In today’s Marijuana Market Update, I examine:

- A recent report that indicates where the cannabis industry is headed by 2025.

- An email from a viewer concerning a previous episode’s look into cannabis ETFs.

Cannabis Industry’s Stellar Sales

Last year was massive for cannabis.

Despite the COVID-19 pandemic, cannabis producers and retailers experienced a big boom in sales to the tune of more than $20 billion in the United States alone.

The main reason for that is that, despite widespread economic shutdowns, cannabis was deemed “essential” in most states where it is legal.

That meant dispensaries could stay open, and most developed curbside pickup or even delivery options for buyers.

So, while other industries slowed to a crawl or even a halt, the cannabis business was booming. Now that we are at the midpoint of the year, we can see if the strength of 2020 was a flash in the pan or a carrying trend.

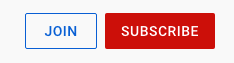

Recent research from New Frontier Data — a cannabis data company — found that last year’s quarterly cannabis sales reached their zenith in the third quarter, which you can see in the chart above.

Combined medical and adult-use sales topped $5.8 billion for the quarter.

That beat the previous high set the quarter before by nearly $1 billion.

However, forward projections of the cannabis market suggest 2021 could be even better for the cannabis industry.

In the first quarter of the year, combined cannabis sales were $5.8 billion — matching the third-quarter 2020 mark.

Adult-use cannabis sales reached the highest in recent history by hitting $2.7 billion in the quarter ending in March 2021.

However, New Frontier’s expectations are for cannabis sales to continue climbing to top $6.1 billion in the second quarter.

Of that figure, adult-use sales will make up a near-record $3.3 billion while medical sales will surpass $2.9 billion — a new quarterly record for the sector.

The rationale for the projection is simple — customer demand isn’t going away, and more states opening their doors to cannabis sales will strengthen those figures.

But what does this mean looking forward?

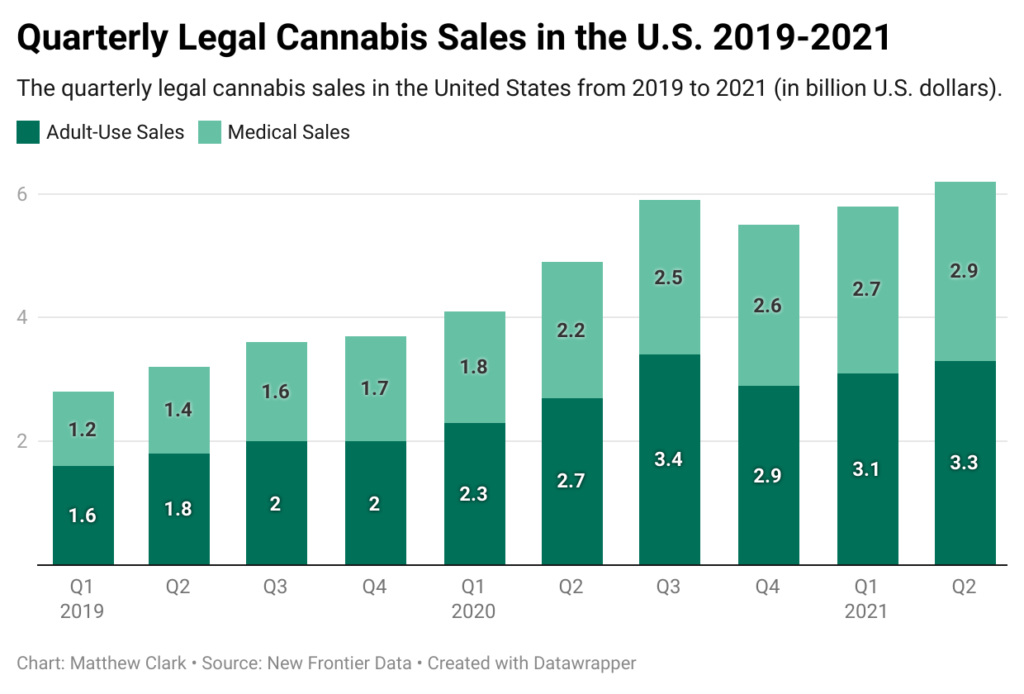

Look at the chart above. Using the current trends and factoring in new states jumping into the legalization fray, the cannabis market could reach nearly $43 billion by 2025 — a steady increase every year.

Remember, 38 states and the District of Columbia allow for medical cannabis sales right now.

Of course, if any of the remaining 12 states elect to add medical cannabis legality, that number will push cannabis industry sales even higher.

The Cannabis Industry’s Prognosis

The takeaway here is that, while some legal headwinds push against cannabis stocks — namely a lack of movement on federal legalization — these stocks are still viable investments.

