Sometimes, I just want to drive.

I don’t need a destination. But, after two years stuck at home, I want to see what’s going on around me.

It also gives me time to think about big investing ideas.

One thing stood out during last weekend’s excursion: Construction is booming in South Florida.

Cranes and walled-off construction zones lined I-95 as I drove south to Miami.

And mixed-use development (think retail shops on the first floor and condos/apartments above it) is everywhere!

Artist rendering of Strata Wynwood, a mixed-use development in Miami’s Art District. Plans call for 257 residential units along with retail and office space. (Rendering courtesy of Wynwood Miami.)

It got me thinking: With all of this development, there has to be a path to profits for smart investors like us.

Using Adam O’Dell’s six-factor Green Zone Ratings system, I found a real estate investment trust (REIT) with strong stock performance … and a Florida connection.

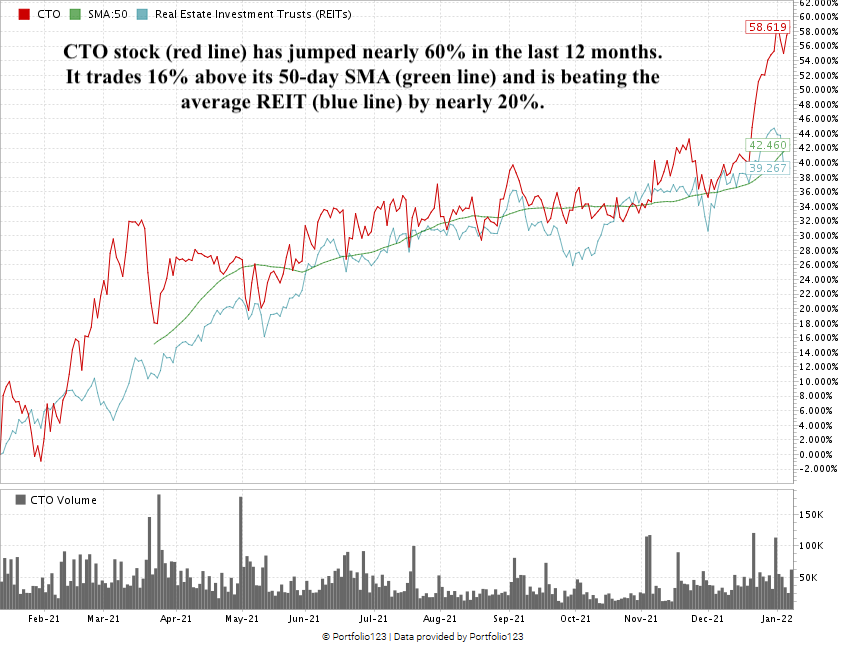

The company’s stock jumped nearly 60% in the last 12 months… and 2022 is going to be even stronger.

The stock rates “Strong Bullish” in Green Zone Ratings, which means it is poised to outperform the broader market by at least three times over the next 12 months.

Pro tip: This stock appears on our January 5 Money & Markets Hotlist. Since then, the stock’s price has jumped up 2.3%. Click here to learn more about our weekly hotlist.

Let’s see why investors should buy this commercial REIT now.

Commercial Real Estate Prospects High for 2022

Commercial real estate didn’t have a great 2021.

Prospects for commercial real estate development was the lowest it’s been in five years in 2021, according to developers surveyed by PwC and the Urban Land Institute.

However, in 2022, developers believe prospects for all types of commercial real estate (industrial, single-family, multifamily, office, hotel and retail) will reach pre-COVID levels again.

Investors can find big profits in this trend.

Small Commercial REIT, Big Future: CTO Realty Growth Inc.

CTO Realty Growth Inc. (NYSE: CTO) is a Winter Park, Florida-based commercial REIT.

It owns and operates commercial real estate in high-growth areas across 10 states including Florida, North Carolina, Texas and Arizona.

Its tenants include grocery stores, retail outlets and restaurants.

According to its last quarterly report, CTO has:

- 19 properties under management — REITs own more than 503,000 properties in the U.S, so CTO is relatively small. By comparison, Prologis Inc. (NYSE: PLD) … which I recommended last week … has 4,675 buildings under management.

- 2 million square feet of lease space — PLD has 994 million square feet under management.

- $43 million of in-place net operating income — PLD has $3.3 billion in net operating income.

- 100% rent collection.

