Chevron Corp. (NYSE: CVX) is one of the world’s largest energy companies, with operations in more than 180 countries. How does Chevron stock rate?

Chevron is engaged in every aspect of the oil and gas industry, from exploration and production to refining, marketing and transportation.

In 2021, Chevron was ranked sixth on the Fortune 500 list for total revenues.

In 2022, Chevron plans to invest $20 billion dollars into its business operations — a 5% over its budgeted expenditures for 2021.

This increased investment will be focused on upstream projects such as unconventional resources.

Chevron Operates In More Than 60 Countries

Chevron is a major player in the global energy business.

With more than 60 countries contributing to its operations, Chevron does everything from exploration and production of crude oil and natural gas to refining, marketing and petrochemicals manufacturing.

Chevron also owns upstream and downstream assets around the world such as interests in pipelines, liquefied natural gas terminals, power plants and renewable energy projects.

Founded in 1879, Chevron has been headquartered in San Ramon, California since 1926.

You’ve heard of Chevron.

Ranked as the second-largest oil company in the United States and the 22nd largest publicly traded company in the world, Chevron has a lot of influence beyond its own business sector.

Chevron Stock Reaches New Highs In 2022

Chevron stock is climbing higher.

In 2013, Chevron stock was hovering around the $70 per share level. But in 2022, the stock hit a 52-week high of $186 per share. Investors and analysts alike are bullish on Chevron’s future prospects.

Stock Power Ratings for Chevron Stock

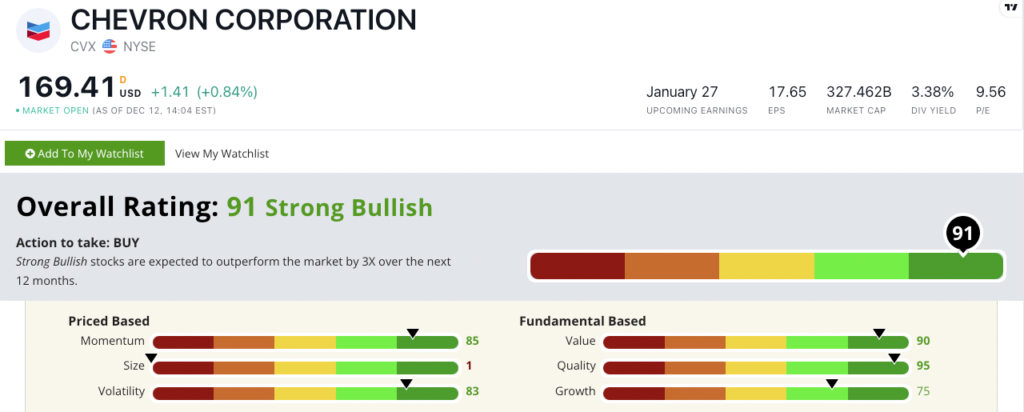

CVX scores a 91 out of 100 overall on our proprietary Stock Power Ratings system in December 2022. (Click here to see how Chevron’s stock rating has changed.)

It’s “Strong Bullish” within our system, which means it is set to outperform the broader market by 3X over the next 12 months.

Chevon earns its highest rating on our quality metric — where it scores a 95.

This is due to double-digit returns on assets, equity and investment as well as strong gross, net and operating margins.

CVX is also a fantastic value stock — scoring a 90 on that factor.

All of Chevron’s price-to ratios (earnings, sales, cash flow and book value) are in line with the integrated oil and gas industry averages.

The company has shown great growth potential with a one-year annual sales growth rate of 65.6% and an earnings-per-share growth rate of 374.5%.

Chevron stock is a great value and management has done a solid job turning profits.

The bottom line: As one of the largest oil companies in the world, Chevron has a lot to offer investors. The company is stable and profitable, with strong revenue growth potential.

P.S. Adam O’Dell is watching the oil market closely. He sees a “Super Bull” forming in the coming months.

And when it hits, he expects this No. 1 stock to soar 100% higher in just 100 days. Click here to sign up for his upcoming presentation.