Last Friday, we pulled the trigger for our seventh winner out of eight trades…

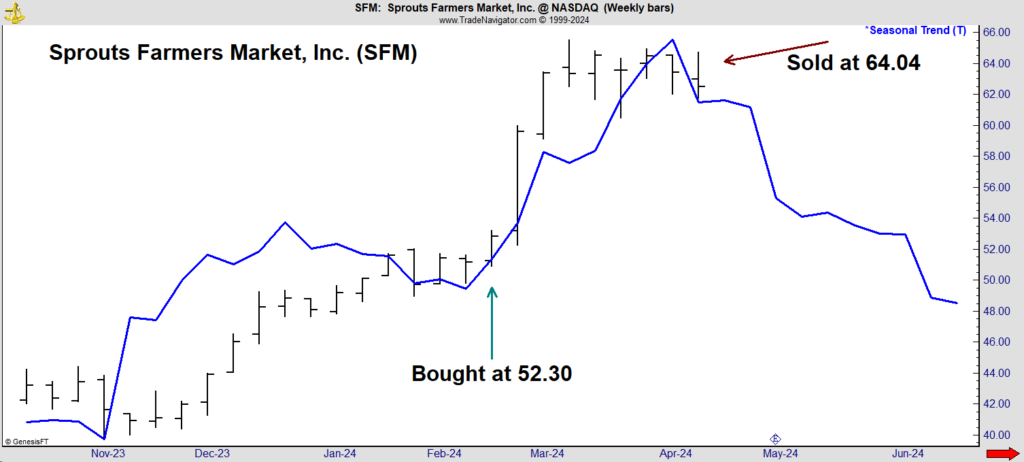

I told my Apex Alert subscribers to sell Sprouts Farmers Market Inc. (Nasdaq: SFM) after holding the stock for about two months.

Those following the trade knew the date we were selling before they even bought the stock. They also knew ahead of time that we would be buying a stock in the food and beverage sector.

That’s all thanks to a simple seasonal calendar that lays out the predetermined sectors and dates to trade.

To construct the Apex Calendar, I studied 20 years of stock market data to identify the optimal seasons for owning different market sectors. The result was a calendar that shows the exact buy and sell dates for 15 trades a year.

These are trades with the highest probability of delivering profits for those specific holding periods.

Apex Alert subscribers already know the entry and exit dates for trades in 2025, 2026 — and every year beyond that. What we don’t know in advance is exactly which stock to buy.

And that’s where Adam O’Dell’s Green Zone Power Ratings system comes in…

Trade the Top Stock in the Best-Performing Sector

The calendar is a powerful investment strategy in itself. But it becomes even more effective when combined with the ratings system that drives a lot of what we do at Money & Markets.

Every time we enter a seasonal trade window, I review the power ratings of stocks in the sector. In February, for example, that process pointed me to SFM — a stock that had already gained more than 60% in the previous 12 months.

Now, this large gain indicated that the stock carried momentum into the upcoming seasonally bullish period. Its overall rating of 94 at the time showed it not only had momentum — but it also offered great value and quality.

When we sold the stock last week, we booked a gain of 22%. Meanwhile, the S&P 500 Index gained just 2.1% during the time our position was open (February 15 to April 12).

Take a look at the chart below. It shows SFM’s seasonal trend (the blue line). Seasonality was a factor that weighed heavily on the sell date.

We Hit the Apex of SFM’s Profit Season

Last year, after the end of the buying season, the stock dropped about 7% in two weeks. It then moved sideways for about three months.

SFM fell more than 35% in 2022 after the end of the buying season that year. History shows that losses often follow strong runs in this stock. That is why we followed the Apex Calendar and held SFM for a specific short period. It’s designed to make sure we avoid these likely downtrends.

Collect Wins in Any Market

Our trade in SFM demonstrated the power of seasonality.

Few traders look at this factor. Yet we have studies showing it is persistent and can help identify winning trades in any market environment.

Seasonality can also help traders avoid times when a stock is unlikely to perform well. Selling as seasonal trends turn bearish can help grow wealth by allowing us to move into other stocks with bullish seasonals.

In some ways, we are buy-and-hold investors in Apex Alert. We are just buying different stocks and holding them only when history shows us it’s best to do so.

This process reduces the risk of holding a stock in a downturn, especially when the seasonal pattern points to weakness.

If you’d like to see the full details of this strategy, and learn how you can get a copy of the Apex Profit Calendar, you can do so right here. We just entered the tech sector with my latest recommendation, so now is the perfect time to join as we continue stacking profits.

Until next time,

Mike Carr

Chief Market Technician