Bridgewater founder and Co-Chief Investment Officer Ray Dalio generally makes all of the headlines, but it’s his partner and fellow co-CIO, Greg Jensen, who is now sounding the alarm about a much greater negative outlook for the market and policymakers both.

“Earnings expectations particularly in the U.S. are too high, and generally the Fed and other policy makers are still expecting stronger growth than we see.”

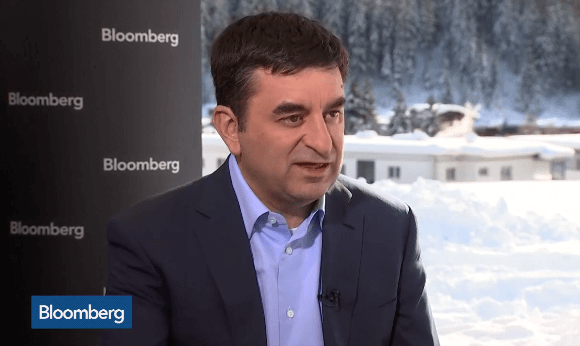

Per Bloomberg:

“While people have certainly diminished their growth expectations and you’re hearing all about that at Davos, we don’t think they’ve done it enough,” he said in an interview on Bloomberg TV Wednesday from the World Economic Forum. “Earnings expectations particularly in the U.S. are too high, and generally the Fed and other policy makers are still expecting stronger growth than we see.”

Jensen, who helps oversee the world’s biggest hedge fund at Bridgewater, said that he expects to see lower interests rates, particularly on the short-end of the Treasury curve. Regions that have priced in high growth expectations will be hurt the most. On the other hand, some emerging markets that have already suffered from the U.S.’s tighter monetary policy will benefit as policy makers resume easing, he said.

European markets will be the first test, he said, as the region is “starting from a worse level in terms of the economy, lower inflation — close to deflation in many places — and already have negative interest rates,” Jensen said. “Their movement will be kind of a leading indicator because they’re going to struggle more with easing” than the U.S. or China, which have “more tools available to them.”

In December, Jensen said growth in 2019 would be near recession levels at about 1 percent in the U.S., and slightly lower for the rest of the developed world. Jensen said cash continues as a viable alternative to U.S. stocks and bonds.

As the annual summit got underway on Tuesday, Bridgewater founder Ray Dalio chastised monetary policy makers for an “inappropriate desire” to tighten monetary policy faster than the capital markets could handle, but expressed hope that they were now looking to shift more slowly.

Westport, Connecticut-based Bridgewater oversees about $160 billion in assets. Its flagship hedge fund strategy Pure Alpha rose 14.6 percent in 2018. The macro manager trades globally across more than 150 markets.