Last year, cannabis was already bigger than e-cigarettes, the Fortnite video game craze and Goldfish Crackers combined. Legal cannabis is even surpassing Taco Bell in terms of annual sales!

This year, the cannabis market will surpass $11 billion … on its way to $166 billion … $452 billion … and beyond.

Cannabis-leveraged stocks have been compressing recently, with the benchmark ETFMG Alternative Harvest ETF (NYSE: MJ) down 20% from its March highs. But these stocks are coiling up like a spring — the next move to the upside in this multibillion-dollar industry could be explosive.

Let me show you three charts that point the way to a potentially massive rally. First, via Bloomberg and Arcview Market Research, is the projection of legal cannabis stock sales in the U.S. …

U.S. spending on legal marijuana is expected to reach $22.2 billion in 2022. That’s on top of $5.9 billion in Canada.

This tells us that: A) global growth potential is huge, which is great for companies that can capitalize on this megatrend, and B) the current pullback is shorter term.

Obviously, companies that can make the most of that trend can do very well indeed.

Second is a chart of projected cannabidiol (CBD) sales in the United States. CBD is a non-psychoactive substance in cannabis. Like its cousin hemp, it has proven medical benefits.

After all, hemp was legalized on a federal level in last year’s farm bill. CBD made from hemp is generally legal, though FDA murkiness on the issue leaves market participants scratching their heads.

Nonetheless, the growth is explosive …

That’s a compound annual growth rate (CAGR) of around 40%. Wow! Select companies that are leveraged to CBD should be on the launch pad.

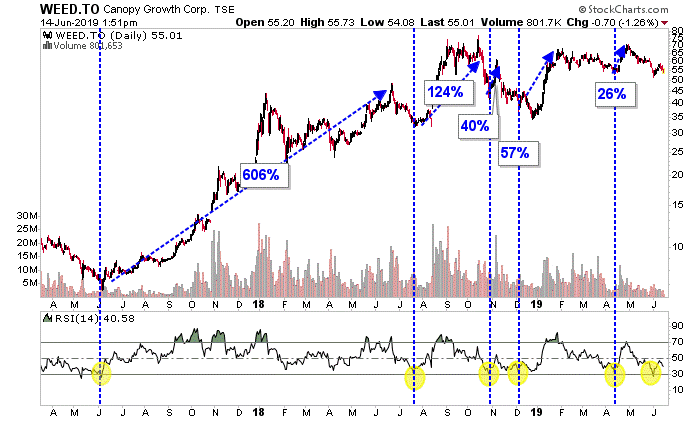

Finally, I want to show you a chart of Canopy Growth (TSX: WEED) (NYSE: CGC). Why Canopy? Because it is not only the largest cannabis company in the world. It’s an early industry leader with a clear history of leading the entire cannabis sector higher.

Image credit: StockCharts.com

On the bottom of the chart is a momentum oscillator called RSI, for relative strength index. Every time Canopy Growth has seen its RSI touch the oversold line on the bottom of the indicator, it has been followed by a rally. Not right away, but soon. Some of those rallies have been extraordinary.

When that “elastic” snaps back, all sorts of cannabis-leveraged stocks could catapult higher.

So … the cannabis market is growing by leaps and bounds. The CBD market is growing even faster. And a leading cannabis-leveraged stock is primed for an explosive move to the upside.

All of this tells me that it’s time to get busy in this industry. Many cannabis stocks are not what I would consider “cheap.” But the best ones are about to get more expensive.

I think the best deal in cannabis stocks right now is the FREE year of my Marijuana Millionaire Portfolio service that I’m offering for a limited time …

That’s 12 months of access to the powerful Weiss Cannabis Stock Rankings … first look at my exclusive video interviews with cannabis-industry insiders … all my newest research on the megatrends that are moving this industry forward (and key stocks higher) … and, best of all, every stock pick based on our $2 million Ranking system and my timely research.

Click here for more information and to claim your free year while you still can.

All the best,

Sean