Sky-high valuation and elevated regulation risks are becoming a “hazard” to tech stocks and it might be time to write off high-growth equities, according to Goldman Sachs.

The darlings of the market the past couple of years, software companies are the big hits of 2019 because of their large profit margins and insulation from the ongoing trade war with China. However, Goldman is now warning of their “lofty” valuations and investor overoptimism toward the big tech antitrust probe.

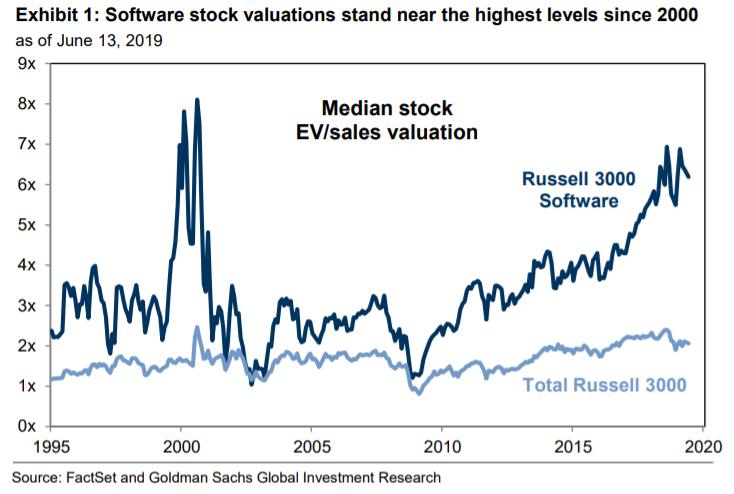

“Rising market concentration and the political landscape suggest that regulatory risk will persist and could eventually weigh on company fundamentals,” Chief U.S. Equity strategist David Kostin said in a note to Goldman Sachs clients. “The valuation premium for growth is elevated today relative to history; Software in particular now carries the highest multiples since the Tech Bubble.”

The information tech sector has led this year’s rebound from fourth-quarter 2018’s market collapse, rising 22% vs. the S&P 500’s 15% gain, the rally has stretched the value to extreme levels. Goldman notes, the tech sector carries a valuation premium of two standard deviations above its 10-year average across a range of metrics. Within tech, software stocks have the highest multiple near the peak of the dot-com bubble.

“History shows that stocks with the highest EV/sales ratios typically underperform peers over the long term. In general, these firms deliver the same upside as cheaper stocks when beating growth estimates, but more downside when missing forecasts,” Kostin wrote.

Microsoft has helped power the run in software stocks this year, returning more than 30% year to date.

Goldman also advised clients to reduce exposure to targeted companies in the event of an antitrust lawsuit being considered by the Justice Department like Alphabet (Google), Facebook and Amazon.

“Markets have reflected little concern,” but history shows “valuations and share prices declined between lawsuit filing and resolution,” Kostin said. “The cases took years to resolve, and sales growth slowed following resolution.”

Full disclosure: The author of this story currently owns NYSE-traded shares of Microsoft.