A financial crisis in 1837 touched off a trend that’s grown into a nearly $100 billion market today.

The United States experienced a period of economic expansion from 1834 to 1836. Commodity prices rose to new levels and international trade boomed.

But then a devastating winter killed American wheat and cotton crops, putting pressure on everything from labor to westward expansion.

By May 1837, a bank run, mass unemployment and next to no imports of American goods created a global recession.

Consumer spending tanked in response.

In order to make it easier for people to buy more expensive goods, such as furniture and farm equipment, producers developed a system where consumers could pay off purchases over time.

This was the first instance of the buy now, pay later financing.

Today, the buy now, pay later market is worth an estimated $100 billion in the U.S. … and it’s growing at a rapid pace.

I’m going to share what I found out about investing in buy now, pay later (BNPL) companies using our Stock Power Ratings system in a bit.

But first…

The Buy Now, Pay Later Market Continues to Soar

While credit cards remain the preferred way to spread payments out on smaller purchases, there are advantages to using BNPL:

- It breaks down payments into smaller amounts.

- Loans typically come with 0% interest.

- And it can provide financing without a “hard” credit check.

These benefits have caused an explosion in the BNPL market in the U.S.:

Data from Insider Intelligence shows the payment value of the BNPL market in the U.S. was only $3 billion in 2019.

That rose to $42.6 billion just two years later, as financial pressures due to the COVID pandemic made BNPL more attractive.

By 2026, the value of the BNPL market is estimated to reach $143.4 billion in the U.S. alone — a 4,680% jump from 2019.

And as that market continues to grow, major players have taken notice.

New Player in the Buy Now, Pay Later Game

After some developmental delays, Apple Inc. (Nasdaq: AAPL) launched its BNPL service last week.

The Apple Pay Later feature was launched to random Apple Pay users and the company plans to roll it out to a broader audience in the coming months.

Apple Pay Later users can spread purchases ranging from $50 to $1,000 over four payments in a six-week period with no interest or fees.

But this rollout comes at a time where BNPL companies are simultaneously facing rapid expansion … and scrutiny.

In 2021, Swedish-based Klarna was the most valuable fintech startup in Europe with a valuation of $45.6 billion. In July 2022, though, Klarna’s valuation dropped to $6.7 billion after raising $800 million in a funding round.

This reflects a dour perspective on Buy Now Pay Later stocks, as investors grow wary of their ability to withstand a recession.

Take Block Inc. (NYSE: SQ). The fintech company, best known for its small-business point-of-sale terminals, purchased Australian BNPL company Afterpay for $30 billion back in February.

Just a couple weeks ago, Block was targeted by short-seller Hindenburg Research for its decision to buy Afterpay.

At the same time, more players are establishing a foothold in the BNPL game. Walmart Inc. (NYSE: WMT) and PayPal Holdings Inc. (Nasdaq: PYPL) have jumped into the deep end of the BNPL pool.

That leads to…

Should You Invest in Buy Now Pay Later Stocks?

I turned to our Stock Power Ratings system to find the answer.

There are several fintech exchange-traded funds (ETFs) out there, but I wanted to be more specific to companies that specialize in BNPL.

So I scanned various ETFs and pulled other names working in the space, and ran them through the ratings system.

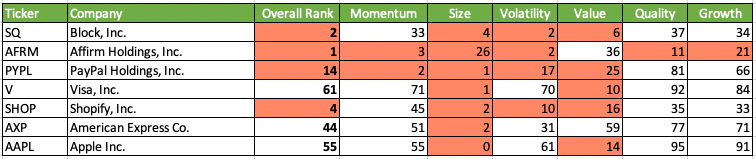

Of the seven I zeroed in on, four rated “Bearish” or lower, two were “Neutral” while only one was “Bullish.”

Buy Now Pay Later Stocks Average “Bearish” Stock Power Ratings

The average overall score of stocks I examined was 26 out of 100. This indicates our system is “Bearish” on this group of stocks.

All seven rated low on our size factor and five scored “Bearish” or lower on value.

Bottom line: The buy now, pay later purchasing plan is expected to grow massively in the next few years.

But competition in the space is already high. Some of these companies are struggling to secure new customers. No one is exhibiting market dominance.

While there is a lot of revenue to be had in BNPL, our Stock Power Ratings system tells us now is not the best time to invest in the space. We’ll keep an eye on this mega trend to see if a company comes out ahead and turns into a stock to buy in the future.

Stay Tuned: What’s Next for the Global Energy War

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Tomorrow, Adam O’Dell will share the latest on a key investment theme for the 2020s — the Energy War — and the steps you should take today to make sure you’re on the winning side.

Stay tuned…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets