I am incredibly bullish long term on the renewables mega trend.

But ever since oil futures went negative during the 2020 pandemic, I’ve beaten the traditional oil and gas stocks drum.

I know renewable energy stocks will eventually overtake more traditional energy plays, but that transition’s going to take a while.

With what’s going on overseas, you want to know if now is the time to get into oil and gas stocks.

In this week’s Ask Adam Anything, I analyze one of the oil giants: Chevron Corp. (NYSE: CVX).

Let’s see how you can play the oil trend with CVX in today’s market environment.

Here are the highlights from my conversation with our research analyst, Matt Clark.

Why Oil Stocks Are Outperforming

Matt: I’ll give full disclosure here. A couple of weeks ago on MoneyandMarkets.com, I recommended Chevron as a buy because of the market conditions.

CVX has done well, but I know there are different ways to look at this stock. What do you think of it? Is it a buy today?

Adam: Yeah, it’s a great question.

I’m not at all surprised that folks are writing in asking us about specific oil and gas stocks.

You have to look at more than just growth rates of a mega trend, or an industry or a stock.

You have to also consider valuations.

The valuations of traditional oil and gas stocks were absolutely beat up in early 2020. Unless you thought that all of the major, and even smaller, oil and gas operations were going out of business within a couple of months, there was no reason not to buy some of these stocks.

There was also a lot of underinvestment over the past several years due in part to environmental, social and governance (ESG) investing.

A lot of funds haven’t been allocating to oil and gas stocks because of their impact on the environment.

I certainly support that idea, but what it’s led to is an underinvestment in production of oil.

We’ve seen that affect the price of oil, even well before the Russia-Ukraine conflict.

I’m not surprised that folks are asking about energy sector stocks now. Year to date in 2022, the Energy Select Sector SPDR Fund (NYSE: XLE) is up 40% [as of this recording].

It’s the only sector exchange-traded fund (ETF) that we track, as far as the U.S. sectors, that is in positive territory. Everything else is down upward of 10%.

Energy has been just about the only place to be this year so far.

Is Chevron Stock a Good Buy Now?

Adam: I’m going to have to hedge my answer on if Chevron stock is a good buy now, because it depends on what type of investment or trade you’re looking to make.

If you are a longer-term investor, someone who wants to hold well-rounded stocks over a two- or three-year period, you need to check out CVX’s Green Zone Rating.

Editor’s note: Chevron’s stock rating has changed slightly since recording. The numbers below reflect the new rating.

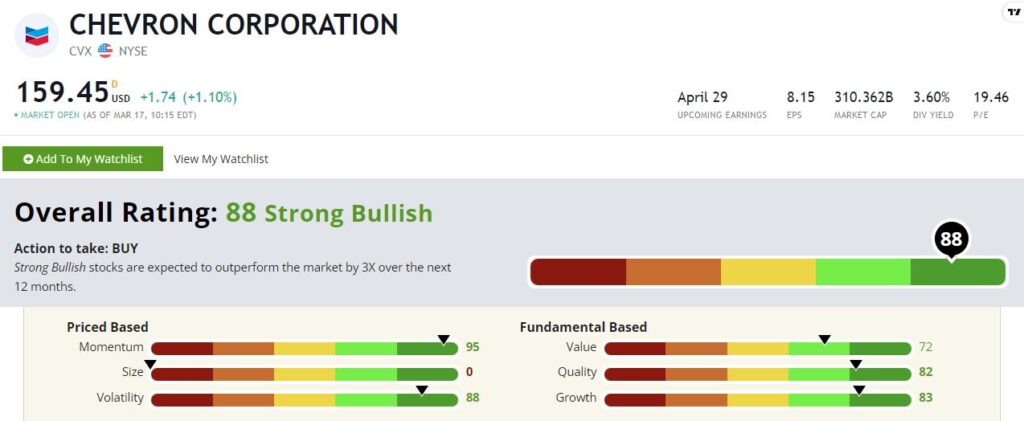

CVX rates an 88 overall in my proprietary system.

It would probably be a 99-rated stock if it were not for the size. Large companies get a low size rating. Chevron is a $330 billion market cap company. It’s about as large as it gets.

Even with that zero score on size, this stock rates incredibly well. It’s a 95 on momentum and an 88 on volatility, because we have upside volatility and better risk-adjusted returns.

Then if you look at the fundamental metrics of Chevron stock, this is what I was talking about.

It was so undervalued in 2020 that it was crazy not to buy it along the way here. But even after this run up, you can see in the chart below it still rates 72 out of 100 on value.

Chevron Goes Vertical

And it rates 82 and 83 on quality and growth.

From a long-term perspective, I would support buying Chevron stock.

The stock rates 88 out of 100. We think it’s going to either double or triple the market’s return ahead.

A Word of Caution on CVX

Adam: CVX has run up very sharply. It’s almost made a vertical move higher over the last three months.

If you’re looking for a better entry point on a short-term play, you might want to wait for a bit of a pullback.

The stock is pretty well stretched above its 200-day moving average, and I wouldn’t be surprised to see something of a pullback ahead.

This is a run-up that is not sustainable at this pace. It’s hard to say what this stock will do next with momentum, and specifically with a geopolitical crisis like we’re in now. It could keep going higher, but the risk/reward isn’t as much in favor of a short-term buy now.

I would be a little hesitant to buy in right now with a large position. I would probably wait a little bit for a pullback or wait for another momentum signal down the road.

All in all, I do believe that Chevron is going to be a solid performer over the next couple of years as the energy sector kind of comes to an equilibrium.

But, that said, shares have run up a lot. I think we’ve seen the meat of the move.

CVX and the Renewable Energy Mega Trend

Matt: You mentioned ESG investing earlier. Some people avoid getting into oil stocks because of their environmental impact.

But I was attracted to Chevron for two reasons:

- It has recently entered into an agreement to purchase Renewable Energy Group Inc. (Nasdaq: REGI), which is a huge renewable energy company, for around $3 billion. This is going to make Chevron a major renewable energy player.

- Chevron has also partnered with Algonquin Power and Utilities Corp. (NYSE: AQN) to develop some renewable power projects.

Chevron is not only buying into, but it’s also partnering with other companies to find renewable ways to make electricity.

You have a giant who has realized the value of renewable energy and is now putting its money where its mouth is.

Adam: Absolutely. I’m glad you brought all these points up, Matt, because you’re absolutely right.

Market forces and the incentive of profit is really what’s driving Chevron to want a piece of the renewable energy mega trend.

It’s not that it’s being forced to. It just wants to adapt with the times.

As I see it, CVX and its investors can have their cake and eat it too.

Chevron is a profitable, cash flow positive company that is going to generate a lot of cash flow and a lot of returns for shareholders now while oil and gas are still a big part of the energy mix.

At the same time, it’s investing in the future to be part of that renewables mega trend going forward.

I think that its purchase of Renewable Energy Group is a telltale sign that Chevron sees this as the future. Otherwise, it wouldn’t be doing it. It would just try to out-compete renewables.

And speaking of the renewable energy mega trend, I have put together a presentation recently on a technology I call “Infinite Energy.”

It’s about accessing an untapped energy resource that will disrupt the multitrillion-dollar energy industry.

With new technology coming online that’s going to speed up the adoption of renewables, I think a couple of companies are absolutely going to go gangbusters in that mega trend.

Click here to watch my presentation now and see how you can follow this trend into the future.

Bottom line: This isn’t an either/or thing with old oil and gas or renewables. It’s a transition that will take time.

And there’s opportunity in both spaces along the way.

To good profits,

Adam O’Dell

Chief Investment Strategist