Gold is up about 13.6% for the year. And that strength is surprising a lot of people.

There are bunch of factors shifting the metal’s move into higher gear. But today, I’m going to tell you about the most important one. One you should keep an eye on and use to your advantage in making investments.

The “usual suspects” of what’s driving gold include negative real interest rates, market uncertainty, geopolitical risk — especially in Hong Kong, the Middle East and Europe — fears over the global economy and buying by central banks and investors.

Speaking of investors — ETFs were buying gold again this week. Total gold held by ETFs is up 14% so far this year to 80,965,950 troy ounces. And as for central banks, they purchased 547 metric tons (17,586,460 ounces) through the end of the third quarter. That raises their gold holdings a collective 12%. That’s near a 10-year high.

These things are important. But they’re not THE most important driver of gold.

Do you want to know what that most important thing is? I’ll show you.

The most important thing driving gold right now is the amount of negative-yielding debt in the world. You can see on the chart how gold is tracking negative-yielding debt closely.

A dozen countries around the world — including heavyweights like Japan, Switzerland, France and Germany — have 10-year-bonds with negative yields. That means if you buy one of their 10-year bonds, at maturity, you get back less money than you paid for it.

In other words, you are guaranteed to lose money.

This is on its face absurd. It shows how bad central bank polices have distorted the market beyond recognition. It raises the odds of something going catastrophically wrong in the debt markets.

But while we can complain all we want, that’s the new reality.

The amount of negative-yielding debt surged earlier this year to $16.8 trillion on Aug. 30, and the price of gold rose right along with it.

Negative-yielding debt then pulled back, and the markets breathed a sigh of relief as the total negative-yielding debt dropped to $11.5 trillion on Nov. 8.

Gold pulled back too, but not as much. Probably because of all those other forces I mentioned that are lining up to push the metal higher.

But NOW, the amount of negative-yielding debt is rising again. It’s at $12.6 trillion — and climbing. Based on history and this chart, the price of gold is going to go higher, too.

And THAT’S why you want to own gold and gold-leveraged stocks.

Why does the amount of negative-yielding debt impact the price of gold? Because it levels the playing field. One of the arguments that the bears like to make about gold is it pays no interest. Well, I can give you 12.6 trillion reasons why there are worse investments.

There is another chart people should be watching. They aren’t, though. And that chart tracks the TOTAL amount of global debt.

It recently soared over $250 trillion. I told you about the debt tsunami last week. You know, you just know, that governments will try and print their way out of the mess they’ve created.

And they can’t print gold.

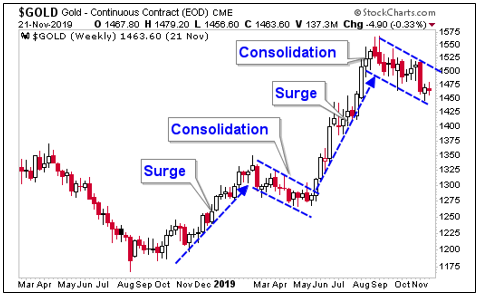

But let me close with one more chart, this time of gold itself …

This chart shows gold’s bull run since last year. It surged … then consolidated … surged … and is now consolidating again.

You’ll want to be onboard for the next surge higher.

All the best,

Sean

To our friends: It’s not a mining stock, ETF or bullion — but this virtually unknown $7 investment could hand you a small fortune as gold soars higher. If you’d like to learn more about the No. 1 gold play for 2020, click here.