When markets reach new highs, many investors vow to buy after the pullback.

However, they forget to follow through because it is difficult to know when the pullback has ended.

If you’re eyeing gold, this looks like the time to buy. Gold offers a clear signal that the pullback is ending.

Gold reached new highs in July when the metal traded for more than $1,940 an ounce.

Many individuals buy SPDR Gold Trust (NYSE: GLD) for exposure to gold. This gold ETF trades at a price equivalent to about 1/10 of an ounce of gold.

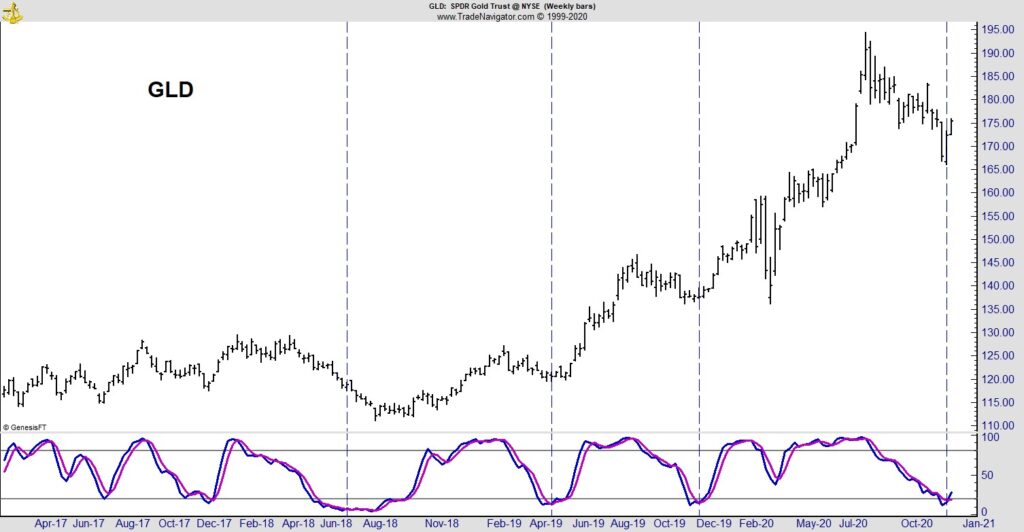

The chart below shows GLD as it fell more than 14% from its all-time high. A momentum indicator at the bottom of the chart indicates that the GLD gold ETF is now on a buy signal.

GLD’s Momentum Suggests a Buy Signal

Source: Trade Navigator.

How Gold ETF Investors Will Profit

This chart uses weekly data and shows stochastics as the momentum indicator.

Stochastics tends to be more profitable using weekly data than with daily or shorter-term data. There are fewer signals on the longer time frame, reducing the number of short-term losing trades. This indicator uses two lines to show the trend’s direction — signals fire when the lines cross.

The formula for calculating stochastics sets a lower limit of zero and an upper bound of 100. Values below 20 are relatively rare, as are readings above 80. The thin gray lines in the chart show the 20 and 80 levels.

Trade signals tend to be more reliable when they occur in these extreme areas.

The blue dashed lines highlight recent buy signals from oversold extremes. Two came as the GLD gold ETF bottomed and began strong up moves. The first one, in June 2018, was early but near the bottom.

Charts of ETFs tracking gold mining stocks, junior mining companies, silver and silver miners show a similar signal.

Using history as a guide, now is the time to buy the GLD gold ETF, other gold investments or silver.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.