You must remember that stocks go up, and they go down. You want to be in the game for the long haul. Day trading cannabis stocks is not a good idea because of the short-term volatility.

About the Cambria Cannabis ETF (NYSE: TOKE)

Recently, Joe emailed my team to say:

Hi Matt. Great segment on the current pot ETFs out there from another viewer email. Why didn’t you include TOKE in your video update? Please advise. — Joe

Good question, Joe. Thank you for asking.

I looked at the cannabis exchange-traded fund (ETF) AdvisorShares Pure U.S. Cannabis ETF (NYSE: MSOS) as part of a viewer question and compared it with AdvisorShares Pure Cannabis ETF (NYSE: YOLO) and ETFMG Alternative Harvest ETF (NYSE: MJ).

Joe wondered if I left off the Cambria Cannabis ETF (NYSE: TOKE) for a reason.

The short answer is: No.

TOKE Underperforms Other ETFs

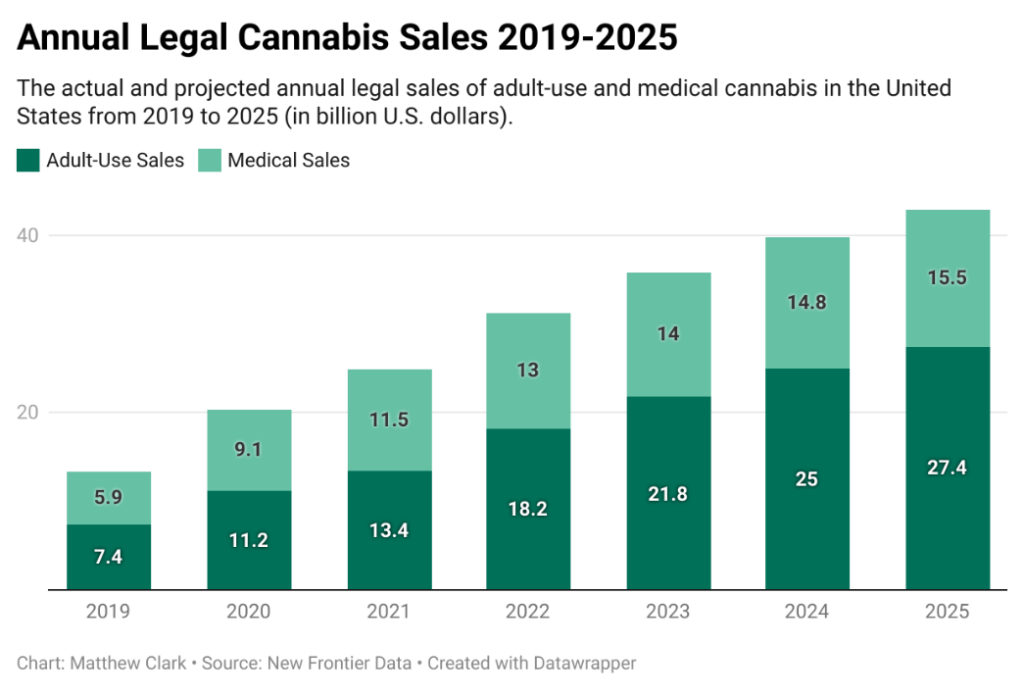

These cannabis ETFs move in lock-step, as you can see with this chart.

TOKE’s (light blue line) moves are similar to YOLO (green line), MJ (red line) and MSOS (purple line).

However, TOKE’s return percentage is the lowest (43.1%). The other three are above 50% — YOLO and MJ boast 60%-plus returns.

So, if I include TOKE, I’ll say the same thing I did in the previous video: MSOS and TOKE aren’t bad investments to break into the cannabis market, but you have better options.

New YouTube “Join” Feature

We offer members new exclusive content, including:

- Interviews with cannabis insiders.

- Blog posts, stock analysis and company breakdowns.

- More about our Cannabis Watchlist.

- Monthly live chats with me, where we’ll discuss cannabis stocks, the cannabis sector and much more.

Just click “Join” on our YouTube page to find out what you can access.

If you have a cannabis stock you’d like me to look at, email me at feedback@moneyandmarkets.com.

Where to Find Us

Coming up this week, we’ll have more on The Bull & The Bear podcast and our Money & Markets Week Ahead, so stay tuned.

Don’t forget to check out our Ask Adam Anything video series, where we ask your questions to Chief Investment Strategist Adam O’Dell.

Green Zone Fortunes co-editor Charles Sizemore also has a weekly series called Investing With Charles, where he breaks down dividend investing each week.

Remember, you can email my team and me at feedback@moneyandmarkets.com — or leave a comment on YouTube. We love to hear from you!

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.