Focus on that last statistic for a second. In its third quarter of 2021, CTO collected all rent owed. With COVID-19 wreaking havoc on the retail industry, the company’s clients still paid their bills.

Total annual revenue for many REITs, including Prologis, declined in 2021.

CTO, on the other hand, managed to increase its annual revenue, despite COVID-19 challenging the retail and real estate sectors.

After bringing in $56.4 million in 2020, CTO increased its annual revenue to $62 million in 2021. It’s projected to reach top-line revenue of more than $66 million by the end of this year.

CTO stock jumped 32% from January to March last year. It saw a slight decline into April but found more solid footing in May and traded at a resistance point of around $53 per share into October.

After an up-and-down November, CTO shot past $61 by the end of December and carried that momentum to a new 52-week high of $63 last week.

CTO Realty Growth Inc.’s Stock Rating

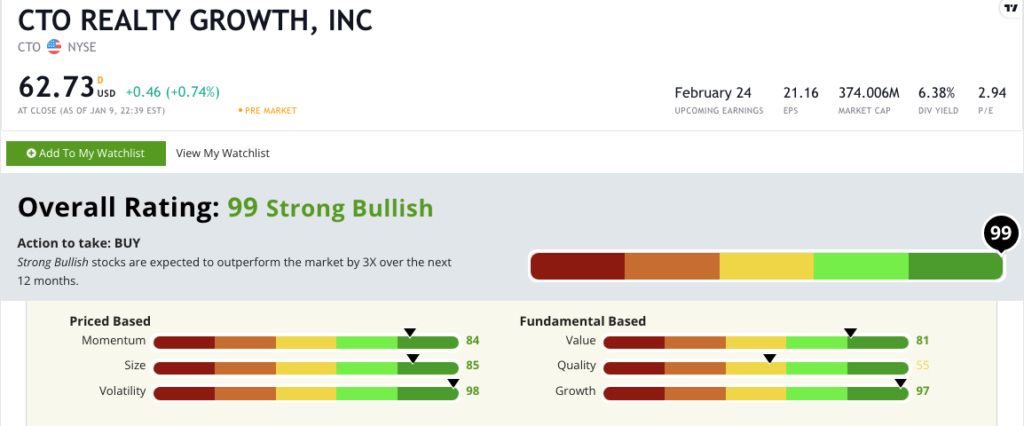

Using Adam’s six-factor Green Zone Ratings system, CTO Realty Growth Inc. scores a 99 overall. That means we are “Strong Bullish” on the stock and expect it to outperform the broader market by three times in the next 12 months.

CTO rates in the green in five of the six factors we use to rate stocks:

- Volatility — Since November 2021, CTO’s stock has risen almost 20% with little headwinds to slow it down. The company scores a 98 on volatility.

- Growth — CTO has a one-year annual sales growth rate of 25.5%. Its one-year annual earnings-per-share growth rate is massive at 794%. It scores a 97 on growth.

- Size — This is a small REIT with only 19 properties covering 2.2 million square feet under management. With a market cap of only $374 million, CTO scores an 85 on size and is in a perfect sweet spot of companies we like to recommend.

- Momentum — In the last 12 months, CTO’s stock price has risen nearly 60% — including a 20% increase since November. This is “maximum momentum” to a T. It’s 84 momentum rating is what we aim to find in a stock.

- Value — CTO currently trades at a price-to-earnings ratio of 2.9 compared to the REIT average of 33.4. It’s price-to-book ratio is 0.85 — half the REIT average of 1.7. All of that suggests CTO is a much better value than its REIT peers. It scores an 81 on value.

CTO does score a 55 on quality, however its returns on assets, equity and investment are all in double digits and higher than the average REIT. Its return on equity is 30% compared to the REIT average of 5.4%. REITs are often penalized in our system due to their accounting, so a middle-of-the-road rating on quality isn’t a huge red flag.

A big bright spot for investors looking to get into CTO is its dividend. Because it’s a REIT, it has to pay out 90% of its profits back to investors. Currently, CTO’s forward dividend yield is 6.4% which equals a $4 per share cash payout to shareholders per quarter.

Bottom line: Developers are confident that commercial development will return to its pre-COVID glory.

Judging by all of the construction I saw on just a short drive in South Florida, I think they are right.

That’s why CTO Realty Growth Inc. is a commercial REIT worth consideration for your portfolio.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.