If you were hoping for economic growth in 2021, I have bad news.

Inflation remains low, with the latest government data showing the consumer price index (CPI) increased by 0.2% in November.

Details within the report show inflationary pressures remain subdued.

The category with the largest change was fuel oil — a common heating fuel in the North East, and the 3.6% increase in prices was normal for this time of year.

Other changes in the CPI components were more restrained, but some clear trends are emerging since the economy shut down.

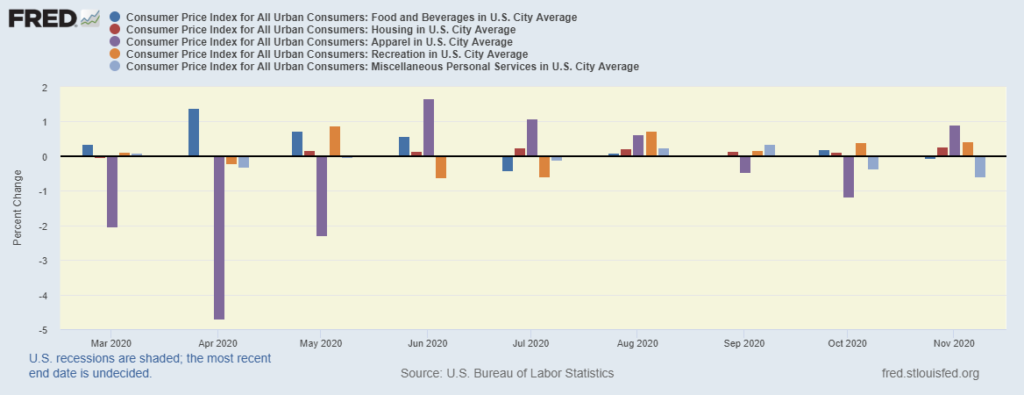

The chart below shows price changes of five categories in the CPI.

Consumer Price Index Data Doesn’t Bode Well for Economic Growth in 2021

Source: Federal Reserve.

Personal Services Decline Could Stunt Economic Growth in 2021

Food and beverage prices stabilized. This is the blue bar that shows a spike in the spring when the shutdowns started. Supply chains responded quickly, and food prices moved back to normal.

Housing, the red bar, shows small gains month after month. This contrasts with the headlines about apartment rents dropping in big cities. Housing generally moves steadily higher, and the pandemic didn’t change that.

Apparel prices, the purple bar, shows strength in November, a sign that consumers could be shopping for clothes again. But it’s also possible this is a seasonal quirk since November requires winter clothes. December’s data will be important to watch for this category.

The most troubling data in the chart is the decline in prices for personal services.

Personal services often require close contact. This category includes haircuts, yoga classes and other wellness activities.

The drop in prices could indicate demand is falling.

Hairstylists might be suffering from George Clooney’s admission that he cuts his own hair with a Flowbee system. Do-it-yourself haircut products sold out after that news.

It’s unlikely anyone thinks he can look like George Clooney by cutting his own hair. It’s more likely Clooney’s acceptance of at-home hairstyling made it acceptable for many to give in to fear.

The most important data in next month’s inflation report could be the personal services category. Until these small businesses can hold the line on prices, economic growth is doomed to crawl.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.