Oil is back.

The price of a barrel of West Texas Intermediate — a crude oil that we can use as a global oil benchmark — is now over $65, putting it at late-2019 levels.

The pandemic-related supply glut has passed through the system. But according to the U.S. Energy Information Administration, demand won’t return to pre-pandemic levels until 2022.

So, most of the price recovery in crude is due to production cuts rather than increased use. Longer term, adoption of renewables such as solar and wind will eat away at demand growth.

Nevertheless, the world oil market has reached an equilibrium of sorts — at least in the short term.

This is good news for major oil companies, and their stock prices show it.

After bottoming out at $51.60 during the pits of the COVID-19 bear market, American giant Chevron Corp.’s (NYSE: CVX) share price has more than doubled.

Of course, crude oil prices aren’t even close to pre-pandemic highs, and the entire industry still faces major risks — including the Biden administration’s aggressive push for green energy.

Investors are warming up to Big Oil again.

If you’re among them, Adam O’Dell’s six-factor Green Zone Ratings model tells us to exercise caution.

Chevron Stock: Green Zone Rating

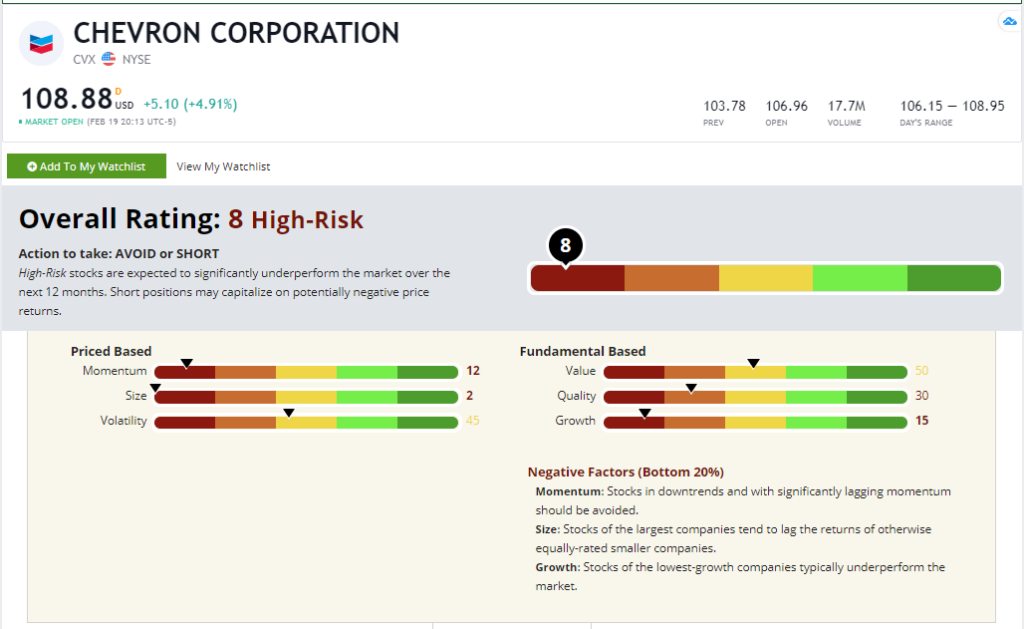

Chevron stock rates a paltry 8 out of 100, making it a “High-Risk” stock in our system.

Chevron’s Green Zone Rating on March 5, 2021.

It was rough for the oil majors even before the pandemic turned the world upside down.

And our data is inherently backward-looking, hence the abysmal score.

Let’s do a deeper dive on CVX to look for the positives.

Value — As beaten up as the energy sector is, you might think it would represent a real value. That’s not the case. Chevron rates a 50 out of 100. It’s the definition of average. The stock isn’t overvalued. But it isn’t priced for years of outsized returns either.

Volatility — Chevron is also in the middle of the pack on volatility, rating a 45. So, CVX is roughly as volatile as the broader market. But if you’re looking for a staid portfolio anchor, look elsewhere.

Quality — Chevron rates below average on quality with a score of 30, and it’s not due to any single metric. After a rough decade, the company rates low across the board by our measures of profitability and balance sheet strength. This is still one of the oldest and best-run companies in America, at least within its industry. But by our objective criteria, it rates low based on quality.

Growth — Oil and gas is not a growth business in 2021. Chevron rates poorly here at just 15.

Momentum — Chevron might seem to have solid momentum at the moment. But we measure momentum over various time frames. Overall, the stock rates just 12. This rating may change quickly as investors rotate into energy stocks like CVX.

Size — Chevron is a major energy company and one of the largest operations in the world. That’s why it garners a size rating of 2.

Bottom Line: Chevron’s low ratings across the board make me skeptical of the stock as a long-term holding. But as a shorter-term trade, I think it might have legs. Energy stocks are showing life lately as investors take profits in tech stocks and look for new opportunities.

I wouldn’t bet on Chevron just yet. But Adam and I are analyzing a shortlist of smaller energy companies that have the potential for outsized gains as rotation into the energy sector continues in 2021.

We’ll reveal our highest-conviction pick within the sector in our March issue of Green Zone Fortunes. It’ll be in our readers’ hands early next week.

To make sure you’re one of the first to see this recommendation, sign up for Green Zone Fortunes here.

To safe profits,

Charles Sizemore is the editor of Green Zone Fortunes and specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.