Berkshire Hathaway Inc. on Saturday reported a $1.1 billion first-quarter loss as new accounting rules forced it to change the way it accounts for the value of its investments.

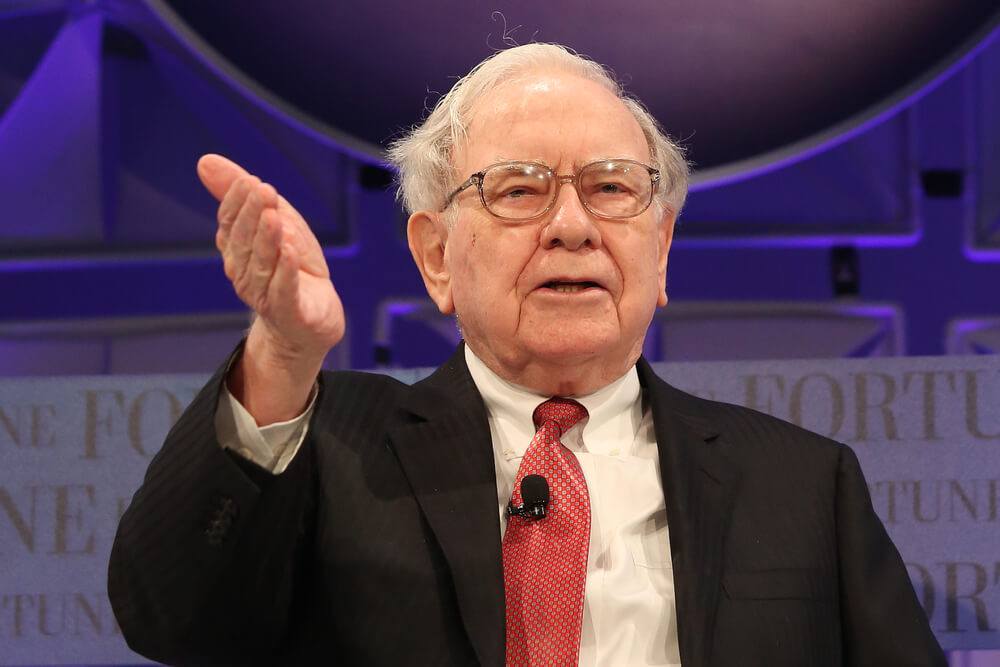

Warren Buffett’s conglomerate reported the loss of 46 cents per Class B share shortly before its annual meeting in Omaha, Nebraska. A year ago, Berkshire reported $4.06 billion in net income, or $1.65 per Class B share.

Buffett has long said Berkshire’s operating earnings offer a better view of quarterly performance because they exclude investments and derivatives, which can vary widely.

By that measure, Berkshire reported operating earnings of $5.3 billion, or about $2.14 per Class B share. That’s up from $3.6 billion, or about $1.78 per B share, a year ago.

Analysts surveyed by FactSet expected operating earnings of $2.08.

The biggest factor in the quarterly loss was that Berkshire recorded a $6.3 billion loss on the paper value of its investments in the quarter.

Berkshire’s revenue declined to $58.47 billion in the quarter from last year’s $64.37 billion. But Buffett said Saturday that most Berkshire businesses are performing well and the economy remains strong.

“We have jobs available one way or another at most of our companies,” Buffett said.

Berkshire’s insurance unit, which includes Geico and several large reinsurance firms, reported a $407 million underwriting profit, compared to a $267 million loss a year ago.

BNSF railroad added $1.1 billion to Berkshire’s profit, up from $838 million last year.

Berkshire’s assorted manufacturing, service and retail businesses generated $1.8 billion net income, up from $1.3 billion a year ago.

Berkshire Hathaway Inc. owns more than 90 companies, including railroad, clothing, furniture and jewelry firms. Its insurance and utility businesses typically account for more than half of the company’s net income. The company also has major investments in such companies as American Express, IBM and Wells Fargo & Co.

© The Associated Press. All rights reserved