Pop quiz: What do these three stocks have in common?

Hmmm, well…

Amgen (AMGN) is a biotech stock…

Baker Hughes (BKR), an energy company…

And O’Reilly Automotive (ORLY) is a car parts retailer.

So, they do not share a common sector.

I’ll help you along…

These three stocks are all “large caps,” with market capitalizations of $10 billion or greater.

They’re also all members of the ever-popular Nasdaq 100 index.

But neither of those commonalities is what makes them special.

Here’s the answer…

These are the only three Nasdaq stocks that, today, are…

Ready for “Liftoff”

Hey friends, Adam here.

Today, I’m stealing space from our typical Thursday “New Bulls” report with a Kinetic Profits takeover!

See, for the first time in over five years, I’m releasing a brand-new trading tool…

It’s called the Kinetic Profits Indicator.

This is not a “rating” system, like the Green Zone Power Rating system I released in early 2020.

This is not a trading “service.”

This is an institutional-grade, price-based indicator that you can use for life, on any stock of your choosing.

The indicator is designed to answer one simple, but very lucrative question:

“Is this stock …

… ready for ‘liftoff’ …

… today?”

I ran through each of the Nasdaq 100 stocks this morning before the market opened, just to show you what it looks like.

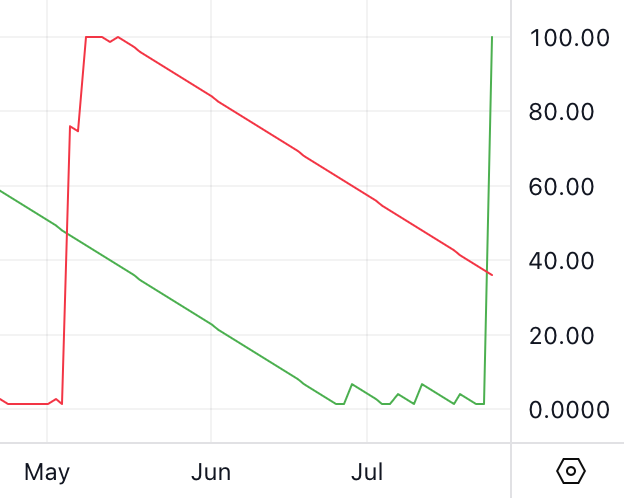

Here it is on Amgen (AMGN)…

See? Yesterday, the green line crossed over the red line…

Just as Amgen shares were breaking free to a three-month high…

Here’s what the Kinetic Profits Indicator looks like on Baker Hughes (BKR):

See? The green line just crossed above the red line…

Right as shares of the stock began to rocket higher to a four-month high.

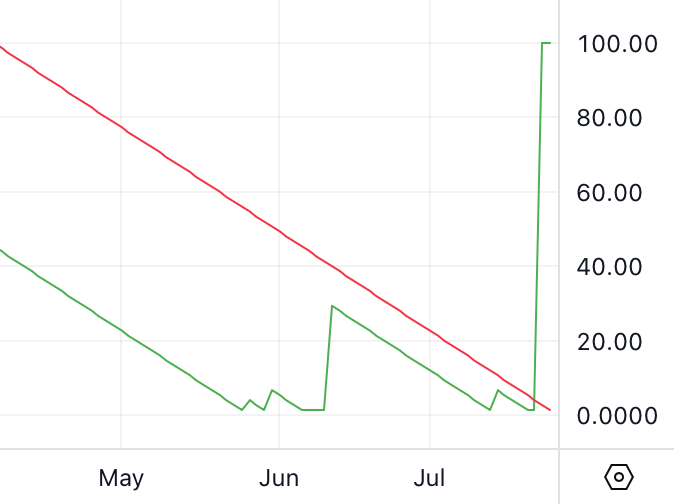

Same with O’Reilly Automotive (ORLY):

See? The green line just crossed above the red line…

Only difference here? ORLY shares are now breaking out to an all-time high!

And that’s after my Kinetic Profits Indicator had previously signaled a nice little run in ORLY, from $74 a share last July to as high as $97 come April – a 31% move in only nine months.

Have a look:

Now, at this point, you may be wondering…

Why Give You the Kinetic Profits Indicator … for Life?

After all, the financial newsletter industry is built on a model of recurring subscription revenue.

That’s all fine and well … and you have my commitment that I’ll continue to be your “guide” in the premium research services we offer, from Green Zone Fortunes and 10X Stocks … to Infinite Momentum Alert and Max Profit Alert.

But I wanted to do something different here … because I truly believe that putting the power and potential of this indicator in your hands for life … is the right thing to do.

I see it as fulfillment of the proverbial “teach a man to fish, feed him for life” idea.

This way, as I explained to my Green Zone Fortunes subscribers yesterday, the next time you’re wondering…

“Is it too late to buy into that Green Zone recommendation Adam issued last month?”

Or maybe…

“I heard about this small tech company, but is it the ‘right time’ to get in?”

Well, you can now have access to a data-driven tool that can answer those questions (and many others) for you, with a crystal-clear “yes” or “no.”

And by putting this tool directly into your hands, for life, the possibilities are practically limitless…

You don’t have to limit yourself to just the Nasdaq 100 — I only did that today to show you a few examples of “fresh” signals.

You could just as easily apply my Kinetics Profits Indicator to:

- S&P 500 stocks.

- Equity-market and sector ETFs.

- Small-cap stocks.

- Even crypto!

Consider the indicator’s latest signal on bitcoin (BTC/USD)…

Here’s what the bullish “X marks the spot” crossover looked like when it appeared on my charts on May 7, when bitcoin was trading for around $96,ooo:

You may know … bitcoin has since rallied $27,000 to hit an all-time high!

My point is that the Kinetic Profits Indicator is extraordinarily flexible with respect to the assets it can be used to assess. And it’s laser-focused on a single, highly valuable task … determining whether a stock (or any asset) is already moving higher and with enough bullish momentum to achieve “liftoff.”

If you couldn’t tell, I’m highly enthusiastic about this new offering.

It’s unlike anything I’ve released publicly in the last five years … and I’m 99% certain you’re going to love it!

Unfortunately, I can’t cover every single detail about the Kinetic Profits Indicator in this one-day takeover of What My System Says Today.

I haven’t even touched on the nine-point, solid-business “checklist” that this indicator can be used alongside.

To good profits,

Editor, What My System Says Today