Let’s take a trip around the world, and look at the CAPE by country.

If your memory needs jogging, the CAPE is the cyclically-adjusted price/earnings ratio. The CAPE compares current stock prices to a 10-year average of earnings. The idea is that, over a 10-year window, you’re likely to see a boom, a bust and everything in between.

I’ve been commenting for months that U.S. stocks are wildly expensive at current prices. In fact, even during the pits of the March sell-off, when the S&P 500 fell 34%, they never stopped being pricey. They were just slightly less so than they were in February (or are today).

Research site GuruFocus did the math and found that, at today’s levels, the S&P 500 is priced to deliver returns of about 3% per year over the next eight years. You’re not exactly getting rich at that rate.

But what about the rest of the world? Months into a post-COVID bull market, can we find better values overseas?

Today, we’re going to take a look at the entire developed world to see what’s cheap — and what’s not.

The U.S. Is Not Alone

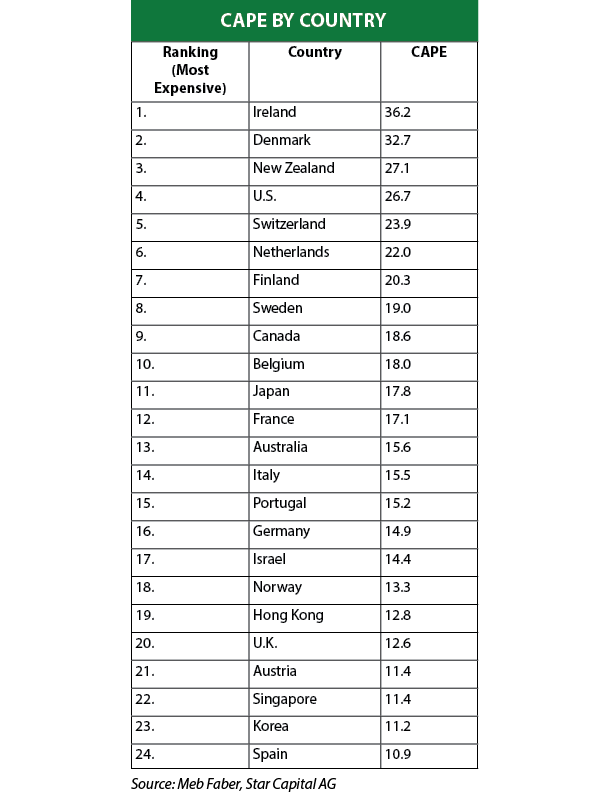

The U.S. market is expensive. But it’s not the most expensive. Ireland, Denmark and New Zealand hold the top spots. Check out the chart below to see where the U.S. and other markets rank.

Of course, these are all small markets with little global recognition. The first countries with any real markets to speak of are Switzerland and the Netherlands. These two European markets trade at CAPEs of 23.9 and 22.0, both significantly cheaper than the 26.7 seen in American stocks.

Moving down the list, the major European markets look a little cheaper. France trades at a CAPE of 17.1, Italy 15.5 and Germany 14.9. The U.K. is lower, at 12.6. And developed Asian markets of Singapore and South Korea come in at 11.4 and 11.2. All of these are less than half the valuation of the U.S. market.

Spain comes in as the cheapest of all developed markets with a CAPE of just 10.9.

Consider CAPE When Investing Abroad

Now, before you dump your American stocks and put everything into a Euro-Pacific fund, keep a few things in mind.

To start, the composition of the U.S. market is different than most of Europe.

European stock indexes tend to be full of old-economy stocks. There’s really no equivalent to Apple Inc. (Nasdaq: AAPL), Microsoft Corp. (Nasdaq: MSFT) or Amazon.com Inc. (Nasdaq: AMZN) in Europe.

You also have currency risk when you leave the United States. If your living expenses are in U.S. dollars, then most of your income stream should be too.

But all of that said, given how cheap most of the rest of the world looks right now, putting a little bit of your portfolio into non-U.S. stocks just might make some sense.

• Money & Markets contributor Charles Sizemore specializes in income and retirement topics, and is a frequent guest on CNBC, Bloomberg and Fox Business.

Follow Charles on Twitter @CharlesSizemore.