In today’s Marijuana Market Update, I:

- Answer a reader email about the future of the cannabis and psychedelic markets.

- Provide an update on the brand-new Money & Markets Cannabis Index.

So, let’s start today with a reader email.

Lin emailed me and asked:

What is your outlook on the cannabis market, including psychedelics, in the U.S. and Canada? Thanks, in advance, for your expert opinion. — Lin

Thank you for the email, Lin! I’m more than happy to address your question.

Lin’s question piggybacks on what Maureen asked last week about the psychedelic market.

The psychedelic market of the cannabis sector is small, and its companies focus on developing the use of psilocybin, which is an ingredient in “magic mushrooms.”

Oregon became the first state to legalize psilocybin in November 2020.

In an interesting interview, Jerrold Rosenbaum, then head of the Center for the Neuroscience of Psychedelics at Massachusetts General Hospital, which studies the effects of psilocybin to treat conditions including depression and ADHD, said the following about psychedelic legality:

I don’t think it makes sense for psychedelics to continue in Schedule 1. When you talk about harm to self or harm to others, they are way down the list, below things you can buy in your pharmacy or that your doctor can prescribe.

While that may be true, when looking at the future of psychedelics, you have to understand that they have been around for a long time, but their study concerning the treatment of illness is new.

That said, companies are pouring millions of dollars into studying psychedelic-assisted therapy.

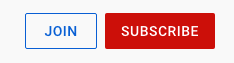

As you can see in the chart above, a 2021 study by Research and Markets concluded that the global psychedelic drugs market could hit a value of $4.1 billion this year and reach $7.6 billion by 2026.

That’s an 85% increase in value in five years.

I see a great growth potential in this segment, but it will depend on the federal government’s proactivity in approving the use of psilocybin.

The same can be said for the cannabis market.

In the first two quarters of the year, cannabis sales increased 7% to $6.2 billion in the second quarter — combining medical and adult-use cannabis sales.

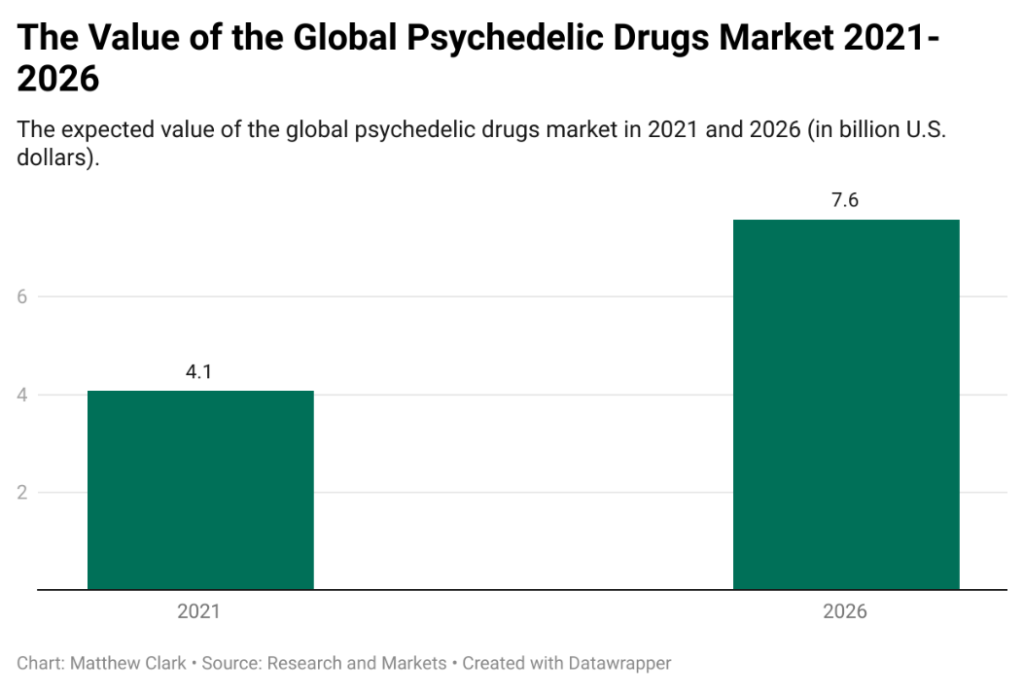

Cannabis research firm New Frontier Data expects that trend to continue in the second half of the year, as you can see in the chart below.

New Frontier Data finds that annual cannabis sales could reach $24.9 billion in the U.S. by the end of this year — and $43 billion by 2025. This is due to current sales trends and legalization in new states.

So, just like psychedelics, the cannabis market has a great deal of potential. However, that depends mostly on regulation changes at the federal level.

Cannabis and psychedelic research companies need freer access to capital, and that won’t happen until legalization becomes a reality.

