Health care is big business in the U.S.

According to the Centers for Medicare & Medicaid Services, Americans will spend $5.7 trillion on personal health care by 2030.

That’s more than $16,000 per person, per year.

And it’s 72% higher than the $3.3 trillion we spent in 2020!

That’s massive growth ahead for the health care industry, but certain stocks aren’t set to benefit.

This is the case with Cano Health Inc. (NYSE: CANO).

Cano Health: Losses Lead Institutional Investors Out

CANO’s business is simple: It provides primary care services for seniors.

It has medical practices in Florida, Texas, Nevada and Puerto Rico.

However, Cano Health ran into cash concerns recently.

The company reported a net loss of $112 million in its newest quarterly report — a 72.8% increase over the same quarter a year ago.

That led to investment advisor Third Point Management selling off its entire company position last week.

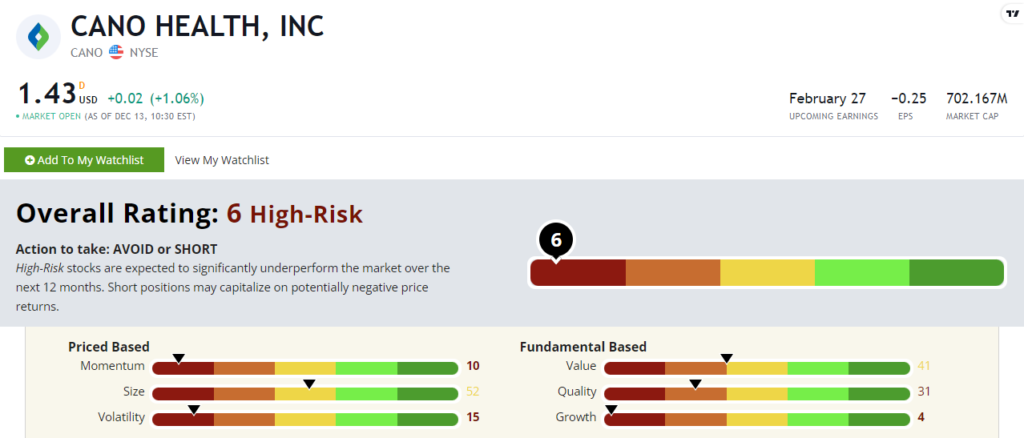

CANO stock scores a “High-Risk” 6 out of 100 on our Stock Power Ratings system. We expect it to underperform the broader market over the next 12 months.

Cano Health Stock: Poor Momentum + Lackluster Value

Here’s where I usually tell you about positive company financials.

Not so for Cano Health:

- Its trailing 12 month earnings-per-share growth rate is negative 45.4%!

- The company’s earnings per share dropped 172.4% quarter over quarter.

That shows why CANO stock scores a 4 on growth.

It scores in the red on five of our six fundamental factors.

CANO stock has negative price-to-earnings and price-to-cash flow ratios, meaning it’s not making any money. It scores a 41 on value.

The company has negative returns on assets, equity and investment, earning it a 31 on quality.

This stock is overvalued. Despite increasing its membership 40% from last year, the company isn’t generating any profit.

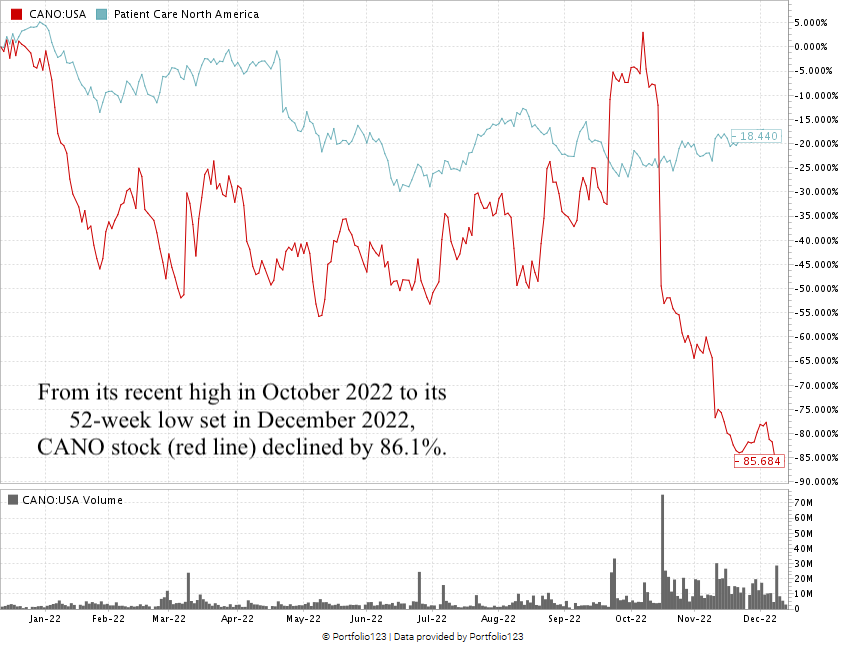

From its recent high in October 2022 to its 52-week low set this month, Cano Health stock fell 86.1%:

It’s down 85.7% over the last 12 months. Cano’s patient care peers (blue line in the chart above) have only fallen 18.4% over the same time.

Cano Health stock scores a horrendous 6 overall on our proprietary Stock Power Ratings system.

That means we consider it “High-Risk” and expect it to underperform the broader market.

Bottom line: Health care will be big business in the U.S. for years to come.

Cano Health’s plan is to serve seniors with primary care, but something isn’t working in the business.

With no profit and negative margins, CANO is a stock you should stay away from.

Stay Tuned: From Senior Care to Sleep Care

Tomorrow, we’re returning to our original Stock Power Daily form.

Stay tuned — I’ll share all the details on a leading stock in the sleep apnea space.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. I’d love to hear what you thought about my “Stock to Avoid” article today. Was it valuable? Would you like us to continue sharing high-risk stocks on occasion, so you know what to stay away from?

Would you prefer that we only share “Bullish” and “Strong Bullish” stocks?