Veteran specialty finance company Capital One Financial (NYSE: COF) unveiled definitive plans for acquiring longtime credit card rival Discover Financial Services (NYSE: DFS) in a $35 billion, all-stock merger agreement framed as maximizing each entity’s payments network potential together rather than separately.

Specifically, the deal outlook cites melding Discover’s sprawling 70 million global merchant access portal and the existing cardholder base exceeding 100 million customers between the two companies as the rationale for projected expansion benefits surpassing current standalone reaches.

By consolidating back-end acceptance infrastructure with front-end consumer rolls into a singular payments ecosystem, Capital One intends to aggressively pursue transaction volume gains and tech synergies — including cross-selling digital money management and analytics solutions to enlarged combined users.

Stock Swap Deal Terms and Structure

From a structural standpoint, current Capital One and Discover investors would exchange equity holdings predicated on a set ratio wherein Discover shareholders receive 1.0192 Capital One shares for each Discover share presently owned once regulatory greenlights confirm closure by 2025.

This framework equates to Capital One ascribing a roughly 25 to 30% premium in purchase price compared to the latest Discover market valuations before public acquisition declaration.

Discover shareholders then stand to control 40% ownership in the merged credit card titan, with Capital One parent claiming the remaining 60% stake.

Positive ‘Bullish’ Stock Rating Signals Investor Optimism

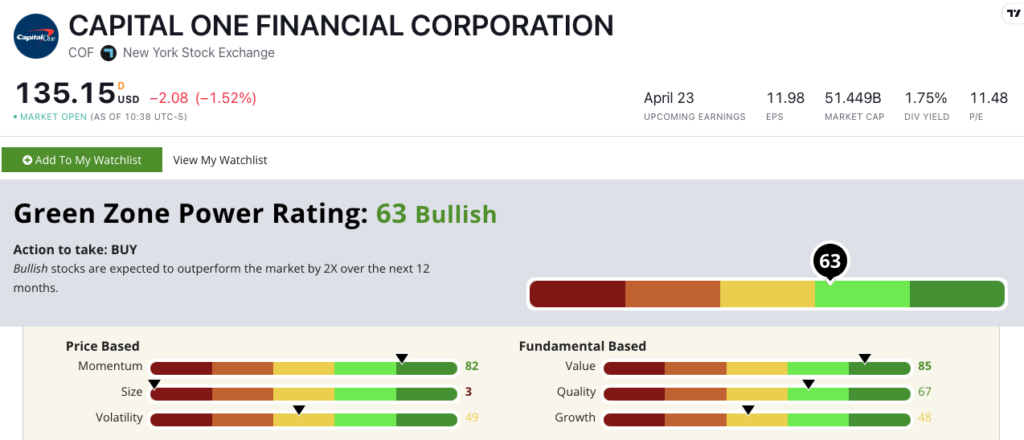

Adam O’Dell’s proprietary Green Zone Power Ratings system assigns Capital One a 63 out of 100 overall.

This means we are “Bullish” on the stock and expect it to outperform the broader market by 2X over the next 12 months.

COF earns an 85 on Value, with its price ratios all lower than industry averages.

The stock trades with a price-to-earnings ratio of 11.5 — lower than the 18.8 average in the specialty finance industry.

It also trades with a price-to-book value ratio of 0.9, while its peers average a ratio of 2.3.

The overall rating includes a 67 on Quality based on strong returns on assets, equity, and investment, as well as net and operating margins, all higher than the industry average.

Capital One has a return on equity of 8.3% compared to the specialty finance sector average of minus-7.3%. Its operating margin is 12.2%, while its industry peers average minus-9%.

COF earns an 82 on the Momentum factor thanks to a 23% climb in share price over the last 52 weeks.

While customary post-merger integration risk remains ever-present, these credible Green Zone indicators buttress Capital One leadership assertions that combined entity upside merits assuming deal costs for fortified positioning.

Bottom line: If seamlessly welded, the newly enlarged Capital One payments footprint could extend relevance against other fintech apps seeking to redistribute market share.

First, however, flawless execution realizing $2.7 billion forecast cost savings and revenue lifts must follow this blockbuster M&A to materialize favorably.