Cryptocurrencies remain a hot commodity for retail and institutional investors alike.

Bitcoin surged back to around $60,000 earlier this week after trading between $36,000 and $48,000 since August.

Investors are turning to cryptocurrencies for a lot of different reasons:

- Unlike traditional currency, cryptos cannot be printed or seized and they potentially provide a safe store of value.

- That value cannot be diluted, as there is a limited supply. They are basically protected against potential inflation.

- Governments can’t tax cryptocurrencies until the owner of the tokens cooperates.

There are many other reasons why cryptocurrencies remain in-vogue with investors. But the lesser-known altcoin Solana has gone under the radar, yet provided a 15,000% return over the last 12 months.

In this episode of The Bull & The Bear, I tell you about how Solana is crushing the competition.

Money Pours Into Crypto, Just Like Stocks

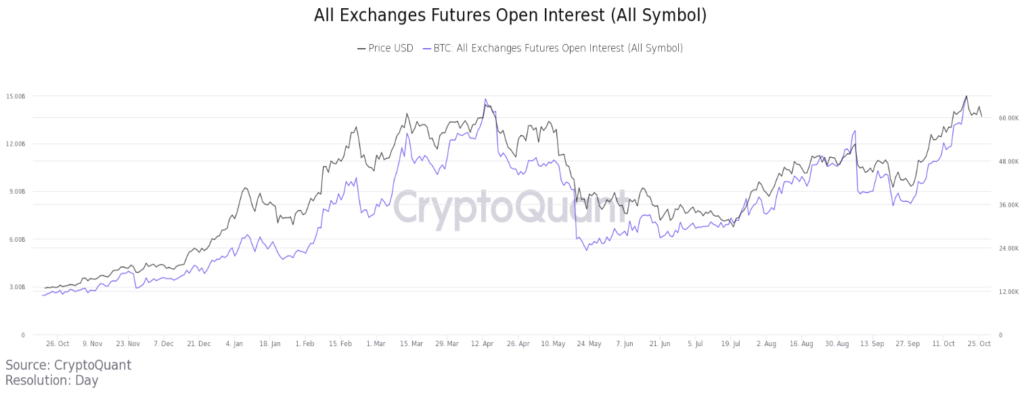

To gauge the current popularity of cryptos, we can examine the futures open interest in the world’s most popular cryptocurrency, bitcoin.

Bitcoin Futures Open Interest Remains Close to All-Time Highs

By definition, open interest is the total number of futures contracts held by market participants at the end of a trading day. You take all the contracts from open trades and subtract the contracts when the trade is closed to get the open interest.

Experts use open interest as an indicator to examine market sentiment and the strength of current price trends. With bitcoin, as with many cryptocurrencies, the open interest has risen along with the closing price.

As of mid-October, the open interest in bitcoin futures contracts reached an all-time high of $14.9 billion, while its price moved closer to $60,000.

This high point indicates that more traders are entering the market, infusing more capital into buying the cryptocurrency.

Solana follows the same trend and producing massive gains. Listen to The Bull & The Bear to find out why.

Pro tip: Imagine being able to target stocks that are about to shoot up like a rocket, with top gains as high as 430% in only 63 days. LIVE On Thursday, November 4 our chief investment strategist Adam O’Dell will reveal how he does it, and how YOU can use this strategy to take advantage of the “Perfect Trading Window” that’s opening up right now! To reserve a VIP spot for this game-changing live event, click here.

The Bull & The Bear

Led by Adam O’Dell and a team of finance journalists, traders and experts, Money & Markets gives you the information you need to protect your nest egg, grow your wealth and safeguard your financial well-being.

You can listen to The Bull & The Bear on Apple Podcasts, Spotify, Amazon and Google Podcasts. Make sure to subscribe and leave us a review.

Be sure to also subscribe to our YouTube channel for more videos like my weekly Marijuana Market Update. You can find more investing insights from Adam and Green Zone Fortunes co-editor Charles Sizemore in our Ask Adam Anything and revamped Investing With Charles videos, respectively.

Have something you want us to talk about? Email thebullandthebear@moneyandmarkets.com and give us your thoughts.

Check out moneyandmarkets.com, and sign up for our free newsletters that deliver you the most important and unbiased financial news, commentary, and actionable advice.

Also, follow us on:

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.