If I learned anything from the holiday seasons, it’s that instant gratification is the new normal.

We want what we want, and we want it now.

The COVID-19 pandemic fueled this desire as we grew accustomed to everything from clothes to groceries arriving at our doorstep every day.

Now, getting those items isn’t enough. We want them today.

It’s why companies like Amazon are spending billions on more delivery vehicles and warehouse space in populated areas.

It’s also one of the reasons why I think the retail logistics market sector is poised for rapid growth in the years to come (more on that in a second).

Using Adam O’Dell’s six-factor Green Zone Ratings system, I found a logistics company with strong stock performance.

The company’s stock jumped 35% in the fourth quarter of 2021 … and I think 2022 will be even better.

The stock rates “Bullish” in Green Zone Ratings, which means it is poised to outperform the broader market by at least two times over the next 12 months.

Pro tip: This stock appears on our December 8 Green Zone Hotlist. Since then, the stock’s price has jumped around 5%. Click here to learn more about our weekly hotlist.

Let’s see why investors should buy this logistics stock now.

Same-Day Delivery Market Reaches New Highs

With the surge in-home delivery during the COVID-19 pandemic, companies are searching for every advantage to ensure getting their products from the warehouse to your doorstep faster.

Amazon pioneered this by offering same-day delivery for some of its goods.

Now, other retailers are following suit.

In 2021, the global same-day delivery market was valued at around $8.4 billion.

Over the next six years, that market size is expected to grow to $26.4 billion — a 214% increase from last year.

Investors can find big profits in this trend.

A Logistics Stock Winner: Prologis Inc.

Prologis Inc. (NYSE: PLD) is a real estate investment trust (REIT) focused on property in high-volume markets. It owns property used in two major categories:

- Business-to-business. (As an example, it owns three properties around Miami International Airport for rental car and parking operations.)

- Retail and Online fulfillment. (Think large warehouses where product is stored before being shipped to your door.)

According to its last quarterly report, Prologis has:

- $177 billion in assets under management.

- 994 million square feet of lease space.

- 4,675 buildings.

- 5,500 total customers.

It’s global property portfolio includes real estate in major populated areas like the United States, Mexico, Europe and South America.

Prologis had strong revenue growth from 2017 to 2020 — increasing its annual top-line revenue by 65.2% in that span.

The company scaled back its investments in 2021 due to lingering concerns over the COVID-19 pandemic, but it still maintained a healthy balance sheet.

Looking ahead, forecasts suggest Prologis will not only make up for the drawback in 2021 but surge to a new record for total annual revenue by 2023.

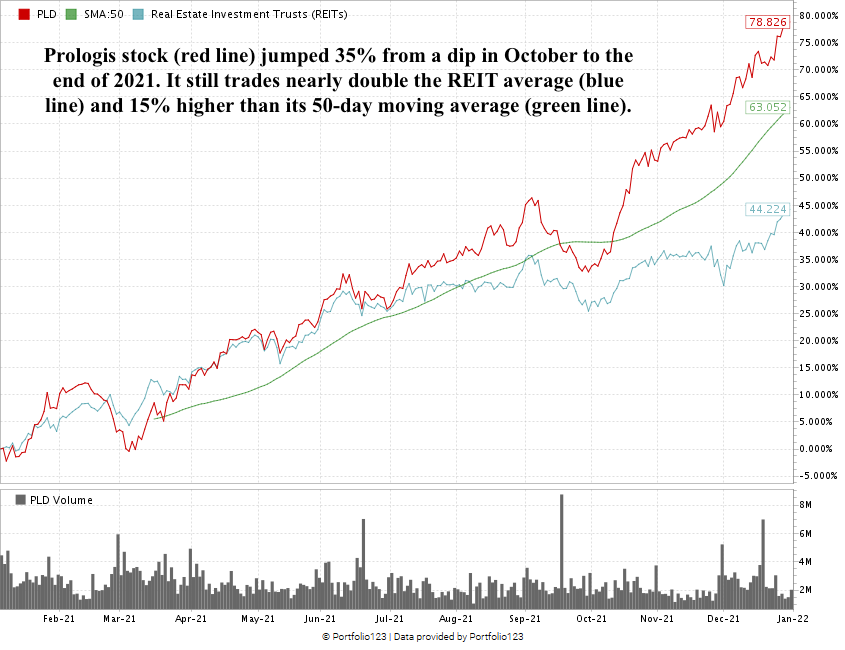

Prologis Stock Reaches New Highs in Q4 2021

After suffering a 10% drop in its stock price from February to March of 2021, PLD went on a tear, jumping 46% from March to September.

