November was an interesting month. Some stocks that have struggled the most in 2020 finally had their day in the sun. Battered value stocks showed signs of life for the first time in months.

As a case in point, consider British American Tobacco PLC (NYSE: BTI), the stodgiest of value stocks.

BTI was up 11% in November. But even after that move, the shares are still down by nearly a quarter from their pre-COVID-19 highs. British American owns the Dunhill, Kent, Lucky Strike, Pall Mall, Newport and Camel brands, among others.

It seems that a cigarette stock is something that many investors would prefer not to own during a respiratory virus pandemic. Smoking kills nearly half a million Americans each year, doubling the deaths from COVID-19 so far. And you might think that 2020 would be enough to make a smoker think twice before lighting up.

Yet, perhaps ironically, cigarette sales have enjoyed a slight comeback in 2020. Or at least the rate of decline has slowed. Cigarette sales fall 3% to 4% every year, and last year the trend accelerated. Sales declined by a noteworthy 7% in 2019. But through the midpoint of 2020, industry sales were on pace to be down only 2% to 3%.

Perhaps it’s stress or a lack of anything else to do while sitting at home, but Big Tobacco is shaping up to have a good year.

Tobacco stocks are strong dividend payers. BTI stock yields 7.6%. As was typical of European companies, BTI’s semi-annual dividend used to be variable and dependent on profits for the year. But in 2018, the company adopted a regular quarterly payout more in line with American norms. And BTI has raised its dividend every year since.

Tobacco stocks have high yields for two prominent reasons:

- The industry isn’t growing, so there is little need for major capital spending.

- Federal guidelines restrict marketing.

So, with effectively nothing else to spend the cash on, tobacco companies have more available to pay out as dividends.

But beyond this, tobacco is the quintessential consumer staple. It’s a basic product that gets used and replaced quickly. It helps that it’s also addictive.

Today, let’s take a look at British American Tobacco using our Green Zone Ratings model. We already know it’s a high-yielding dividend machine. Let’s see how it stacks up on other metrics.

British American Tobacco Stock Rating

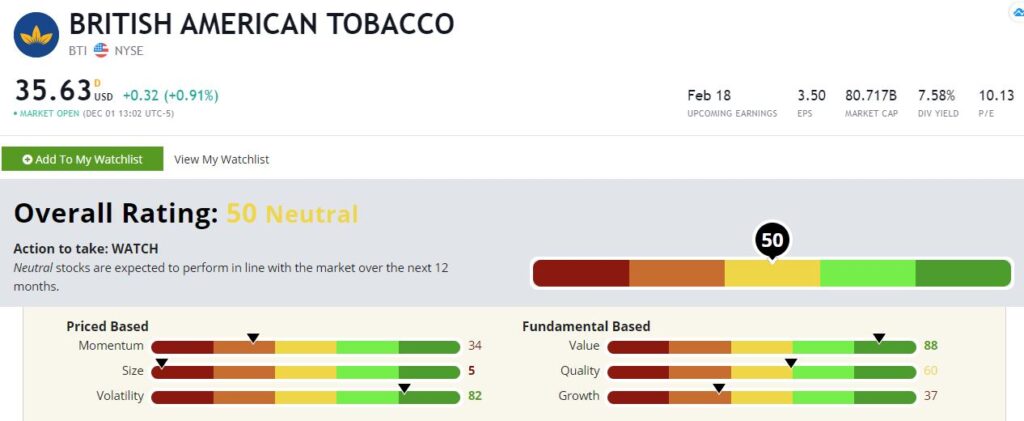

At first glance, BTI is the definition of average with an overall score of 50 out of 100.

British American Tobacco’s Green Zone Rating on December 1, 2020.

Stocks in this neutral zone are expected to move in line with the stock market averages over the following 12 months. Let’s dig into the individual metrics to see what may drive the stock higher.

Value — British American Tobacco stock rates exceptionally high on value with a score of 88. Only 12% of the stocks in our universe are cheaper. The past decade has been tough for value stocks. Investors have targeted growth stocks, and the pandemic only accelerated this. But, as the world slowly gets back to normal in 2021, there’s a good chance that value stocks take the lead, at least for a little while.

Volatility — In the world of investing, volatility is bad in most cases. Slow and steady wins the race. And BTI certainly fits the bill on that count. The stock rates as an 82 on volatility. While BTI’s product may very well give you a heart attack, owning the stock will not.

Quality — BTI rates respectably high in quality at 60. In our system, quality is measured by various factors tied mostly to profitability and debt management. BTI is a healthy company and has the financial strength to survive for decades in a truly brutal competitive environment.

Growth — From here, it drops off. BTI rates a 37 on growth. That meets expectations. British American operates in a world where falling volumes are the norm and where growth is accomplished through price hikes.

Momentum — British American also rates rather low on momentum with a rating of 34. Growth stocks have dominated the momentum trade in recent years. BTI is showing signs of life, but the stock hasn’t had much in the way of sustained momentum for years.

Size — And finally, we get to size. BTI is a large, established company with a size rating of 5. We can’t expect to get a small-cap bounce here.

So, what’s the final verdict?

Bottom Line: With an overall rating of 50, we shouldn’t expect major gains here.

But it’s important to see how the rating is calculated, and BTI rates high in value and volatility. If the bull market in growth stocks finally breaks in 2021, BTI might end up performing better than its middling overall rating would suggest. And even if it doesn’t, investors are being paid nearly 8% to wait. That’s not too shabby.

Money & Markets contributor Charles Sizemore specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.

Follow Charles on Twitter @CharlesSizemore.