I’ve written a number of times on home country bias.

It’s the tendency for Americans to invest predominantly in U.S. companies … and for Canadians to invest mostly in Canadian companies … and so on.

Investors prefer home-country stocks because it feels more comfortable. But that’s not a good reason to ignore foreign markets. Anyone who overlooks opportunities outside their home country is passing on opportunities to earn outsized returns.

It’s true that U.S. stocks have been particularly strong in the secular bull market that began in 2009. But that won’t always be the case. Even throughout that timeframe, there have been occasions when foreign markets were better buys.

And currently, the tide has shifted in favor of foreign stocks.

In fact, since Biden’s election win became evident around November 6, the stock markets of the top 15 economies globally have outperformed the United States’ S&P 500 — earning an average return of 19% versus the S&P’s 12%.

During that foreign-market rally, I was able to lead my Home Run Profits subscribers to a 92% profit in four months on a bullish play on Mexican stocks.

Of course, when you’re investing in a foreign-market stock or fund, it’s important to realize you’re essentially making two different bets.

- For one, you’re making a bet that that country’s stocks will outperform U.S. stocks.

- And just as importantly, you’re making a bet that the predominant sectors and industry groups within that country will outperform.

Take Canada, for instance …

Canada’s ETF Sector Bets

The Canadian economy is known for doing a few things well — mainly, banking and commodities.

And more recently … cannabis.

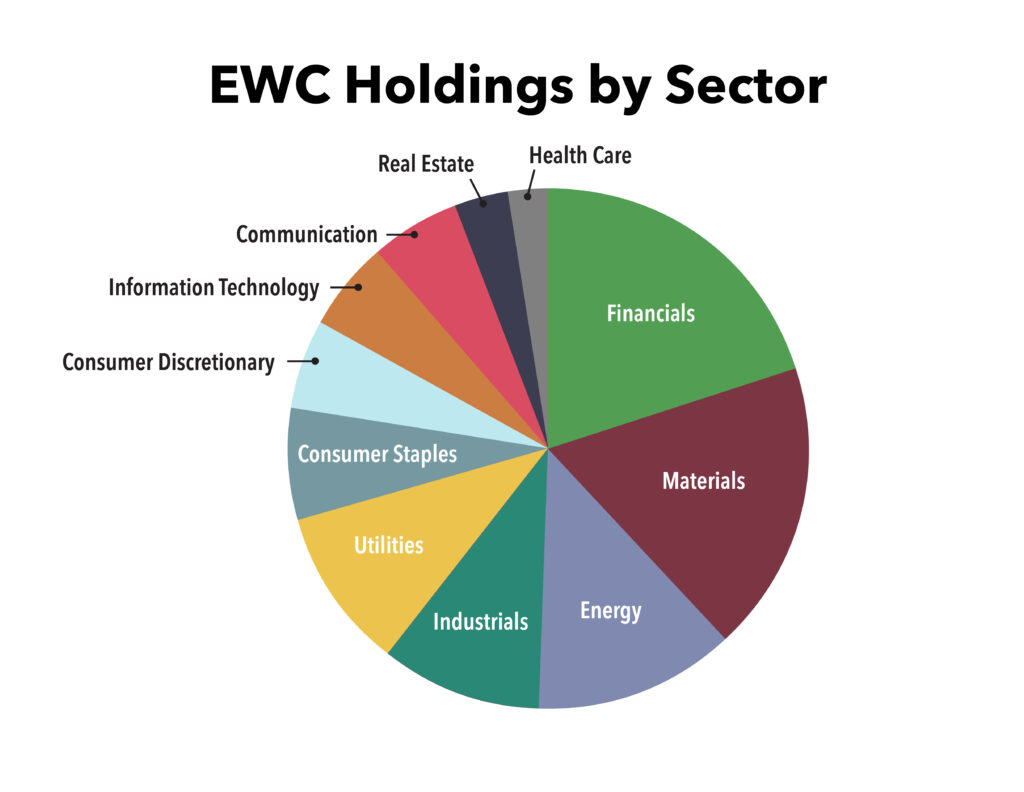

In fact, you can see this in black and white when you do a sector breakdown of the individual stock holdings of the iShares MSCI Canada ETF (NYSE: EWC).

Here’s a pie chart showing the number of stock holdings from each sector:

The top-three sectors represented are:

- Financials, with 18 individual holdings.

- Materials, with 16 holdings.

- Energy, with 11 holdings.

