Chewy Inc. (Nasdaq: CHWY) has become a top competitor in the pet retail space. But how does Chewy stock rate?

Chewy is an online pet supply store founded in 2011 and based out of Boston, Massachusetts.

It’s one of the most recognizable names in pet retailing, with over 1 million customers visiting its website each month.

As of 2021, Chewy is a publicly-traded company with a market capitalization of $15 billion, making it one of the most successful e-commerce companies on the U.S. stock exchange.

With all of this said, what does the future hold for Chewy’s business and outlook for 2023? Let’s take a look.

Chewy’s Growth Strategy

Chewy has been successful due to its commitment to customer service and strong relationships with suppliers. The company offers competitive pricing on its products, which are sourced from more than 2,000 manufacturers around the world.

It also boasts a wide network of warehouse distribution centers that enable it to offer fast delivery times without sacrificing quality or customer satisfaction.

In addition to these strategic advantages, Chewy invests heavily in marketing and advertising campaigns to increase brand awareness and drive sales growth. The company partnered with Disney on a promotional campaign featuring Mickey Mouse as its mascot, which was very well received by consumers.

This type of creative marketing helps build loyalty among existing customers while attracting new ones as well.

Outlook for 2023

Given its success in recent years and its current growth strategy, it appears that Chewy will continue to be a top player in the pet retailing space going into 2023.

The company currently holds an impressive share of the online pet food market, and analysts believe that this number could grow even further in the year ahead as more people turn to online shopping for their pet supplies needs.

In addition to organic growth from increased demand for pet products, analysts also expect that acquisitions will play a key role in driving future expansion for Chewy.

But that hasn’t quite translated into sustainable profits and a solid Chewy stock. Our system shows why that’s the case.

Chewy Stock Power Ratings

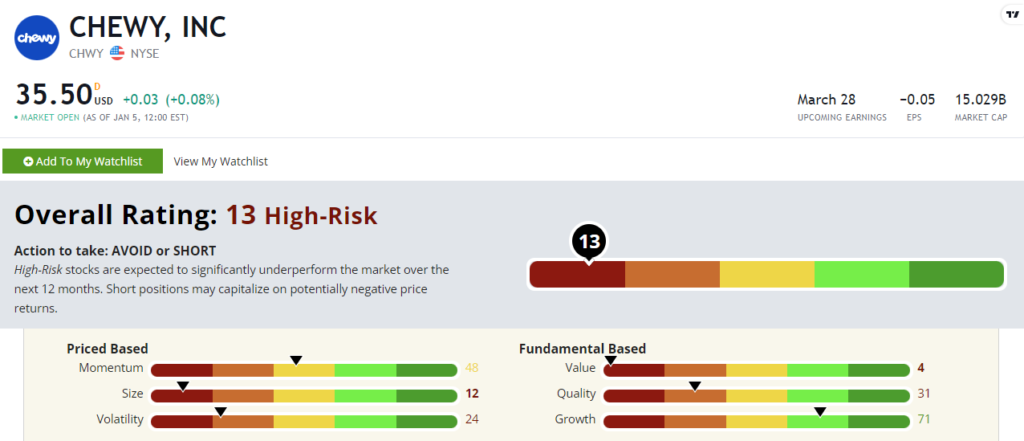

Looking at our proprietary Stock Power Ratings system, Chewy stock scores an abysmal 13 out of 100. That means its expected to underperform the broader market over the following 12 months.

Its growth factor rating of 71 is the lone bright spot. It has worked hard to establish itself as a leading online retailer for our furry friends, and that’s spurred a lot of fantastic growth.

But its also created a stock that investors were too eager to jump into following the 2020 coronacrash. Like many similar tech stocks, CHWY is overvalued (4 on the value factor), low-quality (31) and too large to deliver outsized gains (size factor rating of 12).

To see why Chewy rates poorly on momentum and volatility, just check out its recent stock movement. Over the last 12 months, Chewy stock is down 30%!

If you follow Stock Power Ratings, add this one to your “high-risk” file.

We’ll have to see if CHWY has a brighter 2023 after a rough year in 2022.