In today’s Marijuana Market Update, I discuss:

- New federal cannabis legislation.

- The state of cannabis deals in the first half of 2021.

- The rollout of a new feature to the Marijuana Market Update.

First, news on legalization.

Congressional Democrats Plan to Draft Federal Legalization Legislation

According to Marijuana Moment, Senate Majority Leader Chuck Schumer plans to roll out a draft of legislation aimed to legalize marijuana on the federal level.

While details of the bill were not available — reportedly titled the Cannabis Administration and Opportunity Act — let’s just say this is a long time in the making.

We’ve heard rumblings in Congress that this was happening since Joe Biden won the presidential election back in November.

Now, it seems some movement on the federal level is happening.

But I have to caution against too much excitement concerning federal legalization because this will just be a draft … not a formal introduction of the bill.

Once introduced (whenever that will be), the bill will have to go through committees on both sides of Congress before it ever reaches President Biden’s desk.

And, with an infrastructure bill still in the offing, it’s no guarantee that any federal legalization will move in a fast manner through Congress.

Nonetheless, this is big news for cannabis investors as it shows that some lawmakers are serious about ending the prohibition of cannabis.

Schumer has said before that he hopes to restrict the ability of big alcohol and tobacco companies from taking over the cannabis industry as well.

I’ll monitor the situation and let you know of any updates.

Cannabis Sector Deal Breakdown

The second thing on the agenda is looking back at the first half of 2021 regarding cannabis industry acquisitions.

Investors Pour Into Cannabis

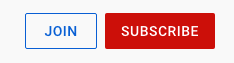

According to New Frontier Data, cannabis companies raised $7.7 billion in the first half of 2021.

That’s three times more than the $2.5 billion raised during the same period last year and tops the previous high of $7.5 billion raised in the first half of 2019.

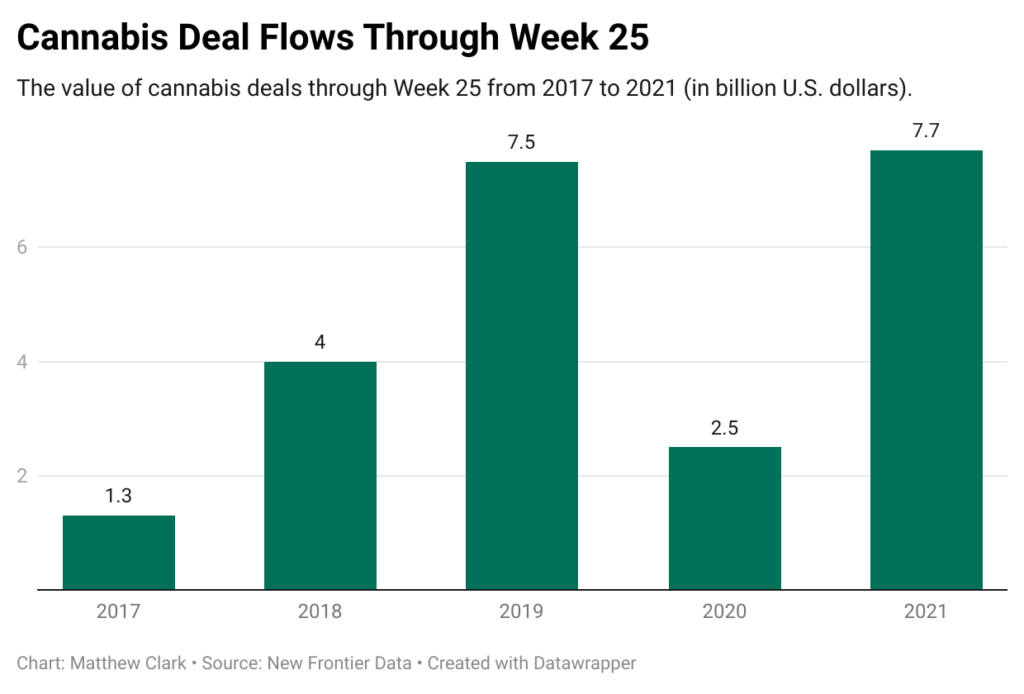

The difference between debt and equity financing for these deals has also risen.

In 2021, 69% of deals were equity-based, with the remaining 31% debt-financed.

That compares to 84% of deals being equity-based in 2017 and 16% debt-financed.

Cannabis Deal Size Expands Exponentially

In 2017, the total average deal size was about $6.9 million. In the first half of 2021, that average was more than $28 million, according to New Frontier Data.

One of our Cannabis Watchlist stocks — GrowGeneration Corp. (Nasdaq: GRWG) — has already announced nine acquisitions in the first half of this year.