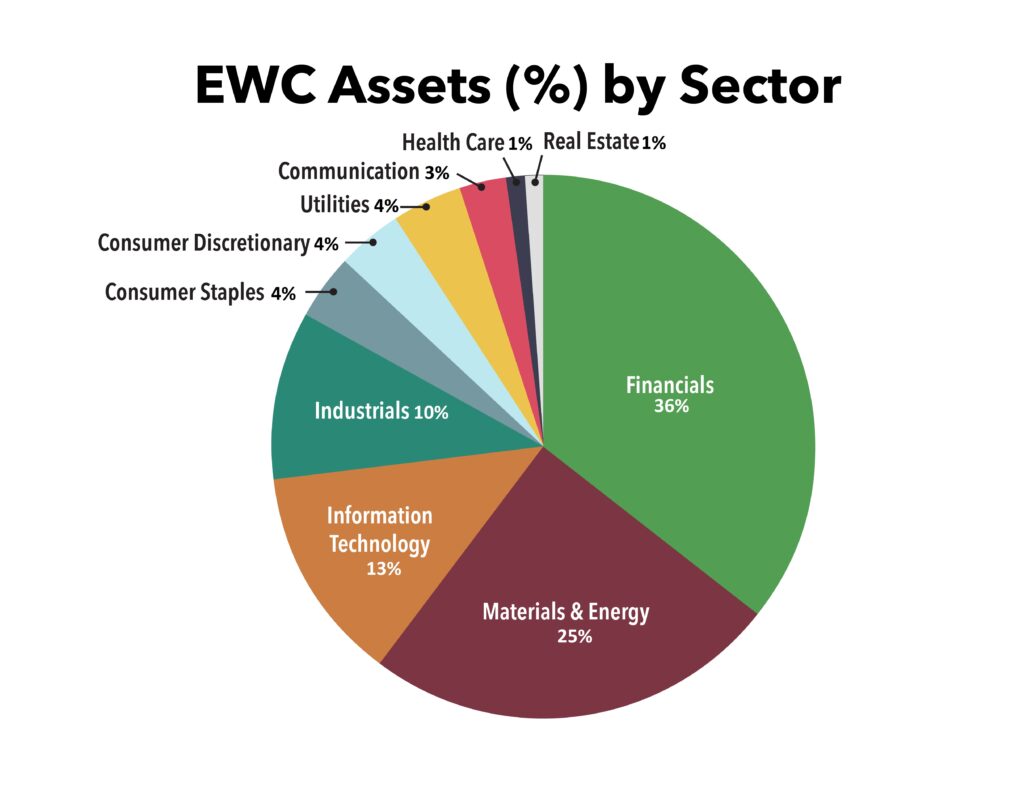

Looking at the data in a slightly different way, here’s a pie chart of the percentage of assets held in the stocks of each sector, including a combination of the materials and energy sectors, since both are commonly classified as commodities.

Here again, we see that investing in the iShares MSCI Canada ETF (NYSE: EWC) gives us an outsized bet on the financials and commodities sectors, with investments in those spaces representing a full 61% of the fund’s assets.

Is this a bad thing?

Well, it depends. On its face, it’s neither bad nor good. It’s just something you need to know as a potential investor in this diversified Canadian stock ETF.

Beyond that, you need to decide whether or not you’re particularly bullish on financial and commodity stocks.

If you are — as I am — then an investment in EWC may make a lot of sense. You gain diversified exposure to a non-U.S. market … and express your view that commodity-related stocks and financials are poised to outperform other sectors ahead.

Of course, if you don’t have a particularly strong conviction as to which sectors are likely to outperform ahead, you may find my Leaders & Laggards Board of great value in that regard.

Each week, readers of both my Green Zone Fortunes and Home Run Profits services receive my updated rankings of the major stock market sectors … telling them which ones are poised to provide market-beating returns and which ones aren’t.

Right now … both the financial and energy sectors are top-ranked. My Home Run Profits readers have been able to make nice profits in both spaces, including a 48% profit in two months on the first two-thirds of a partial play, with the final third still on the run on an oil and gas producer. And another on a small regional bank stock that led to a 114% profit in two months on the first two-thirds of a partial play, with the third still on the run.

Wait, What About Cannabis

Yes, the Canadian economy has evolved from its pure banking and commodity days. It’s emerged as a global leader in the cannabis space, as legalization and business development have led the U.S.

Interestingly, though, the iShares MSCI Canada ETF (NYSE: EWC) has a paltry investment in the cannabis industry. The fund owns a measly 0.58% allocation in Canopy Growth Corp. (TSX: WEED; Nasdaq: CGC).

That’s hardly enough to move the needle if you’re an investor wanting meaningful exposure to Canadian cannabis companies.

For that, you’re better having a look at the ETFMG Alternative Harvest ETF (NYSE: MJ). Among this fund’s top 10 largest holdings, eight of them are domiciled in Canada.

What’s more, if you’re looking for more in-depth analysis on the cannabis space as a whole, I definitely recommend you check out what my research analyst Matt Clark has to say on his weekly Marijuana Market Update videos — check it out here.

To good profits,

Adam O’Dell

Chief Investment Strategist

Adam O’Dell is the chief investment strategist of Money & Markets and has held the title of Chartered Market Technician for nearly a decade. He is the editor of Green Zone Fortunes, the trend and momentum options-trading powerhouse Home Run Profits and the time-tested switch system 10X Profits.