Amazon is taking over the world.

Now, I’m not telling you anything you don’t already know. If your household is anything like mine, you probably know your neighborhood UPS driver by his first name. The boxes just keep coming…

The rise in online commerce has put pressure on retail real estate for years.

That’s nothing new, of course, but not all retail real estate is created equal. Amazon can’t deliver some items. No matter how much you might like the delivery guy, you wouldn’t let him cut your hair or fix a broken filling in your tooth, and he probably won’t make you a coffee.

Service-based businesses like these still need a physical presence, and that’s where STORE Capital Corp (NYSE: STOR) fits in. STORE, which stands for “Single Tenant Operational Real Estate,” is a real estate investment trust (or REIT) that specializes in smaller retail tenants.

About STOR REIT

STORE Capital’s tenants aren’t all from the service industry, but they are a larger percentage of the portfolio than you’d find at most REITs. About 64% of the REIT’s base rents come from service businesses that are located near target customers and sell things not readily available online.

During the pandemic, service businesses suffered. After all, social distancing meant staying away from the people performing the services. Yet that didn’t stop STOR from maintaining 99.6% occupancy in its properties. And as virus concerns continue to recede, STOR’s tenant base should get even healthier.

Now, let’s talk dividends. At today’s price (around $36), the stock yields about 4%, which is solid in this market.

Furthermore, the company aims for annual dividend growth of about 3% per year, which is (normally) well ahead of inflation.

Inflation has trended higher of late, but if that continues, STOR’s dividend growth should have no problem keeping up. The REIT has lease escalations in place that ensure rents remain competitive with market rates.

STOR REIT Stock Rating

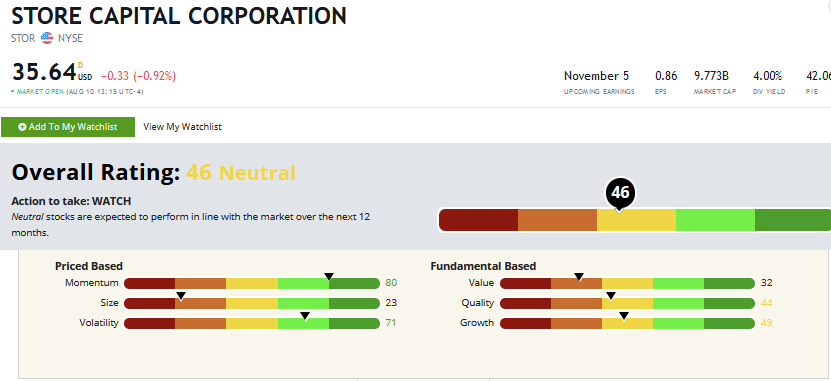

Our Green Zone Ratings system is chief investment strategist Adam O’Dell’s brainchild.

His proprietary model rates stocks on the six factors proven to drive market-beating returns.

We run this model daily on a universe of more than 8,000 stocks and rank based on “Overall Rating.” These ratings range from 0 – 100, where 0 is “worst,” and 100 is “best.” Anything rating over 80 is considered “Strong Bullish,” meaning we expect it to beat the market by a factor of three over the following 12 months.

At first glance, STOR seems to rate in the middle of the pack with an overall score of 46 out of 100.

But it earns high ratings where I want it to in this environment. Let’s dig into those details.

STOR’s Green Zone Ratings on August 10, 2021.

Momentum — STOR rates a competitive 80 on our momentum score. Income-oriented investments, and REITs in particular, have enjoyed a fantastic 2021, and I expect that to continue as yield-starved investors continue to hunt for income.

Volatility — STOR is a low-volatility stock, which makes it ideal for an income play. It rates a 71 on our volatility factor, meaning it’s less volatile than 71% of the stocks in our universe. At the end of the day, it makes no sense for us to risk major capital loss in the pursuit of a 4% yield, so STOR’s low volatility is a major plus.

Growth — STOR is a moderate grower with a middling rating of 49. Again, that’s OK. We’re not buying this as a high-growth dynamo. We’re buying it as a “Steady Eddie” dividend payer to effectively replace bonds in our portfolios.

Quality — REITs generally get punished on our quality score because they are asset-heavy, have a lot of mortgage debt and have artificially depressed earnings due to non-cash expenses like depreciation. All the same, STOR rates near the middle of the pack at 44. That’s not bad for a REIT.

Value — It wouldn’t break my heart if STOR were cheaper. It rates just a 32 on our value factor. But REITs also tend to get punished here, as their depressed earnings make them appear expensive in common valuation metrics like the price/earnings ratio.

Size — STOR is a large REIT with a market cap (share prices times number of shares outstanding) of close to $10 billion, so it rates a 23 on our size factor.

Bottom line: If you’re looking for a solid, low-drama dividend payer, STOR REIT is a worthy addition to your portfolio.

To safe profits,

Charles Sizemore

Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.