Editor’s note: Matt walks you through how to find the right value stocks in today’s piece, but make sure to check out an offer that’s closing soon toward the bottom of this article.

Last week, we turned the keys to Stock Power Daily over to Mike Carr, our senior technical analyst.

I hope you read his essays to get a solid understanding of his approach to the markets and the economy.

He took value investing for a bit of a ride. That’s OK because thinking about markets in a different way opens the door to opportunities you may not have considered before.

An educated investor is likely a richer one.

Besides, we aren’t strict value investors here. If we were, this publication would probably be called Value Power Daily, not Stock Power Daily!

The beauty of our Stock Power Ratings system is that value is one of six factors we look at. Adam O’Dell developed this tool so that you can find the absolute best of the best in whatever factor you choose to focus on.

And the strongest investment opportunities are based on good ratings in multiple factors (more on that below).

To show you what I’m talking about, let’s look at the argument of growth versus value that’s played out over the last year or so…

When Value Stocks Took Center Stage

Back at the end of 2021, I made a bold … and what might have been an unpopular call on the markets.

I said that the environment was shaping up for value stocks to outperform growth stocks.

This was after growth stocks had blown past value stocks for over a decade during the last bull market.

So I went out on a limb because my analysis and insight from Chief Investment Strategist Adam O’Dell showed some pain ahead for growth investors.

Not to toot my horn, but the call was right. In 2022, value stocks averaged a 7.6% loss amid the bear market while growth stocks tanked more than 30%!

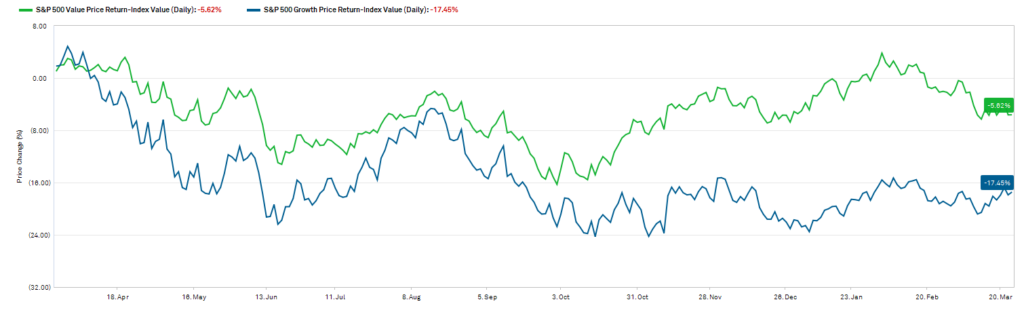

That trend has carried over into this year:

Value Outperforms Growth Over Last 12 Months

As you can see from the chart above, the gap between value (shown in green) and growth (shown in blue) has widened.

The S&P 500 Value Index is only down 5.6% while the S&P 500 Growth Index is off by 17.5% since March 2022.

And I warned about one of the biggest factors that led to this shift in my December 2021 prediction: rising interest rates.

You see, when interest rates rise, investors start dumping growth stocks because the value of their future earnings becomes less attractive against, say, bonds.

Inflation hits the future cash flows of companies and higher interest rates mean it’s more expensive to borrow money, which hits growth stocks that rely on future growth.

Value stocks, all of the sudden, look a lot more attractive and are trading at much cheaper valuations compared to their growth peers. Pair that with greater resistance to higher interest rates, and you can see why the market has shifted over the last year or so.

The longer interest rates remain high, the greater the negative impact that will have on growth stocks. And that’s a benefit for value stocks.

Stock Power Ratings Goes Beyond Pure Value Stocks

The beauty of our Stock Power Ratings system is it allows you to find the best stocks … no matter what kind of investor you are.

Looking for a high-growth stock? You can focus on the overall rating and our growth factor rating.

It works the same for value, quality, momentum, etc.

You can also combine factors.

That’s exactly what I did here.

I used the system to find a stock with a high overall score, coupled with high momentum, value and quality.

I included quality because, as both Adam and Mike Carr have said, a lot of nuance in value investing is lost if you’re only looking at a narrow set of metrics … such as the price-to-earnings ratio.

By adding quality, I can eliminate companies that are just cheap without good future prospects that will boost the stock price. I verify sales and earnings are strong, in addition to a “cheap” stock valuation — and that gives us a better chance at buying stocks with better potential to go higher from here.

I filtered to make sure the stocks I look at rated 85 or above overall and on those three factors.

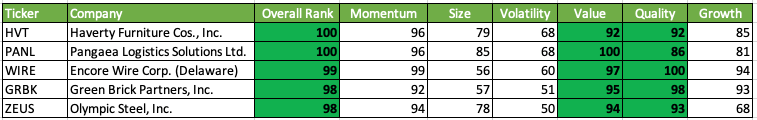

Here are five that made the cut:

All five of these stocks rate above 98 overall, meaning we are “Strong Bullish” and expect them to beat the broader market by 3X over the next 12 months.

They’re all above 92 on value and 86 on quality as well. And they all sport strong momentum too.

This tells me these are stocks that are undervalued but have strong balance sheets … avoiding that “value trap” I just mentioned.

I’ve written about four of these stocks in previous issues of Stock Power Daily — meaning the system already identified them as strong contenders for your portfolio.

Bottom line: It’s OK to focus your investment strategy on one factor or another.

But the great thing about using the Stock Power Ratings system is it combines factors to find even better opportunities in the market.

Before I go… I kicked off this piece talking about Mike Carr’s takeover of the Stock Power Daily that occurred last week.

That event led to the big reveal of his brand-new “9:46 Rule” trading strategy. Mike is targeting 50% gains every day using the rules of this strategy. And he only needs 15 minutes of market data to know where to place his trade each morning shortly after the market opens.

The best part is that you can see how he does it in his live trade room — every day the market is open. (You’ll see me in there most days as well providing insights using our Stock Power Ratings system.)

The doors are closing on this chance to join Mike in the trade room later today, so click here for all the details you need to gain access now.

Stay Tuned: A Strong Bullish Cancer Fighter

The fight against cancer never stops. Companies spend billions researching and developing new treatments for the disease that affects millions of Americans every year.

Tomorrow, I’ll reveal a 100-rated pharmaceutical company that has developed a revolutionary treatment for one of the most common forms of cancer — and its stock is soaring higher in response.

Stay tuned…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets

P.S. Tell us what you think about value investing. Do you consider yourself a value investor or growth investor … or neither? What factors do you look at the most? Email us at StockPower@MoneyandMarkets.com and let us know!