Micron Technology Inc. (Nasdaq: MU) is one of the largest semiconductor companies in the world, specializing in memory and storage solutions for both consumers and businesses. Here’s how Micron stock rates.

The company has been around since 1978 and has seen its share of ups and downs over the years.

Let’s take a look at how Micron got to where it is today and what we can expect from it in 2023.

A Brief History of Micron Technology

Micron Technology was founded in 1978 as a joint venture between Intel Corporation and Advanced Memory Systems.

Initially, the company focused on producing dynamic random access memory (DRAM) chips for personal computers and server applications. In 1983, Micron introduced its first DRAM chip, which was widely adopted by PC manufacturers such as IBM, Compaq and Apple.

In 1999, it acquired semiconductor manufacturer Texas Instruments’ memory business unit, which allowed it to expand into other markets such as image sensors, automotive electronics, embedded systems, medical devices, industrial automation products and more. It was an additional source of revenue for their core DRAM product line.

Over time, Micron continued to acquire more companies including Lexar Media in 2006 which allowed it to expand into NAND flash memory products for consumer electronic devices. If you’ve had a digital camera or MP3 player, there’s a good chance a Micron chip is embedded within.

Micron Stock Outlook for 2023

While there are always risks associated with investing in any company or sector within the stock market — especially during times of economic uncertainty — Micron’s stock outlook for 2023 could benefit from several factors:

- Growth in demand for memory products from new technologies such as artificial intelligence (AI) and 5G wireless networks.

- Increasing demand for their existing NAND flash products.

- Expansion into new markets such as industrial IoT.

- Increasing demand from cloud computing providers.

- And entering new partnerships with leading technology companies.

It appears that Micron will continue to be a leader within the semiconductor industry well into 2023 and beyond. But has that translated into a solid stock to invest in?

Micron Stock Power Ratings

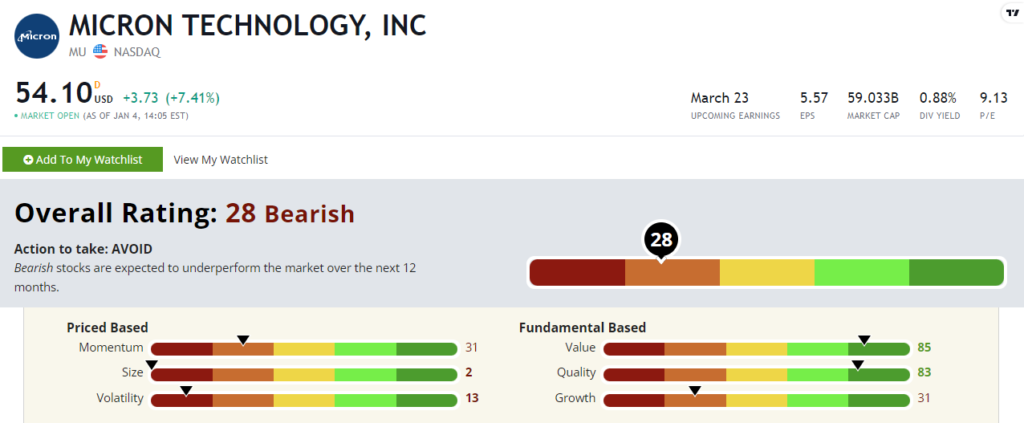

Here’s how Micron stock rates, according to our proprietary Stock Power Ratings system.

MU sports a 28 out of 100 rating in our system. That means its expected to underperform the broader market over the next 12 months.

While it boasts solid ratings on the value (85) and quality (83) factor, it scores in the red on its other four factor scores.

This is a massive company with a market cap north of $59 billion. Don’t expect a small-cap bump from investors piling into Micron stock. It scores a 2 on our size factor.

The stock has also lost 43% of its value over the last 12 months. That’s contributed to its abysmal momentum (31) and volatility (13) ratings.

Micron stock is one to avoid if you go by our Stock Power Ratings system.

Conclusion

Micron Technology is one of the leading semiconductor companies in the world today. With its focus on developing high-performance memory solutions for both consumers and enterprise applications, Micron should be a key player in the technology space.

Time will tell if its stock reflects some of this optimism as 2023 ramps up.