Interest rates are low. That’s not news since rates have been low for more than a decade.

The news is that rates are expected to remain low for the next decade.

The Congressional Budget Office (CBO) provides forecasts on economic growth, unemployment, interest rates and more. These estimates are widely respected.

The CBO says it “is strictly nonpartisan; conducts objective, impartial analysis; and hires its employees solely on the basis of professional competence without regard to political affiliation.”

Lawmakers factor these estimates into policy decisions and use them to craft laws. This means that policymakers are happy with the latest interest rate forecasts.

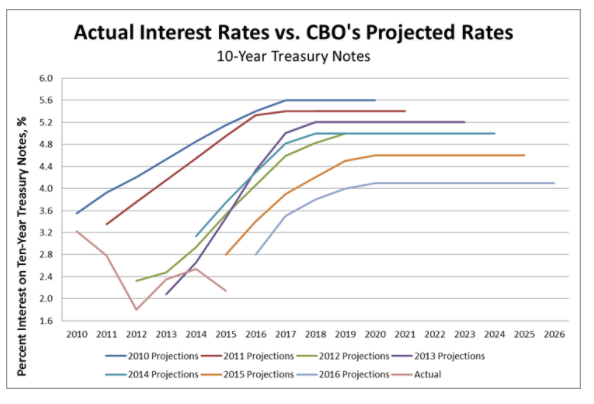

The CBO expects rates on 10-year treasury notes to remain below 2% through 2025. Long-term rates won’t reach 3% until 2029, according to the latest forecast. Short-term rates are expected to be below 2% until 2030.

Source: Congressional Budget Office.

Bad News for Savers

This is good news for Congressional representatives seeking to increase spending. Low rates make it easier to borrow money.

This is bad news for two groups:

- Savers who planned on receiving interest income.

- Pension fund managers who have assumed they can earn interest income of at least 5% on their portfolios to meet their obligations.

If pension funds can’t meet their obligations with investment income, state and local governments may need to raise taxes.

This seems like a lot of bad news. But it gets worse … as the next chart shows.

A History of Being Wrong

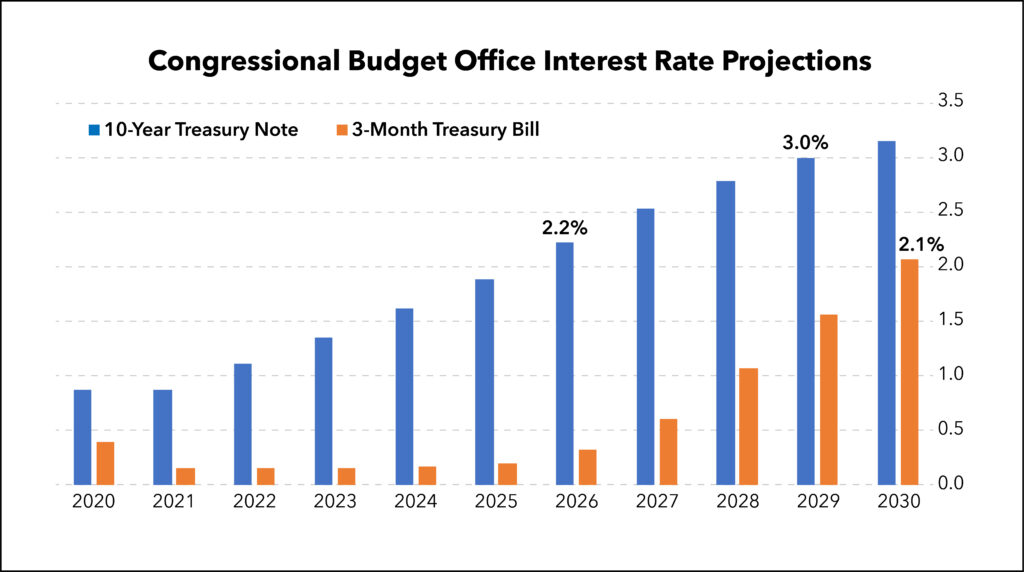

The CBO is well respected, but it has a history of being wrong. Official forecasts consistently overestimate the level of future interest rates.

The pink line that dips from 2010 to 2012, and again from 2014 to 2015, reflects the actual interest rates. The other lines are the CBO’s projections from 2010 to 2016.

If CBO estimates are wrong, as they traditionally have been, interest rates will be lower for longer than anyone expects. All of the problems that income investors and local governments face will be even worse than expected.

Now, there is some good news to consider. This is a long-term problem.

In the short run, the bull market can ignore this issue and deliver large gains to traders.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.