It hit a 52-week high of $137 per share in September but started to pare back its gains into October.

Since bottoming at around $125 in late September, PLD shot up 35% to close out the year at a new 52-week high of around $168. This suggests PLD has that “maximum momentum” quality Adam looks for in a stock.

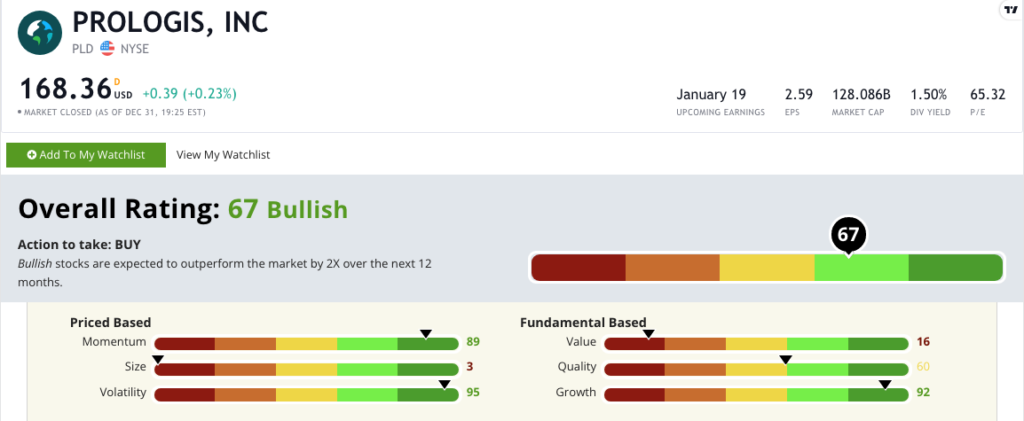

Prologis Inc.’s Stock Rating

Using Adam’s six-factor Green Zone Ratings system, Prologis Inc. scores a 67 overall. That means we are “Bullish” on this logistics stock and expect it to outperform the broader market by two times in the next 12 months.

PLD rates in the green in three of the six factors we use to rate stocks:

- Volatility — In the last quarter of 2021, PLD rose 35% with little to no resistance. In all of 2021, the stock jumped more than 78%. The company scores a 95 on volatility.

- Growth — PLD has a one-year annual sales growth rate of 33.2% and a trailing 12-month earnings-per-share growth rate of nearly 18%. Prologis scores a 92 on growth.

- Momentum — In 2021, PLD’s stock price rose nearly 78% — including a big 35% increase in the last quarter of the year. This personifies “maximum momentum” we aim to find in a stock. PLD scores an 89 on momentum.

PLD does score a 60 on quality. However, its returns on assets, equity and investment are all still higher than the average for all REITs.

Prologis earns a 16 on value as it trades with a price-to-sales ratio of 28.8 and a price-to-book ratio of 4. Both are higher than the average for a REIT.

The company also scores a 3 on size with a $128 billion market cap.

A big bright spot for investors looking to get into PLD is, because it’s a REIT, it has to pay out its profits back to investors. Currently, PLD’s forward dividend yield is 1.5% which equals a $0.74 per share cash payout to shareholders per quarter.

Bottom line: Our hunger to get things delivered to us faster is only getting stronger.

And companies are pouring billions of dollars into making that happen.

From delivery vehicles to last-mile warehouse property, retail logistics should be one of the fastest-growing market sectors in years to come.

That’s why Prologis Inc. is a stock worth considering for your portfolio.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.