Kids across America are getting ready to start school, be it in person or — more likely these days — via a remote learning program.

In the spirit of back-to-school, let’s take a look at Chegg Inc. (NYSE: CHGG). It’s an education technology company that offers online tutoring, textbook rentals and other student services.

While the COVID-19 pandemic has turned the world upside down, it’s been a godsend for companies that deliver their wares over the internet like Chegg.

Chegg isn’t a household name yet, but it’s getting there.

A lot of parents are concerned that their kids will fall behind in school because, let’s face it, an online classroom isn’t as good as the real thing. It’s difficult for a teacher managing a classroom to give each individual student the attention they might need. Chegg’s online tutoring gives students some quality one-on-one time with teachers.

Chegg reported second-quarter earnings on August 3. And the results were exactly what you might have expected. Revenues were up 63% year over year, and its subscriber base grew by 67%.

Chegg’s explosive growth will level off once life returns to something resembling normal. We won’t always have kids attending Zoom lessons at the kitchen table while mom and dad try to work and play tech support at the same time. But I expect some of these changes to stick.

Here’s a snippet from Chegg CEO Dan Rosenweig’s earnings presentation:

Our research shows that the majority of students now feel online learning can be as legitimate, effective and rigorous as in-person instruction … We remain optimistic that this pandemic will end soon and, when it does, one of the legacies will be that the door is permanently open to the promise of online learning: affordable, scalable, on-demand and designed to support whatever the student’s primary goals are, whether it’s academic learning, professional development or both.

I can’t wait to boot my kids out of the house and back into a classroom. It can’t happen a day too soon. But I also think online tutoring and classes will stick around.

It’s a fantastic story. But does that make the stock a good buy?

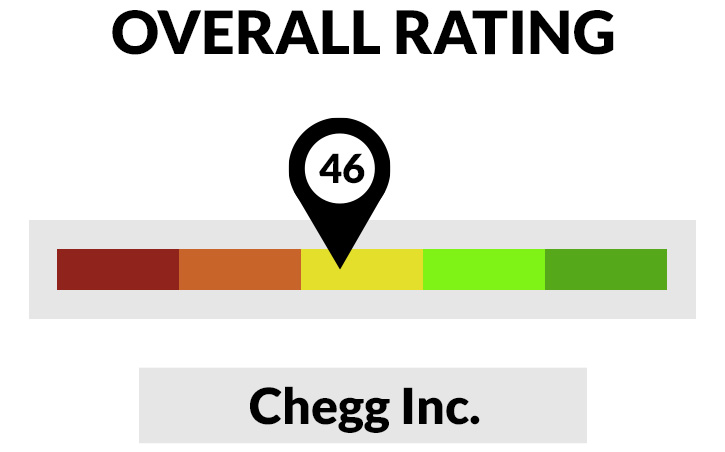

Money & Markets Chief Investment Strategist Adam O’Dell has developed his own stock rating system to help answer questions like this.

Let’s see how Chegg stacks up using Adam’s six-factor system.

How Chegg’s Stock Ranks

Chegg has an overall score of 46, making it the definition of average. A little over half of all companies in Adam’s universe rank higher. Let’s dig into the details.

- Momentum — Chegg rates highly on momentum, coming in at a 95. Only 5% of companies have better momentum than Chegg at the moment. Shares are up about 200% since the lockdowns started in March.

- Volatility — Despite the recent run-up, Chegg rates well in volatility. With a rating of 80, only 20% of companies are less volatile. (Note: The lower the volatility, the higher a company ranks in Adam’s system.)

- Growth — Chegg rates higher than average on growth, coming in at 64. On sales growth, Chegg rates an 82, but its earnings tell a different story. Earnings per share growth rates a middling 47. Chegg’s earnings get dragged down by high investment and administrative expenses.

- Quality — Perhaps not surprisingly, given Chegg’s middling profitability, the company rates only a 34 in quality. The company‘s gross margins are high. But its debt levels, capital efficiency, cash flows and “return on” profitability metrics (return on equity, return on assets, etc.) score in the bottom half of all companies.

- Size — Chegg also loses point on size, rating an 18.

- Value — And finally, there’s value. Or perhaps I should say a lack of value. With a rating of 4, fully 96% of all companies represent a better value in terms of the price-to-earnings ratio, price-to-sales ratio and other common metrics.

It Isn’t a Buy Now

I’d be careful with Chegg. While its products are tailor-made for a pandemic, and poised to do well even once life returns to normal, the lack of profitability is an issue. You can find better new economy plays elsewhere.

Use Chegg’s products. But avoid its stock for now.

Money & Markets contributor Charles Sizemore specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.

Follow Charles on Twitter @CharlesSizemore.