My takeaway: Remember what I said a few months ago … this is a long game. Don’t day-trade cannabis or psychedelic stocks because it’s not likely you’ll see big gains.

However, if you buy in now, you’ll realize those big gains once the federal government gets its head on right and removes both cannabis and psychedelics from the Schedule 1 list.

Thank you again for the question, Lin. Look out for an email from my team as we will send you a Money & Markets hat.

You, too, can get Money & Markets swag by submitting a question for me, Adam O’Dell or Charles Sizemore that we use in any of our videos. Just send us your questions and feedback.

Money & Markets Cannabis Index Update

On to the Money & Markets Cannabis Index…

The index tracks cannabis companies with market caps over $10 million.

Right now, 225 companies meet the criteria of market capitalization and being listed on either a major U.S. exchange or over the counter. I’ll reconstitute the list periodically.

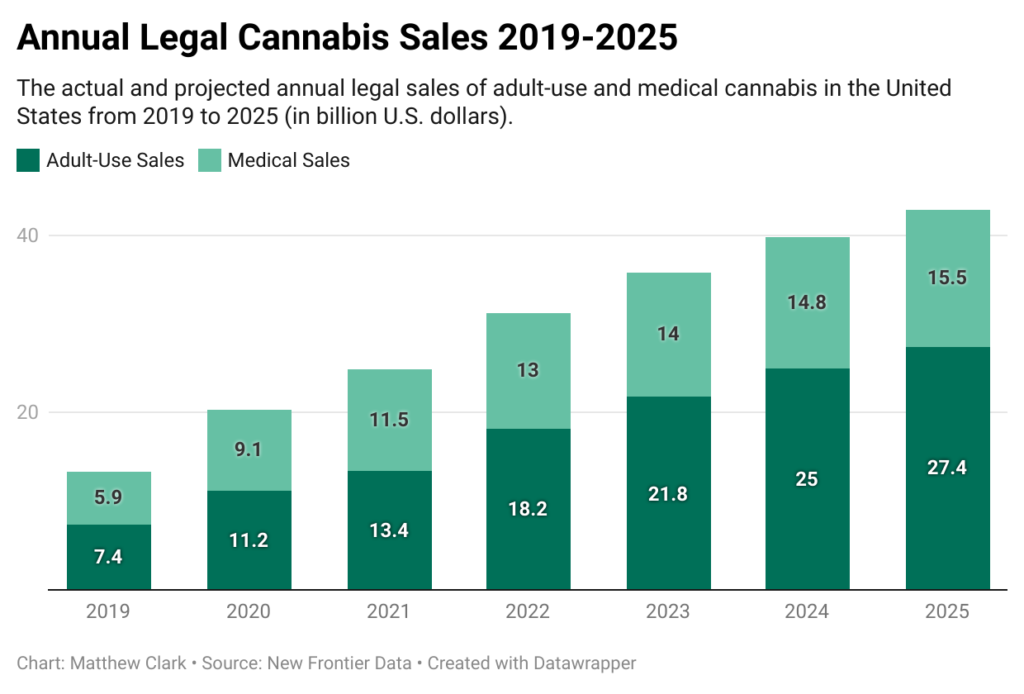

Last week, the index had a value of around 173.2. When I ran the index this week, that value was 173.6 — indicating a slight uptick in the broader market.

As you can see in the chart, the entire cannabis market has been relatively flat during the summer.

It experienced strong upward movement at the beginning of the year when the discussion of cannabis legalization started, but it fell once that conversation cooled.

This index gives you, a cannabis investor, a different look at how the broader cannabis market is performing from one day to the next.

I will update this index and let you know its performance every week here in the Marijuana Market Update.

YouTube “Join” Feature

We offer members exclusive content, including:

- Interviews with cannabis insiders.

- Blog posts, stock analysis and company breakdowns.

- More content related to our Cannabis Watchlist.

- Monthly live chats with me, where we’ll discuss cannabis stocks, the cannabis sector and much more.

I even unveiled another tool you can use to help point you in the right direction for cannabis stock investments.

Just click “Join” on our YouTube page to find out what you can access by joining.

If you have a cannabis stock you’d like me to look at, email me at feedback@moneyandmarkets.com.

Where to Find Us

Coming up this week, we’ll have more on The Bull & The Bear podcast and our Money & Markets Week Ahead, so stay tuned.

Don’t forget to check out our Ask Adam Anything video series, where we ask any question to chief investment strategist Adam O’Dell, and our Investing With Charles series, in which our expert Charles Sizemore and I discuss the trends you write in to ask about.

Also, you can follow me on Twitter (@InvestWithMattC), where I’ll give you even more insights, not just in the cannabis market.

Remember, you can email my team and me at feedback@moneyandmarkets.com — or leave a comment on YouTube. We love to hear from you!

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.