Fun fact: On Wednesday, the S&P 500 was up 296 points this year. Almost half (143) of those points came on two days, Jan. 4 and June 4.

What did those two days have in common? Commentary from Fed Chairman Jerome Powell designed to manipulate the markets.

Now, we can shake our fists at the clouds, and talk about how “unfair” it is. Or we can hoist the Jolly Roger and make money.

I know what I’m going to do. And today, I have one red-hot idea for you.

The Fed Rolls Out the Big Guns

Last Monday, St. Louis Fed President James Bullard said the economic outlook had “darkened” in light of trade uncertainty and a rate cut might be needed “soon.” This sparked a brief rally, which faded.

The next day, Tuesday, Powell said the Fed is prepared to do whatever it takes to keep the U.S. economy rolling along. This includes being ready to “act as appropriate” to sustain the expansion and save the nation from the effects of President Donald Trump’s trade war.

In other words, he’ll consider cutting rates.

Later that same day, Chicago Fed President Charles Evans said he was worried about persistently low inflation. And anyone who’s been up and down Wall Street can tell you that’s Fed code for a potential rate cut, to juice the economy and spark inflation.

On the same day, Federal Reserve Gov. Lael Brainard gave an assist to Powell. She said that the Fed would be “prepared to adjust policy to sustain the expansion” due to uncertainty over trade.

One, Two Three, Four — What Are We Worried For?

So, that’s one-two-three-four (!) Fed governors suddenly sounding dovish. Is that bullish for the markets?

Well, let’s jump into the Way-Back Machine and look at what happened the last time the Fed took a dovish turn. Hey, that was just in January!

Let me take you through the timeline …

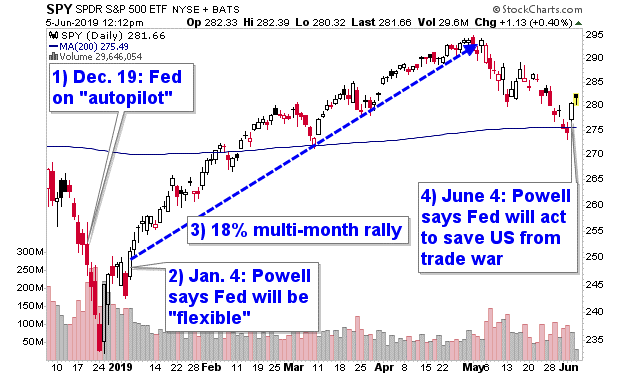

Image credit: StockCharts.com

Late last year, the market was crashing, and the Fed didn’t help. On Dec. 19, the Fed raised its benchmark interest rate by 25 basis points. And it failed to veer from its path of tightening. In fact, Powell said the Fed was satisfied with its program to reduce the balance sheet and it has no plan to change it. The Fed planned to hike rates twice in 2019.

That hawkish news sent the market crashing to its lows for the year. And in the following days, stocks kept crashing.

This sent President Trump into a tirade. He railed against the Fed in a tweet: “Paris is burning and China way down, the Fed is even considering yet another interest rate hike.”

And on Christmas Eve, President Trump tweeted: “The only problem our economy has is the Fed.”

The carnage stopped in the last week of 2018 as the market enjoyed a “Santa Claus rally.” But that rally started running out of steam.

Powell Changes His Tune

Then, on Jan. 4, Powell changed his tune. Buckling under the pressure from President Trump, he gave the market what it wanted. He said that the Fed would be “flexible” on policy and was in no hurry to raise interest rates.

What did that do? As you can see on the chart, Powell’s “flexible” announcement sparked an 18%, multi-month rally. If you add on the Santa Claus rally, the market soared 25% from its December lows.

Starting in May, we had another pullback. And now, Powell and other Fed governors are coming out to tell the market what it wants to hear — AGAIN!

History may not repeat. But it often rhymes.

And if you want to play this kind of move, you want to invest in something that rhymes REALLY LOUD! (Here’s an idea …)

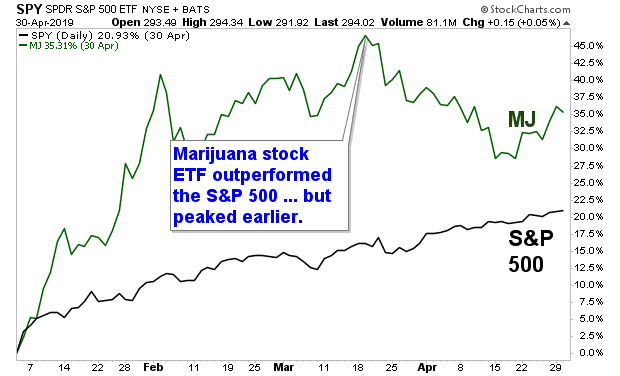

Now, let’s look at a chart of the performance of the S&P 500 from Jan. 4 — when Powell turned dovish — to April 30, when the market peaked. And I’ll include my choice of loud outperformer.

Image credit: StockCharts.com

You can see that the market went up in the wake of Powell’s dovish turn. A 20.9% gain — nice! But cannabis-leveraged stocks — as tracked by the ETFMG Alternative Harvest ETF (NYSE: MJ) — did VERY well.

In fact, MJ rallied 47% by March 21. But then it began to fade before the broad market. It was still up 35% on April 30, running rings around the broad market.

May was a terrible month for marijuana stocks. As a group, they lost 13%. But you know what, that just put the index back to prices it last saw in January.

You know — before it blasted off.

Are marijuana stocks going to blast off again? Will they outpace the broad market? And in turn, will stocks surge on more Fed rate-cut-talk rocket fuel?

I’d say the odds are better than average. And if you want to ride this rocket, MJ — or its components — might be a way to do it. Just do your own due diligence before buying anything.

Want to know how I pick investments in this exciting sector? In this real-time training video I just recorded, you can watch over my shoulder as I analyze the world’s hottest cannabis stocks. Watch it here by midnight tonight, and see how you can claim a FREE year of my Marijuana Millionaire Portfolio service (normally $5,000).

All the best,

Sean