I worked at a newspaper in a small town with an office neighboring the county courthouse.

One of the county historians told me the story of how craftsmen built the now 100-year-old courthouse.

They used tons of limestone to create massive bricks and pillars for the building.

And today, limestone serves a more critical — and profitable — purpose.

This chart shows the market value of high-purity limestone in the U.S.

From 2020 to 2025, Grand View Research expects the industry’s revenue to increase 38.3%.

Today’s Power Stock has produced limestone since 1948: United States Lime & Minerals Inc. (Nasdaq: USLM).

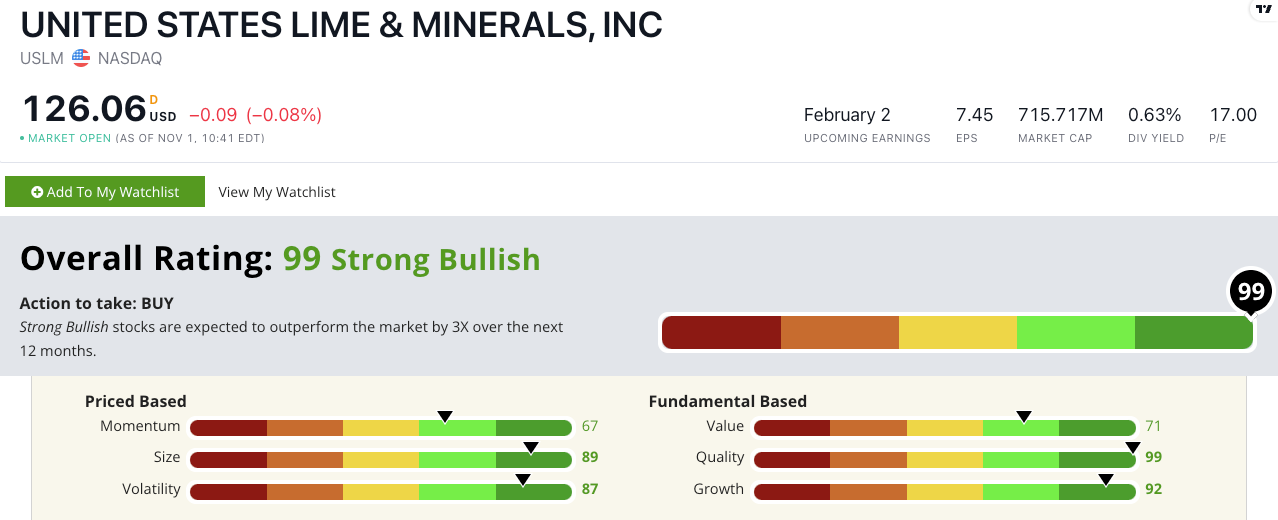

USLM’s Stock Power Ratings in November 2022.

USLM produces lime and limestone products used in highway and building construction, water treatment and soil stabilization.

USLM scores a “Strong Bullish” 99 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

USLM Stock: Great Quality + Low Volatility

United States Lime & Minerals had a strong third quarter.

Here are two high points:

- Reported revenue of $66.5 million — a 27% year-over-year increase.

- The company’s gross profits were $22.6 million — up 30.3% over the same period last year.

These sales figures show why USLM is a top-notch growth stock — scoring a 92 on that factor in our Stock Power Ratings system.

It’s also an outstanding quality stock, with a return on assets that’s more than double the industry average.

USLM’s operating margin is 23.3%. By comparison, the construction materials industry average is 10.7%. This tells us company management knows how to keep profits chugging along.

The stock earns a 99 on our quality metric.

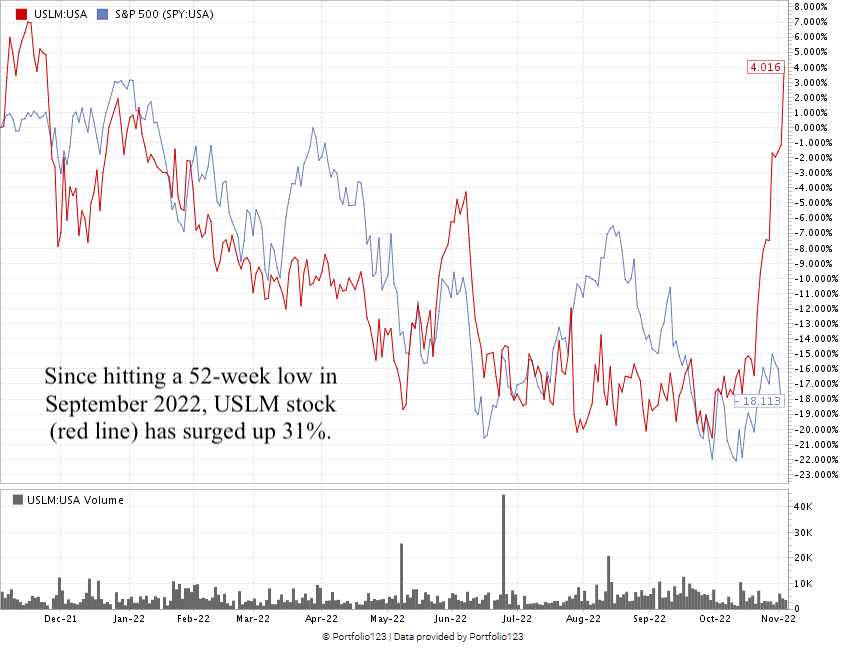

Created November 2022.

Over the last 12 months, USLM stock is up 4%, which might not seem impressive. However, the S&P 500 is down 18.1% in the same time frame.

I want to focus more on what the stock has done since the end of September.

After reaching a 52-week low, the stock has run up 31% into November … showing the “maximum momentum” we love to see in stocks.

United States Lime & Minerals stock scores a 99 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Limestone is critical in building and road construction and water purification systems.

USLM is a leader in producing limestone used in North America and Europe.

This makes it a great addition to your portfolio.

Bonus: USLM stock comes with a 0.63% forward dividend yield, paying shareholders $0.80 per share per year.

Stay Tuned: Unusual Power Stock to Benefit From Oil Surge

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify.

Stay tuned for the next issue, where I’ll share all the details on a “Strong Bullish” Power Stock that rakes in the benefits of the energy sector’s surge without any of the messiness of extracting or refining oil.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.