All this tells us is that multi-state operators (MSOs) are spending cash hand over fist to gain market share by buying up smaller players in the cannabis space.

The announcement of federal cannabis legislation coming to Congress should spur more of that spending in the future.

In all, I think 2021 will prove to be the biggest year for cannabis acquisition in history as more states legalize, global economies expand, and the U.S. starts to take federal legalization seriously.

As an investor, it’s key to keep an eye on these acquisitions and how they position pro forma companies for the future.

New Marijuana Market Update Feature

The third thing I want to discuss is the rollout of a new feature I’ll highlight in the Marijuana Market Update.

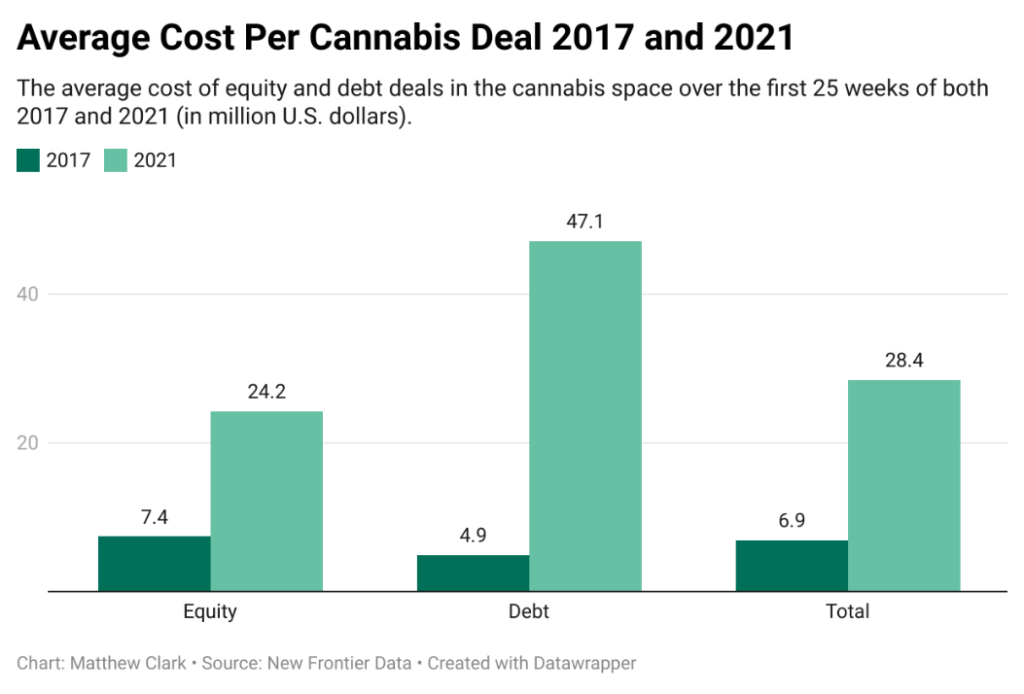

For the last several weeks, I’ve been working to develop the Money & Markets Cannabis Index.

This tracks all cannabis companies with market caps over $10 million and is an equal-weighted index — this means the performance of each company carries equal importance, and bigger companies won’t overshadow smaller ones.

According to my latest scan, 231 companies meet the criteria of market capitalization and listing on either a major U.S. exchange or over the counter.

This list will change every time as companies will rise to the minimum market cap or fall off.

As you can see, the index reached a high point in mid-February when cannabis stocks were more popular with investors. That’s when states passed legalization measures, and talk of federal legalization was at a high point.

The market has cooled. Since April 1, 2021, our index value has only fluctuated by 9%.

This index gives you a different look at how the broader cannabis market is performing from one day to the next.

I will update this index and let you know its performance every week.

New YouTube “Join” Feature

We offer members new exclusive content, including:

- Interviews with cannabis insiders.

- Blog posts, stock analysis and company breakdowns.

- More about our Cannabis Watchlist.

- Monthly live chats with me, where we’ll discuss cannabis stocks, the cannabis sector and much more.

Just click “Join” on our YouTube page to find out what you can access.

If you have a cannabis stock you’d like me to look at, email me at feedback@moneyandmarkets.com.

Where to Find Us

Coming up this week, we’ll have more on The Bull & The Bear podcast, so stay tuned.

Don’t forget to check out our Ask Adam Anything video series, where we ask your questions to Chief Investment Strategist Adam O’Dell.

Also, you can follow me on Twitter (@InvestWithMattC), where I’ll give you even more insights, not just in the cannabis market.

Remember, you can email my team and me at feedback@moneyandmarkets.com — or leave a comment on YouTube. We love to hear from you!

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.