Matt’s Note: Today, we round out Stock Power Daily: 9:46 Edition with what might be Mike Carr’s most contrarian opinion.

Mike believes that nobody who invests in the markets is actually buying businesses like the world’s biggest investors are prone to say.

Ultimately, we’re buying stocks. And there’s no guarantee that a great business will be a good stock, or even that a bad business will be a bad stock.

This reality is what makes traders so successful. According to Mike, they don’t need to worry if a business is good or bad — only whether the stock is moving and how you can trade it.

That, of course, is where the “9:46 Rule” comes into play. You can click here to see how that works, or read on to learn more about how Mike cuts through the noise of the markets…

Why I Don’t Care What a Business Does

As Matt mentioned on Monday, I teach at the New York Institute of Finance. My courses on technical analysis provide an overview of dozens of trading strategies. Anything you want to know about trading, you’ll learn by the end of that course.

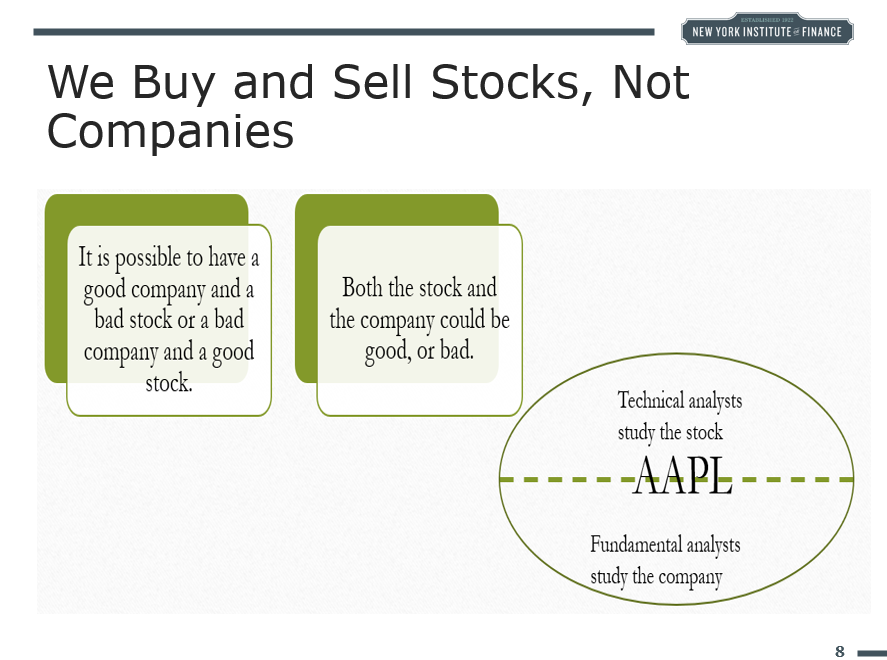

Naturally, I start with the basics. Here’s one of the first slides I show my students:

Credit where it’s due: I got this slide from the last instructor of the technical analysis course, Ralph Acampora.

Ralph is retired now. But he was a frequent guest on Wall $treet Week with Louis Rukeyser when that was a major source of financial news — before we had CNBC or the internet. He’s used a variation of this slide since he began teaching the course in the 1970s.

Many individual investors don’t understand what it means to buy stocks and not companies. They tend to think they’re like Warren Buffett, who says the opposite: buy companies, not stocks.

But do you know the difference between an individual investor and Buffett? Billions of dollars.

The Right Connections

If an investor with billions of dollars calls a CEO, they answer. They probably even do what that investor wants most of the time.

Individual investors like us do not have billions of dollars. We aren’t Warren Buffett. And because of that, we can’t truly “buy companies.”

If you don’t believe me, try calling Tim Cook, Apple’s CEO. Don’t have his number? Maybe one of your friends does?

If they don’t, you’re not in Buffett’s league.

I don’t say this to belittle you. I can’t call Tim Cook either. But I don’t need to.

Our job as traders is much easier than Buffett’s. Instead of deciding whether or not to invest billions of dollars in a single business, we can simply follow Buffett and other large investors using indicators like the one I showed yesterday.

We can also change our time frame. If you think about “buying a company,” you need to allow time for the ups and downs of the business cycle. This takes years.

If you think about buying a stock, there is constant movement. On an average day, the individual stocks in the S&P 500 Index move more than 2%. Small-cap and tech stocks move even more.

Long-term investors like to answer that fact with statements like: “I’m looking for stocks that can move 20% in a year.”

Over the course of a year, even if the stock gains 20%, the stock is likely to move more than 2% a day, on average. That gives short-term traders the opportunity to capture far more than 20% a year.

To make these quick, big gains, we use strategies that target smaller price moves — such as the 9:46 Rule.

This strategy involves establishing a likely breakout direction for the overall market using just 15 minutes of data. Once we have that data, we can set ourselves up for a trade that has delivered gains of 50% in as little as five minutes, and no longer than two hours.

And I have five other strategies revolving around different market factors.

For example, another important time we trade is 9:31 a.m. That’s when we know if we have a trade in a volatile tech stock. The stock varies, but the rules are always the same. We look to take advantage of traders who ended up on the wrong side of the opening price move.

We also generate income with credit spreads. These trades are open from two to four days.

I also have a strategy that benefits from a simple idea: Downtrends end when we run out of sellers, and uptrends end when no one wants to buy anymore. This idea is quantified and then I add a filter to help ensure the trend is reversing.

And the last two strategies are about mean reversion — using technical indicators I’ve modified for my own purposes.

Every single one of these strategies focuses on the stock — not the company.

I understand there are companies behind the stock. But traders like you and me are not buying the company. We’re trading the stock.

The sooner you shift your perspective this way, the faster you’ll start making money in the markets, quickly, even when they’re as uncertain and volatile as they are today.

Yesterday, I put out a detailed presentation about my 9:46 Rule, which is the most promising among the strategies I’m currently trading right now.

To learn more about it, click here. Just know that your opportunity to join me and start trading it yourself won’t last much longer.

Speak to you then,

Mike Carr

Senior Technical Analyst