It can pay to follow the bond market. This has been true for centuries.

Bond prices have long reflected faith in government.

But it’s a lesson that we often need to relearn.

In 1993, bonds reacted negatively to policies of the new Clinton administration.

According to reports at the time, Clinton political adviser James Carville said:

I used to think that if there was reincarnation, I wanted to come back as the president or the pope or as a .400 baseball hitter. But now I would like to come back as the bond market. You can intimidate everybody.

The Bond Market Should Intimidate Investors

Right now, the bond market should be intimidating to stock market investors.

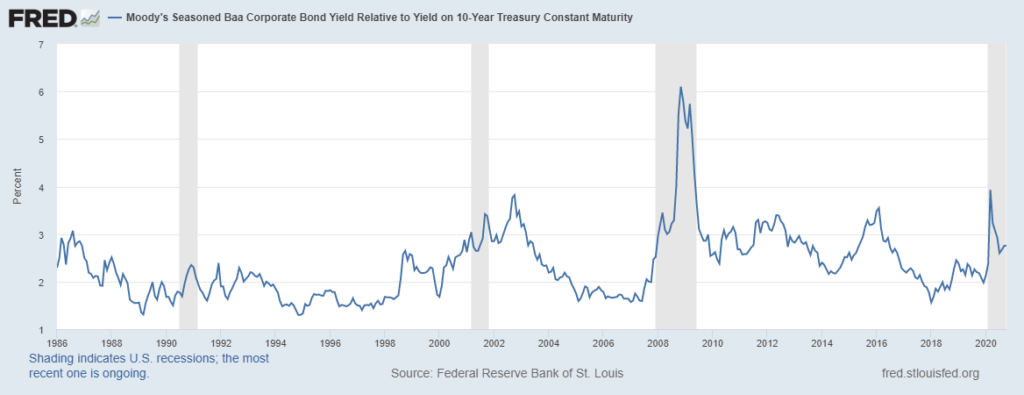

One indicator that stock market investors should follow is the spread between low-grade corporate bonds and Treasury notes.

Low-grade corporates bonds are just one level above junk.

Bond-rating agencies like Moody’s believe companies issuing these bonds have enough cash to pay their debts in good times — but they could miss payments in an economic downturn.

Moody’s assigns a Baa rating to these bonds. When the economy grows, bond market investors buy corporates for the higher yields. This means that they drive rates on Baa bonds down, and the spread, or difference, between Baa rates and Treasury notes falls.

When risks rise, bond traders move to Treasurys, and the Baa spread rises.

Right now, as you can see in the chart below, risk is rising.

Baa Spread: Risk Is Rising

Source: Federal Reserve.

To use this information as a stock market indicator, we can look at the level of the spread to its value.

When this spread increases from the level where it was 12 months ago, risks in the stock market are high.

Over the long run, avoiding stocks when this simple indicator is bearish would beat a buy-and-hold strategy by a wide margin.

This indicator is valuable because it has signaled ahead of almost every major stock market downturn since 1919, when data became available.

In the past 100 years, it missed just two stock market declines, in 1933 and 1942, of more than 15%.

It’s on a sell signal right now. Investors should be cautious.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.