t any shortcuts to understanding the value.

Bond valuation requires understanding risks associated with the issuer, risks related to the economy and details of the bond itself. Each of those factors can be important to investors in the stock market.

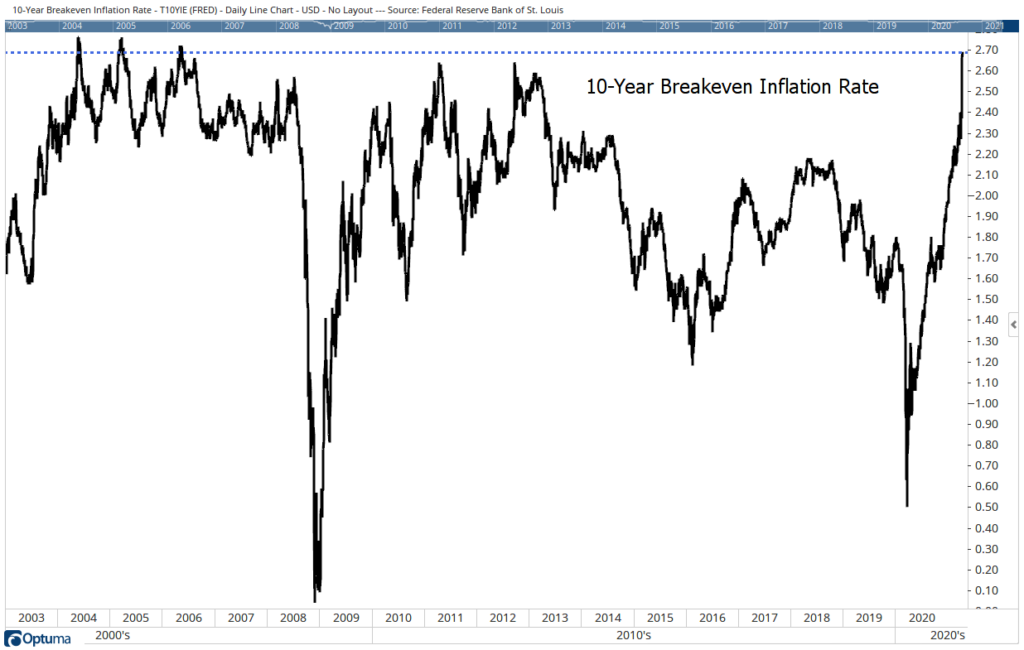

Recently, an obscure bond market factor points to problems for the economy. The breakeven inflation rate is a measure of the average rate of inflation expected over the next ten years. It’s based on market prices rather than the opinions of economists or Federal Reserve officials.

The fact that breakeven inflation rates are market-based makes them more important than economic forecasts. That’s because when forecasters are wrong, they change their forecast. When bond traders are wrong, they lose real money.

The chart below shows that traders with money at risk expect significantly higher inflation over the next ten years.

Traders Expect Prolonged Inflation

Source: Federal Reserve.

Bond Prices Predict Higher Inflation

Bond prices tell us to expect inflation to average 2.65% over the next decade. That’s well above the Fed’s target of 2%. This could force the Fed to make major changes to its policies.

If the Fed doesn’t change policies or its target, it will lose credibility, and that could send interest rates soaring. Changes to policy could be too late or too early, and that could also cause interest rates to rise.

Market-based inflation expectations are at a 15-year high, and few people seem to realize that. This indicates that something important will happen soon. Inflation will jump, or the Fed will act. Either way, stock prices will react, and investors need to watch breakeven inflation rates.

Michael Carr is the editor of True Options Masters, One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.

Click here to join True Options Masters.