Jakob Fugger is a name you probably haven’t heard of before.

But he helped finance empires and popes … all while amassing one of the largest fortunes in history.

A bulk of his wealth came from merchandising as well as copper and silver mining during the 16th century.

At the time of his death in 1525, Fugger’s fortune was valued at $400 billion to $500 billion. This accounted for about 2% of Europe’s entire economy at the time.

While Fugger made most of his money in the mining business, I want to focus on what he did with that money.

In 1521, he founded the Fuggerei — the world’s oldest social housing complex — that is still in use today in Augsburg, Germany. The idea was to create a community of affordable housing.

This vision was akin to the modern-day apartment complex.

Fugger understood how important it was to have a home … whether you were rich or poor.

Homeownership has been a cornerstone of the American dream, but high interest rates, rising home prices and a squeeze on available housing are the stark reality today.

Recent data shows that may be changing.

Today, I want to share that data and show how our proprietary Stock Power Ratings system found a stock in the homebuilding sector you should consider for your portfolio.

The Housing Market Heats Up

After 12 months of declines in both new home construction and existing home sales, the market started to pick back up in February.

According to the National Association of Realtors, sales of existing homes jumped 14.5% from January to February.

Buyers got a dose of good news as, after 131 months of year-over-year price increases, the cost of buying a home started to decline.

That spilled over to new home construction:

The number of permits issued for new home construction increased by 13.8% in February. That reverses four-straight months of declines.

It’s a promising trend reversal after a rough close to 2022.

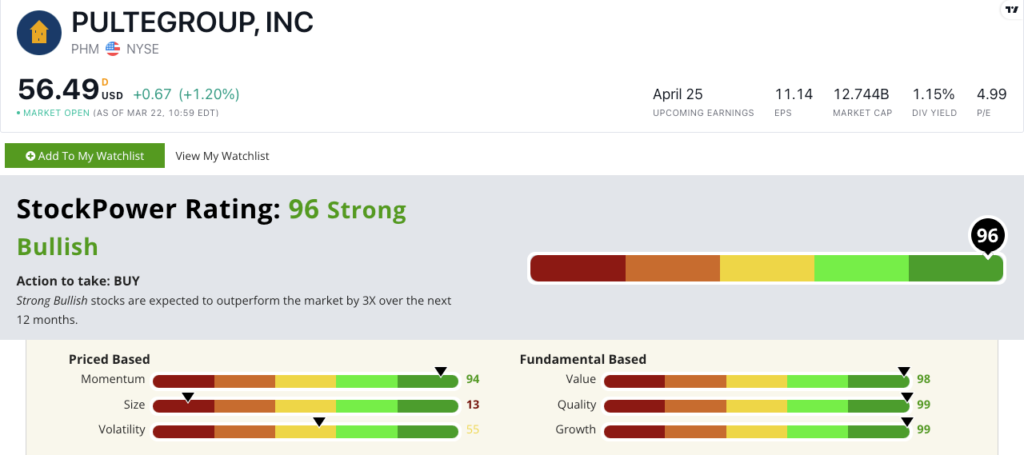

I used our Stock Power Ratings system to find a stock that can best capitalize on this latest trend … and this one scores 96 out of 100, making it a great potential investment.

PulteGroup Stock: 1 Co. Builds AND Finances New Homes

Searching for the perfect home isn’t easy. You know what you want and how you want it.

You also know how much you’re willing to pay.

In a lot of cases, potential homebuyers opt to build their dream home rather than try to find the perfect existing one.

That’s where today’s Power Stock is a market leader.

PulteGroup Inc. (NYSE: PHM) builds homes across the country. It also provides mortgage banking, titling and insurance for homebuyers.

Its 96 out of 100 score on our Stock Power Ratings system means we are “Strong Bullish” on the stock and expect it to outperform the market by 3X over the next 12 months.

As you can see from the ratings chart above, PulteGroup stock has outstanding fundamentals as well as bullish momentum.

The stock scores a 99 on our growth factor and its recent 2022 annual report provides insight into why:

- The company reported $16.2 billion in total revenues … an 18.7% increase over revenue in 2021.

- Net income was $2.6 billion … a 34.5% jump from the year before.

PulteGroup stock is also high quality — scoring a 99 on that factor.

Its returns on assets, equity and investments as well as margins all beat the homebuilders industry averages.

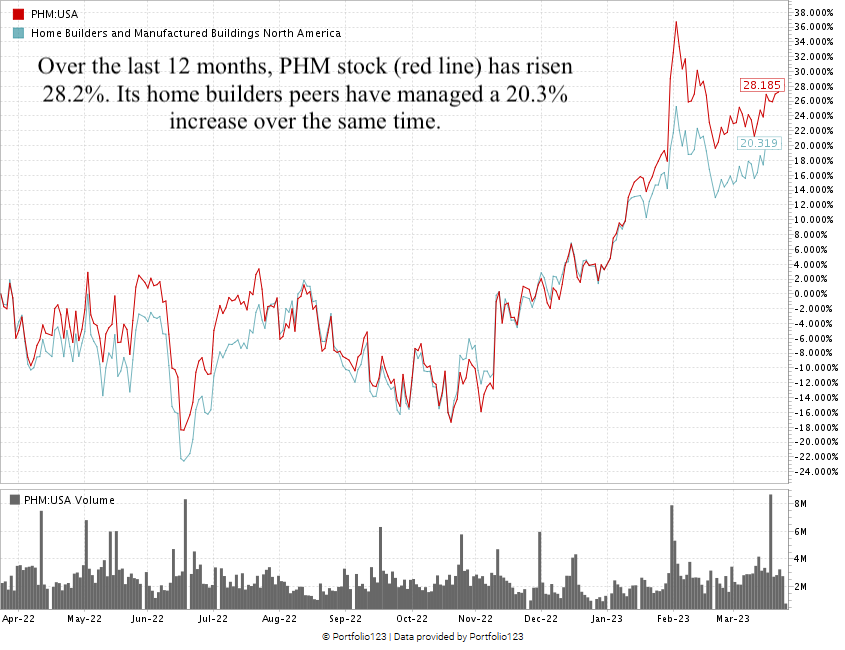

Then, we have its market-busting momentum:

Created in March 2023.

After sideways trading for most of 2022, the stock started to take off in November.

Over the last 12 months, PHM is up 28.2% while its homebuilding peers have averaged a 20.3% gain over the same time.

PHM is showing the “maximum momentum” we want to see in stocks.

The stock scores a 96 overall on our proprietary Stock Power Ratings system. That means we are “Strong Bullish” and expect it to beat the broader market by 3X over the next 12 months.

Bottom line: After languishing for months, homebuying … and homebuilding … is showing signs of life.

PHM is a market leader in helping potential homebuyers build their perfect dream home.

That’s a strong reason why PulteGroup stock should be considered for your portfolio.

Note: PulteGroup’s 1.15% forward dividend yield pays shareholders $0.64 per share per year.

Stay Tuned: The End of the Free Money Era

Tomorrow, Adam O’Dell is going to tell you why the Federal Reserve can’t be fast and loose with its monetary policy anymore, and what that means for markets from here.

And get ready to hear more from Adam every Tuesday in Stock Power Daily from here on out!

Until then…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets