It’s time to get on the fast track to stock profits — with the five things you need to make money this week … in just 5 minutes.

Let’s get started!

More Fuel for S&P 500 Rally

It’s been a good year for the benchmark S&P 500.

Through Friday, the index has gained 22.6% year to date!

Conventional wisdom suggests that, despite the U.S. presidential election coming in a matter of weeks, that rally will continue through the end of the year.

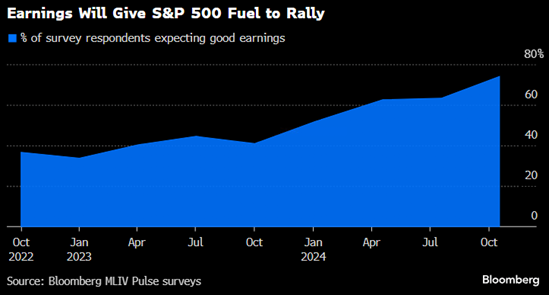

The latest Bloomberg Markets Live Pulse survey found that nearly 80% of respondents expect the Q3 earnings season to provide enough fuel to push the index to 6,000 by the end of the year.

That would mark a 2.3% increase from the S&P 500’s current position.

Nearly 20% of the benchmark’s constituents will release their earnings this week, providing solid insight into the idea.

Tesla Inc. (Nasdaq: TSLA) and IBM Corp. (NYSE: IBM) are among the heavy hitters reporting in the coming days.

Around 70 companies in the S&P 500 have already reported quarterly earnings, with 76% announcing earnings that beat estimates.

Magnificent Seven stocks — Apple Inc., Microsoft Corp., Alphabet Inc., Amazon.com Inc., Nvidia Corp. and Meta Platforms — will report earnings later this month. We’ll see if trends have reversed after most of those stocks lagged earnings in the previous quarter.

Stat to Remember: According to Goldman Sachs, the S&P 500’s median return from mid-October to December 31 is 5%. In election years, that median is even higher at around 7%.

And speaking of the election…

Mega Trend Convergence After Election Day?

We are just two weeks and change away from the U.S. presidential election.

While millions of Americans will head to the polls on November 5, Adam has identified three economic forces that will collide in a massive investment opportunity.

The first of those three forces comes to the forefront just two days after the election.

This confluence of events doesn’t happen very often, so make sure to stay tuned for more details on what these three events are and, more importantly, how you can capitalize on this rare opportunity.

Oil Reversing Higher

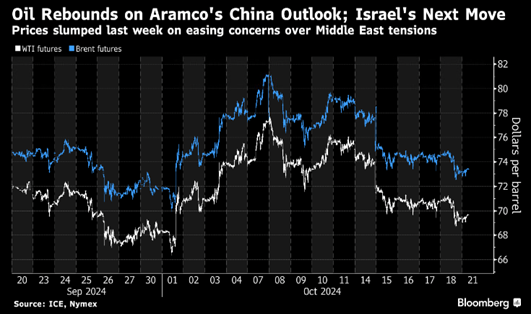

Last week, oil prices plunged nearly 8%, but the commodity is back on the rebound.

Supply risks, instability in the Middle East and economic tensions in China are pushing West Texas Intermediate (WTI) and Brent crude oil higher to start the week.

Brent crude – the global benchmark – reached above $74 a barrel over the weekend, while WTI hit $70.

The price hike comes on the heels of increased tension in the Middle East as Israel conducted a new assault on Hezbollah strongholds in southern Lebanon on Sunday.

China also just trimmed its benchmark lending rates after the central bank lowered them at the end of September.

Crude oil pushed lower last week after the International Energy Agency said rising global supplies could lead to a surplus of oil in 2025 and a softening of demand in China.

Despite the rise to start the week, Bloomberg reported that bullish call options on oil are trading at a premium to bearish puts.

Don’t Want to Move? Quit

Several big companies have instituted return-to-office policies after the COVID-19 pandemic pushed workers to remote work.

One company, Walmart Inc. (NYSE: WMT), is requiring many of its employees at smaller corporate offices around the country to pack up and move to its headquarters in Bentonville, Arkansas.

One high-ranking employee is having none of that.

Sam’s Club’s chief technology officer, Cheryl Ainoa, has decided Arkansas isn’t the move and is leaving the company after five years.

She will remain at her post until February.

Walmart is just one of many companies that now require remote employees to return to the office. Amazon, Apple, The Walt Disney Co., JPMorgan and Google are among the largest companies reversing remote work policies.

Where You’re Invested Now

When it comes to investing, it’s easy to stick to the basics of stocks and bonds.

But we wanted to know if you’ve expanded your portfolio into other assets … so we asked what you’re investing in a couple of weeks ago in Money & Markets Daily.

Digging into the results, 98% of our responses showed you’re invested in stocks, while 40% said they’re invested in bonds.

What’s most interesting, though, is when we consider assets outside of the norm:

- 42% said you’re trading options.

- 42% said you’re investing in hard assets like gold and art.

- 39% said you’re investing in real estate.

- And 33% said you’re buying cryptocurrencies.

Many of you are creating a diverse portfolio outside of stocks and bonds! And that’s a great approach in a market that’s constantly changing and offering new opportunities to shore up your nest egg.

Thanks to everyone who took the time to answer our latest poll. Keep an eye on Money & Markets Daily for new ways to invest in everything from stocks and options to hard assets and cryptos.

Have a great week!

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets