The 2020 U.S. presidential election was arguably the most pivotal one in modern history.

Love him or hate him, President Trump made no bones about his words and actions — and that cleanly divided folks into just one of two camps, “for” and “against.”

It wasn’t just stateside that Trump’s norm-breaking M.O. made waves. Foreign leaders of every major nation stood to attention over the past four years — perhaps more so than ever — taking cues from the unconventional president’s actions and calculating adjustments to make under the new set of rules he was foisting upon the international community.

But realize, I’m not writing a political essay today.

As a pragmatic, profit-seeking investor, I always have one goal in mind: extract profits from the market.

To do that consistently, I must be flexible and open-minded to changes in the market’s trends … to shifts in investors’ preferences … to “changing tides,” essentially.

And, of course, there’s arguably no better time to take a read on the market’s mood than during the immediate wake of a pivotal presidential election.

What Biden’s Win Means for Foreign Stocks

I can’t with 100% certainty tell you why foreign stocks have performed so well since Biden’s election win.

I suppose one speculation could be that the world will be a less uncertain place under a more conventional president. Investors equate uncertainty with risk and therefore are likely to display a renewed risk appetite under the incoming administration.

Of course, that may partly explain why stocks, in general, have performed well since the election, but not necessarily why foreign stocks have outperformed U.S. stocks to such a large degree. (Plus, it ignores the fact that stocks, in general, climbed higher under Trump, too).

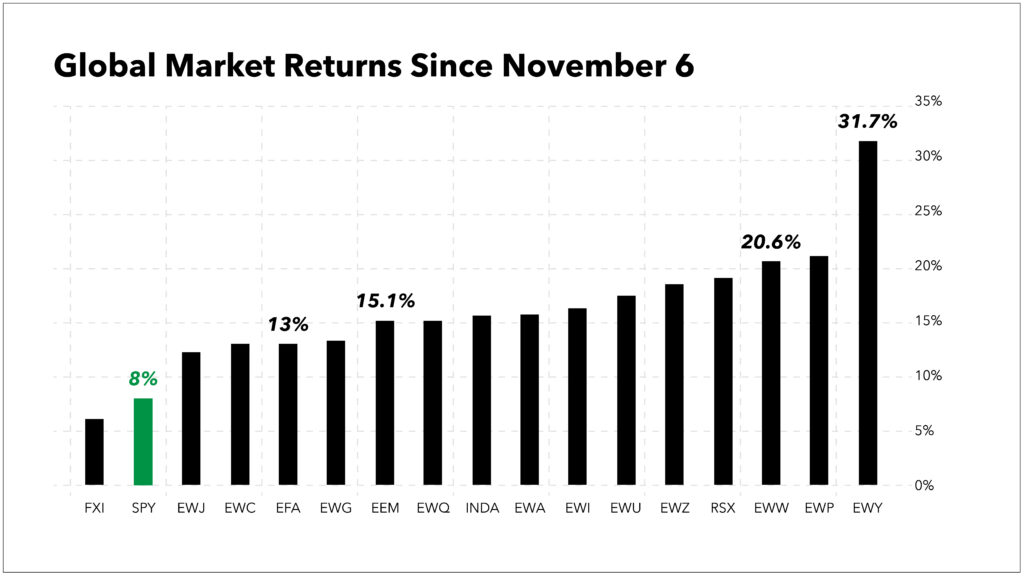

Nonetheless, have a look at this chart, which plots the returns of the stock markets of the world’s top 15 economies since November 6:

As you can see, every major global stock market is up … including U.S. stocks, though they meaningfully trail the pack of foreign stock markets.

Again, I can’t say exactly why foreign stocks have beaten U.S. stocks since the election. But as a believer in price action and successful momentum investor, I know we don’t necessarily need the “why” to make good money from this dramatic shift in investors’ preference.

It’s enough to simply “go with it.”

In fact, that’s what my Home Run Profits readers have done over the past two months in a Mexican stock play I recommended they make in mid-November when it became clear to me that investors were pouring big money into the Mexican stock market following news of Trump’s eventual exit.

That shift in investor sentiment came with a fairly obvious “why” — Trump has been tough on Mexico, both in terms of the border wall and his renegotiation of the North American Free Trade Agreement. It’s clear that investors now expect Mexican stocks to perform far better under a friendlier Biden administration.

Well, in just two months, we’ve already locked in a profit of over 100% on that Mexican-stock position!

I’m proud of my Home Run Profits subscribers who made that play because, frankly, it can sometimes feel “un-American” to put your investment money to work in foreign stocks.

I’ve written on this subject a number of times before, but it bears repeating, especially now that foreign stocks are finally outperforming U.S. stocks for the first time in a long while…

Home country bias is a “mental glitch” all investors suffer from. It’s like a little devil on your shoulder, softly coaxing you … “C’mon, man, you’re American! Invest in American companies, my dude!”

But if you’re the type of investor who will only consider U.S. stocks … you’re missing out on HALF of the global markets’ best opportunities.

Truly, you have to keep an open mind and be willing to make investments in both U.S. and foreign stocks … to be a consistently successful investor.

For instance, did you follow my advice on September 24 last year, when I highlighted this Indian stock market ETF poised to outperform U.S. stocks?

I hope you did because since then, shares of the iShares MSCI India ETF (NYSE: INDA) have gained 10 percentage points more than the SPDR S&P 500 ETF Trust (NYSE: SPY) — gaining 27% versus the U.S. stock index’s 17%.

INDA is an easy way to gain diversified exposure to a top-notch foreign stock market. If you want to go a little deeper, I also offered a high-conviction stock recommendation to my Green Zone Fortunes readers that same month…

An India-based technology company and Amazon Web Services partner, whose stock I estimated was a better buy than Amazon itself.

Well, that Indian-stock play is already handing us gains of 38% … while shares of Amazon are up just 3% in the same time! And we aren’t done with it yet! Read more about the stock here.

Looking ahead, Green Zone Fortunes editor Charles Sizemore and I expect to add more foreign stock plays to our high-conviction, market-beating portfolio.

Our nine-position portfolio has beaten the S&P 500 by 4-to-1 since Biden’s early November win, thanks in part to our willingness to go out on a limb with that Indian stock. Though we’re also invested in stocks that were “expected” to beat the pants off the market under a Biden administration (a solar play … a domestic infrastructure play … and a COVID-19-killer biotech stock) — and indeed, beat the market they have!

So, whether you’re ready to join us in our high-conviction Green Zone positions or simply needing to add a little “foreign” to balance out a naturally American preference for U.S. stocks…

I highly recommend you keep an open mind and take note of important shifts in investor preference in the wake of the 2020 presidential election.

One thing is clear … foreign stocks are now in high demand and attracting major inflows. If that persists, as I expect it will, it will lead to outsized gains in major foreign stock market ETFs, such as the iShares MSCI EAFE ETF (NYSE: EFA) and the iShares MSCI Emerging Markets ETF (NYSE: EEM).

I consider both a “buy.”

To good profits,

Adam O’Dell

Chief Investment Strategist