As a result of falling oil prices and continued market volatility from the novel COVID-19 pandemic, oil and gas giant Chevron is slashing how much money it plans to spend for the rest of the year.

Chevron Corp. (NYSE: CVX) said Tuesday it will cut capital spending by 20% and suspend its $5 billion annual stock buyback program.

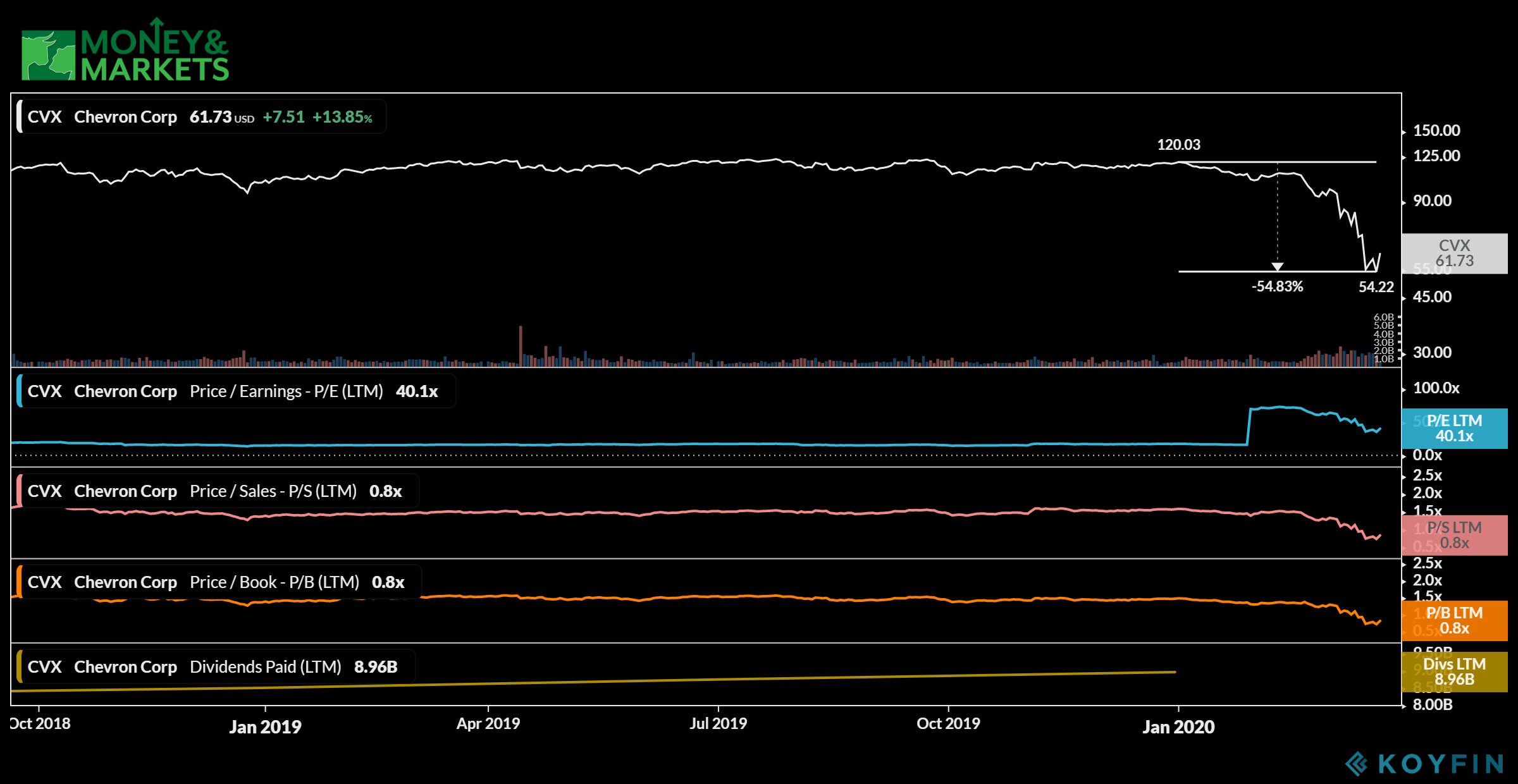

As a result of the announcement, its share price jumped more than 13% Tuesday morning. That, however, pales in comparison to the 54% drop Chevron’s shares have experienced since January 2020.

The company said it hopes the cuts will allow it to maintain its dividend. Its most recent payment to shareholders was $1.29 per share on Feb. 14.

Banyan Hill Publishing’s Matt Badiali said moves like this have kept Chevron in business since 1876.

“This company has lived through ALL the oil price collapses in history,” said Badiali, a geologist who has traveled the world visiting oil well and precious metals mines.

Why Oil Prices Are Tanking

Oil prices have fallen drastically after OPEC nations and Russia failed to reach an agreement to curb production. As a result, Saudi Arabia and Russia decided to go to war over prices by flooding the market.

Saudi Arabia slashed its oil prices and boosted output by more than 1 million barrels a day in an effort to get Russia back to the negotiating table.

Both West Texas Intermediate and Brent crude have fallen under $30 a barrel since.

Between that and the economic impacts of the coronavirus spread, markets have been on a roller-coaster ride. All three indexes are currently in bear markets as a result.

“To see these two things happen simultaneously is really unprecedented,” Chevron CEO Mike Wirth told The Wall Street Journal. “We can’t control that, but we’re focused on making the moves that will preserve the strength of our company.”

Chevron Will Survive

Its propensity to weather past oil price storms is a result of making decisions like Tuesday’s.

Banyan Hill’s Matt Badiali.

“This is the playbook for these major oil companies to get through the downturn — get lean quickly,” Badiali said. “French giant Total SA (NYSE: TOT) announced a $3.3 billion spending cut for 2020. The bulk of that, $2.2 billion, came from exploration investments.

“While ExxonMobil Corp. (NYSE: XOM) hasn’t announced specifics yet, it began warning contractors of spending cuts.”

But Badiali believes only larger companies like Chevron will survive if the market panic and oil price war continues. Chevron’s decision to cut capital spending and its stock buybacks will allow it “to ride out at least 12 months, if not 18-plus months of low oil prices.”

“As 2020 goes on, expect to see smaller exploration and production companies begin to sell assets and go bankrupt,” Badiali said. “In the past, there would be private equity competing for those assets. However, in this climate, there won’t be anywhere near as much interest.

“The major oil companies like Chevron will be the big winners.”

Chevron Not Yet a ‘Buy’

Despite its ugly drop in 2020, Chevron is not likely a buy just yet.

Badiali agrees, saying Chevron may be near the bottom, but investors need to exercise some patience.

“I don’t advocate buying equities for at least a few more weeks. The coronavirus’ impact on the world oil demand will get worse before it gets better,” Badiali said. “It could be priced in, but I don’t think it is yet. The recent price action in CVX looks like a dead cat bounce.

“I think folks have two options here: Wait and see if it falls lower while adding a measure of safety. Or sell out of the money puts to get paid and try to get the stock put to you at a lower price.”