If you’re in the U.S., there’s a good chance you’ve filled up your car at a BP station, and maybe you’ve wondered if it’s a company worth investing in. Let’s explore the company’s outlook and see how BP PLC stock (NYSE: BP) score in our Stock Power Ratings system.

BP is one of the world’s leading energy companies, with a presence in over 70 countries.

It operates in two main areas:

- Exploration and production of oil and gas.

- Refining and marketing activities.

Over the past few years, BP has worked hard to reduce its carbon footprint and shift towards a more sustainable business model.

But what does this mean for the company and BP stock in 2023? Let’s take a closer look.

BP’s Business Performance

BP’s financial performance has been strong over the past few years, with revenues of $230.7 billion for the 12 months ending on September 30, 2022.

And its profits have benefitted from the bull market in energy stocks. It reported a 14-year profit of $8.4 billion for the second quarter of 2022.

This growth is largely attributed to increased production as well as improvements to its refining operations.

Environmental Impact and Outlook for 2023

In addition to its financial performance, BP has been actively investing in renewable energy sources such as solar, wind and biofuels.

The company aims to generate 50% of its power from renewable sources by 2030. In 2021 alone, BP committed $5 billion to renewable energy investments — this is part of a larger goal of investing $25 billion over the next decade on low-carbon technologies such as hydrogen fuel cells and battery storage solutions.

In June 2022, BP agreed to buy a 40.5% equity stake in Asian Renewable Energy Hub in an effort to boost global green hydrogen production.

Given these trends, it is likely that BP’s strong growth will continue in 2023 and beyond. In particular, the company’s focus on renewable energies will likely lead to increased profits as demand for these sources grows worldwide.

BP is also expected to continue focusing on cost-saving measures such as automation and digitalization that can improve efficiency while reducing risk across their operations.

As a result, it is likely that BP will remain one of the top players in the energy industry through 2023 and beyond.

BP Stock Power Ratings

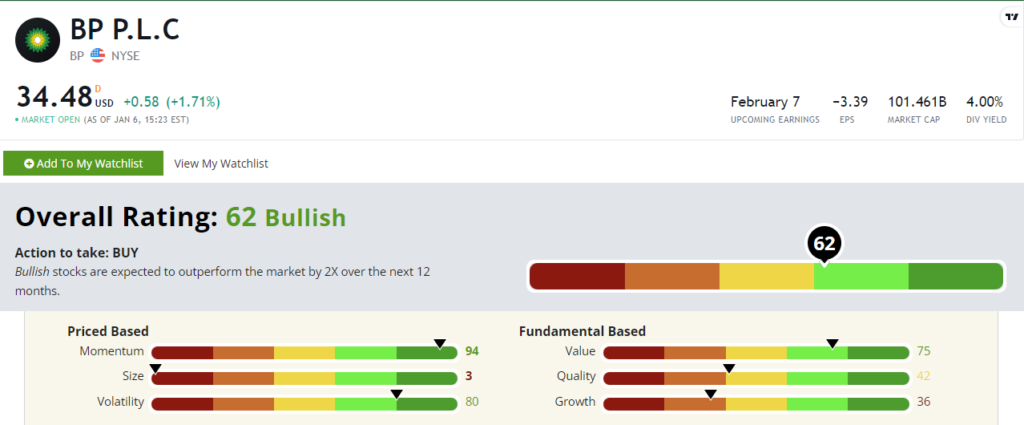

BP stock scores a “Bullish” 62 out of 100 on our proprietary Stock Power Ratings system. That means it’s expected to outperform the broader market by 2X over the next 12 months.

BP sports an impressive 94 out of 100 on our momentum factor. The stock has gained 30% in the last six months. And remember, this is a boring old oil and gas company, not some glitzy new tech stock.

It also boasts solid ratings on volatility (80) and value (75). That means BP stock is less volatile than 80% of more than 8,000 stocks we rate, and investors have not bid it up to unstainable price levels.

Bottom line: By expanding into new markets such as renewable energies while continuing to focus on cost savings through automation and digitalization, BP is sure to remain competitive within the energy sector for years. That’s why BP stock rates so well in our system right now.

P.S. If you’re looking for recommendations within the renewable energy mega trend, my colleague Adam O’Dell’s “Infinite Energy” presentation highlights the largest untapped energy source in the world.

This source is worth trillions of dollars and makes massive oil fields look tiny in comparison.

We’re still in the early stages, but this breakthrough is set to turn the global energy market on its head.

Make sure to watch his presentation for more information about this revolutionary new renewable tech (and the one company behind it all).