Last week, the bulls came out in force to push the market higher.

In fact, the S&P 500 posted its second-best week since President Trump was elected last November.

All three major indexes posted solid gains as investors held out hope for a favorable outcome in the U.S.-China trade fight.

Which sectors benefited the most?

Are things back to normal in Big Tech land?

That’s what this edition of What My System Says Today is all about!

I’ll break down how the 11 major sectors did in comparison to the S&P 500. Then, I’ll show you the stocks that were the “biggest movers” on both the positive and negative side.

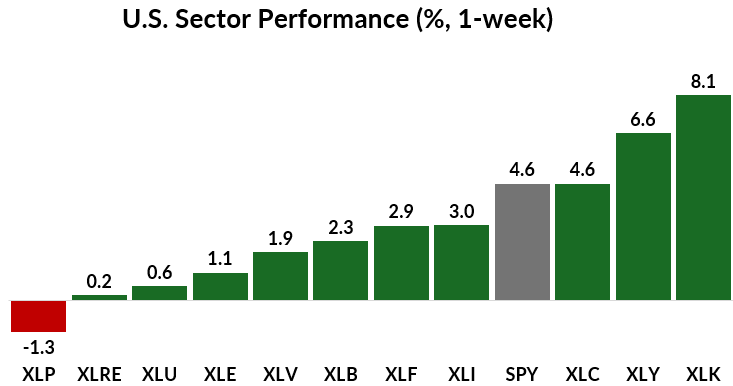

Let’s get right to it by looking at how major U.S. stock sectors fared last week:

Key Insights:

- The S&P 500 (SPY) closed the week 4.6% higher.

- 10 out of 11 sectors showed a positive gain for the week.

- Eight sectors underperformed the broader S&P 500.

- The tech sector (XLK) rallied the strongest, with an 8.1% gain.

- Consumer staples (XLP) was the only sector to post a loss (-1.3%).

One note here…

While all but one sector finished last week in positive territory, a minority of sectors beat the market. This is in contrast to the week prior, when the broad market was essentially flat, while a majority of sectors beat the index.

What gives?

It all seems to come down to the performance of the technology sector, where the largest “Big Tech” stocks have the greatest influence over the market index’s direction.

In short, when Big Tech is firing on all cylinders, the index motors higher, but most sectors lag the benchmark. Conversely, when Big Tech is down, it weighs heavily on the index, but most sectors have a good chance of beating it.

All told, this is why it’s important to have exposure to Big Tech (which you likely do through index funds) … but also make tactical plays across all sectors, which is precisely my strategy for running the Green Zone Fortunes model portfolio.

Now, let’s take a closer look at the tech sector’s top-performing stocks through the lens of a simple momentum screen…

The Best-Performing Sector: Tech’s Recovery Rally

There seems to be a pattern recently…

Any news that could be perceived as progress in the ongoing trade war between the U.S. and seemingly every other major global economy triggers a new wave of bullish activity — and the tech sector tends to lead the rally.

As mentioned, the so-called “Magnificent Seven” stocks, and Big Tech more generally, have enjoyed an incredible bout of outperformance since late 2022.

But that doesn’t mean these stocks will always appear on our momentum screens or that they’re the best place for your money today…

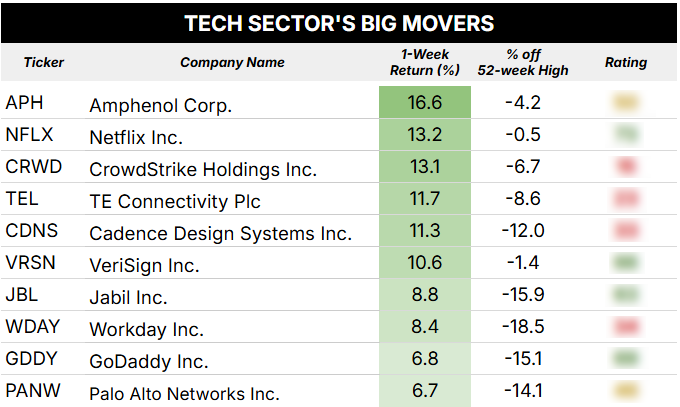

After screening for all S&P 500 tech sector stocks that closed last week within 20% of their 52-week highs, you can see the top performers from last week in the table below:

Overall, there are some Big Tech names in here… but there’s a distinct lack of “Mag 7” in my Top 10 momentum screen. Here’s why…

Microsoft (MSFT) and Apple (AAPL) are now within 20% of their highs, but failed to produce a weekly gain strong enough to make the Top 10 list. Meanwhile, the other five Mag-7 stocks posted gains of between 10% and 25% … but still remain more than 20% off their highs!

This just goes to show that investors have generally been eager to “buy the dip” in Mag-7 stocks; however, they still have a long way to go before recovering the price peaks these stocks made in February.

I think you can do better by looking for bullish opportunities in stocks that have less ground to recover, including some of the stocks listed above.

Here you’ll see a real mixed bag of ratings — four stocks rate “Bullish,” four rate “Bearish,” and the other two are “Neutral.”

While investors are branching out in the tech sector, my Green Zone Power Rating system says only 40% of the stocks above are expected to outperform the S&P 500 over the next year. That means this is still very much a “stock pickers market.”

Now let’s see which stocks pulled the consumer staples sector lower last week…

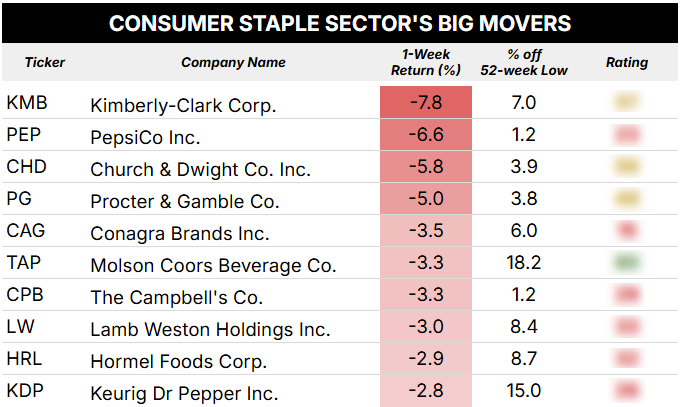

Last Week’s Laggard: Consumer Staples

When investors turn bullish again, defensive sectors like consumer staples typically take a hit.

We saw that last week, as the Consumer Staples Select Sector SPDR Fund (XLP) was the only sector to post a negative return over the five trading days (-1.3%).

Here’s what my screen of the sector revealed:

If you’re going off of Green Zone Power Ratings, it’s clear to see why investors sold off most of the stocks above…

Only one rates “bullish,” while the rest are either “neutral” or “bearish” in my system.

If you put all 10 of these stocks in a hat, there’s only a 1 in 10 chance you pull the stock that my system says should outperform from here. I’ll pass on those odds!

Again, we’ve been enjoying a mostly bullish market since 2022, and the tech sector has been the star of the show. But to find the best opportunities, it pays to “get picky” using a tool like my Green Zone Power Ratings.

Have a great week!

To good profits,

Editor, What My System Says Today

P.S. On Wednesday, I will send out my next monthly recommendation to my Green Zone Fortunes subscribers. I’m recommending a stock that’s in one of the hottest mega trends of this uncertain market. Click here if you’d like to join and get your portfolio ready before I send out my brand-new recommendation in just a couple of days!