With a station on every corner, I can afford to be picky when it comes to where I get my gas.

Because gas prices don’t fluctuate much between different stations, I look to the products sold inside to determine my patronage.

From the drinks they sell to the snacks and food they offer … it all goes into where I decide to spend my money.

According to the U.S. Census Bureau, gas stations raked in $399.7 billion in 2020.

By 2024, revenue is projected to reach $483.2 billion — a 21% increase!

Today’s Power Stock owns and operates gas stations across the U.S.: Casey’s General Stores Inc. (Nasdaq: CASY).

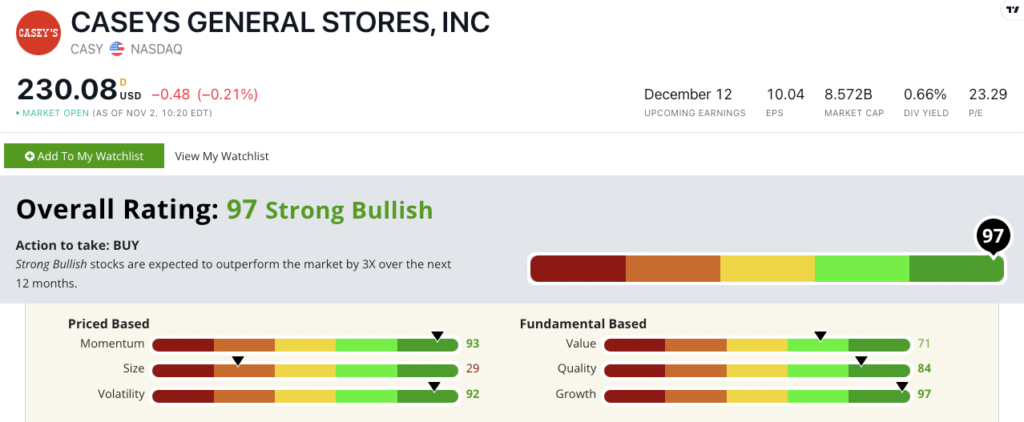

CASY’s Stock Power Ratings in November 2022.

CASY stock scores a “Strong Bullish” 97 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

CASY Stock: Excellent Growth and Momentum

Two items stood out after my deep dive into CASY:

- For its recent quarter, CASY recorded $152.9 million in net income — a 28.3% year-over-year increase.

- Casey’s plans to add 80 new stores and increase sales 4% to 6% this fiscal year.

CASY’s fundamentals are solid. It rates highest on our quality and growth Stock Power Ratings (as you can see above).

Its return on equity is 17%, while its industry peer average is negative 14%.

CASY’s return on investment is 10.7%, compared to an industry average of negative 11.4%.

This tells us that CASY is a much better quality stock than its competitors.

Created November 2022.

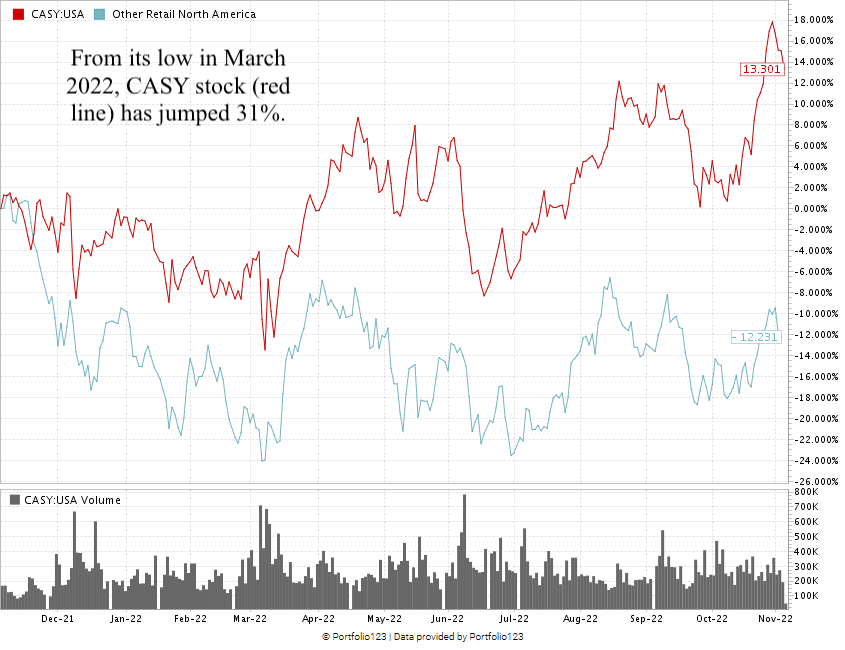

CASY stock hit a 52-week low in March 2022.

By the end of October, CASY raced up more than 34.5% … showing the “maximum momentum” we love in stocks.

Casey’s General Stores stock scores a 97 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Gas stations remain strong because, aside from gas, they offer a diverse range of products — food and drinks, among many other items.

As a big player in the gas station industry, CASY is a strong candidate for your portfolio.

Bonus: The company’s 0.66% forward dividend yield pays shareholders $1.52 per share per year.

Stay Tuned: Natural Disasters Won’t Go Away — No. 1 Insurance Power Stock

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on an insurance stock that will have steady business courtesy of hurricane season.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.