Last week was a wild one for cannabis stocks. A new bottom formed that sent the positions in my Marijuana Millionaire Portfolio rallying. ALL of them. So we grabbed some gains and put that cash right back to work in another little company with big profit potential.

[And for the next few hours, you can still join the small circle of my readers poised to ride the next boom to huge gains … for years to come.]

There’s no question pot stocks are on the launchpad right now. Most of them are still pretty small, but that’s about to change in a big way.

Now, let’s take a look at five big developments that are on my radar right now … including some that could be profitable for investors who can grasp the big picture.

Let me begin with a chart that I think every marijuana investor needs to see …

Reason 1: It’s Still Way Early in the Marijuana Game

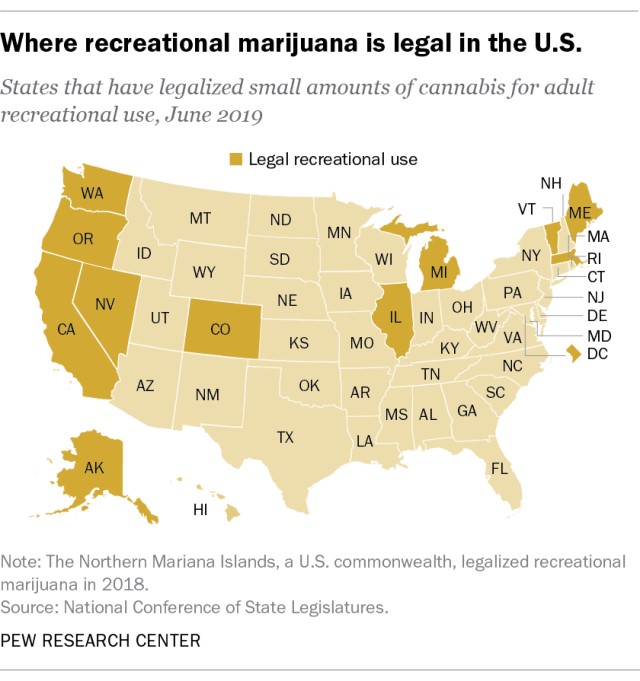

This chart showing where cannabis is recreationally legal is stunning in who HASN’T legalized yet …

Sure, California has legalized recreational weed. No big surprise, eh? But New York, Florida and Texas HAVEN’T legalized recreational weed yet.

How has Florida, the home of “Florida Man,” the state where a man tried to purchase a hot dog with cannabis … the state where a city actually warned its residents about a zombie uprising … the state where baby birds smoke cigarettes … NOT legalized recreational marijuana?

Well, New York tried this year and messed it up. They’ll try again. Florida will put it on the 2020 ballot. And Texas is, well … Texas. But the point is, these three states together have a population of more than 70 million people. California has just 40 million, and people lost their gol-dang minds at the thought of the Golden State legalizing recreational weed.

Do you think these states WON’T legalize weed? Colorado can give you a billion reasons why that view is wrong.

The point of that chart is we are still early in the game, folks. Legalization is going to be a huge driver of profits for select companies. There are markets that are untapped now. They won’t stay that way for long.

Speaking of California …

Reason 2: California is Facing a Weed Avalanche!

California’s regulated marijuana market will produce an estimated 9 million pounds in 2019. Does that sound like a lot? It is! Especially when you consider that the Golden State’s legal wholesale market will only buy 1.8 million to 2.2 million pounds.

To put it in other terms, even if farmers cut their production in half, they’d still produce twice as much marijuana as consumers are ready to purchase.

And that’s the legal weed. There’s still plenty of illegal marijuana in California.

Oregon already faced this problem. This year, farmers in the Beaver State produced six times the amount of weed that could be consumed. The price of cannabis fell like a rock!

Oregon’s answer has been to tighten up licensing and also put regulations in place that Oregon could quickly become an exporter if and when marijuana is legalized on a federal level. There is no word … yet … what California plans to do.

I’ve warned in the past about the “commoditization of cannabis.” There’s a reason they call marijuana a weed. There are cannabis-leveraged stocks with bright futures. But they have to have a plan beyond just growing the stuff.

Reason 3: Marijuana-friendly Laws in the Works

Our Congresscritters are trying to make laws on marijuana, most of them good. For example …

Nydia Velázquez (D-N.Y.), filed a bill (H.R.3540) that would allow marijuana businesses to access resources from the federal Small Business Administration (SBA).

Jared Golden (D-Maine) filed a bill (H.R.3543), the Ensuring Access to Counseling and Training for All Small Businesses Act, that would prohibit SBA partners that provide guidance and training services from denying help to businesses solely because a firm involves cannabis. That would also affect agencies that promote women’s and veterans’ issues.

Dwight Evans (D-Pa.) filed (H.R.3544), the Homegrown Act. That would establish an SBA grant program to provide funding to local and state governments to help them navigate marijuana licensing.

And Sen. Ron Wyden (D-Ore.) and Rep. Earl Blumenauer (D-Ore.) introduced legislation (H.R.1119) to allow marijuana imports and exports between states.

There’s a Grand Canyon of difference between filing a bill and seeing it become law. But, as the saying goes, “The journey of a thousand miles begins with a single step.”

Reason 4: 13.9 Billion Reasons to Legalize

What’s the most addictive substance known to man? Heroin? Crack cocaine? Nope, it’s tax revenue.

If you don’t think so, just try and get your government to do without it.

And that means there are 13.9 BILLION reasons to legalize marijuana.

That number comes from a study published last year. More than 300 economists, including three Nobel Laureates, signed a petition supporting a paper by Harvard economist Jeffrey Miron.

Miron argues the government could save $7.7 billion a year by not having to enforce marijuana prohibition. The report also found that taxing pot at rates comparable to those levied on tobacco and alcohol could raise $6.2 billion annually.

That’s a total of $13.9 billion in savings and income. This chart comes courtesy of Ro Khanna, who represents California’s 17th District, in the heart of Silicon Valley.

He gets it. You can bet that more and more legislators will get it as time goes on.

Reason 5: Another Retailer Catches the CBD Wave

It’s old news now that CVS and Walgreens are introducing CBD products in select stores. So here’s something new: Abercrombie & Fitch is going to sell CBD products at more than 160 locations.

That’s right, A&F, the clothing retailer. It’s going to sell CBD-infused beauty products.

A&F is partnering with Green Growth Brands (OTCQX: GGBXF) and will be selling its Seventh Sense line of wares, from lip balms to exfoliating body scrubs.

By the way, I added Green Growth Brands to my personal portfolio this past week. It wasn’t the only move I made; I bought a bushel of cannabis-leveraged companies.

Plus, I recommended a new pick to subscribers to my Marijuana Millionaire Portfolio. That’s because I believe the bottom is in. And it’s time to get busy in select stocks.

All the best,

Sean Brodrick