I have mortgages on my mind today because, alas, I’m looking for one. After months of house hunting, my family and I finally found one we liked under construction.

Now comes the fun part of having my financial life dissected and analyzed … I’ve often wondered if deep undercover operatives for the CIA have to disclose this much information.

Wish me luck.

While getting a mortgage is a monumental headache, investing in them is easy. And with the yield curve as steep as it is today, this is the time to do it.

All About Mortgage REITs

I’ve recommended plenty of equity real estate investment trusts (REITs) in Money & Markets. In case you aren’t familiar, REITs are a special class of corporation that avoid corporate taxation so long as they pay out at least 90% of their income in the form of dividends.

Avoiding corporate income taxes frees up a lot of cash. That’s why REITs pay such fantastic dividends. Every dollar not paid to the IRS is another dollar available to be paid to shareholders like you and me.

Mortgage REITs get the same tax benefits, but rather than own physical property, such as office towers or apartments, they own mortgage assets. These often come in the form of Fannie Mae and Freddie Mac bonds, and they juice them with a little leverage to get higher yields.

Here’s why that matters.

The Federal Reserve has kept interest rates pegged at zero, even while longer-term bond yields are near pre-pandemic levels again. Mortgage REITs can borrow at almost nothing and use the proceeds to buy higher-yielding mortgage bonds, most of which are guaranteed by Fannie Mae and Freddie Mac. It’s a license to print money.

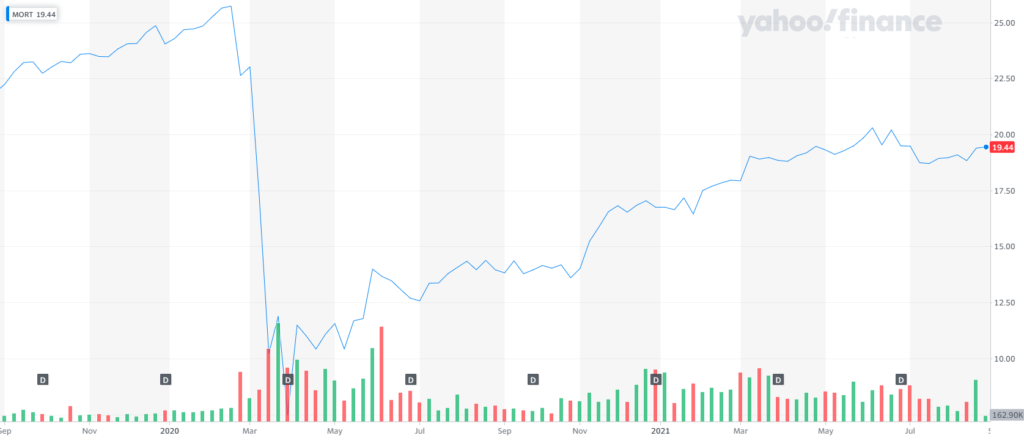

The COVID-19 pandemic dealt a massive blow to mortgage REITs last year. But investors are pouring money back in.

Mortgage REIT ETF Surges

The VanEck Vectors Mortgage REIT Income ETF (NYSE: MORT) is up almost 160% from its March 2020 lows. This is only a single fund, but it illustrates the broad trend that is happening now.

That brings me to our dividend stock of the week, Chimera Investment Corp. (NYSE: CIM). Chimera owns a portfolio of residential mortgages and agency and non-agency mortgage-backed securities. The REIT borrows cheap money, invest it in mortgage assets, and then returns the profits to investors as dividends. Rinse and repeat.

At current prices, CIM shares yield 8.7%.

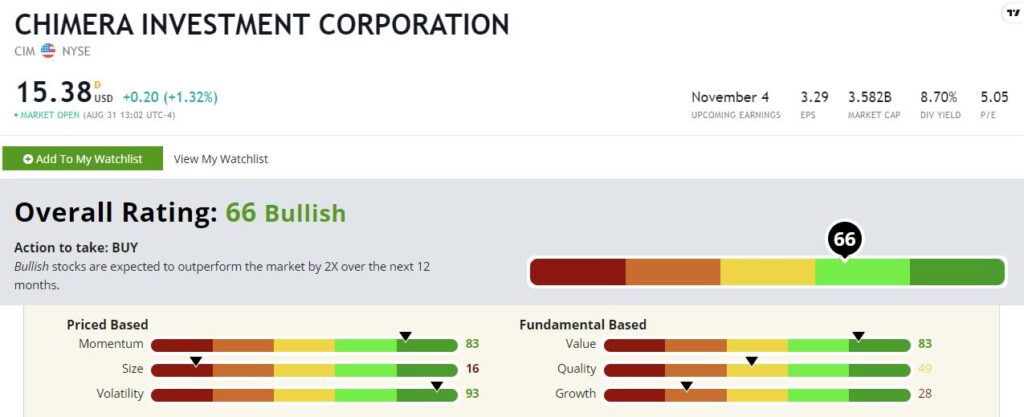

Chimera Stock’s Green Zone Rating

With a composite rating of 66 out of 100, Chimera is “Bullish” in our Green Zone Ratings system.

Chimera Investment Corp.’s Green Zone Rating on August 31, 2021.

Let’s dig a little deeper to see what’s driving that value.

Volatility — Chimera rates highest on our volatility factor with a rating of 93 (Remember, a high rating here denotes low volatility). That’s not uncommon. While mortgage REITs got choppy during the pits of the COVID-19 bear market, they’re designed to be low-drama income investments. When interest rates are stable, mortgage REIT prices tend to be stable as well.

Momentum — Last year’s massive correction also created the conditions for a fantastic move higher once the dust settled. Chimera has been trending higher for well over a year and rates a solid 83 on our momentum factor.

Value — Chimera also rates an 83 on value. The shares are nowhere near as cheap as they were a year ago, of course, but the price is still attractive. Chimera trades at a price-to-book ratio of 1.0, whereas blue-chip mortgage REITs will often trade at a significant premium to book value.

Quality — Chimera rates in the middle of the pack on quality with a rating of 49. That’s OK. Most mortgage REITs won’t score well here, as their high debt tends to penalize them.

Growth — Chimera also rates a very modest 28 on growth. But again, mortgage REITs are designed to throw off income. That’s it. They’re not growth investments.

Size —Chimera is large for a mortgage REIT with a market cap of about $3.6 billion. It rates a 16 on our size factor.

Bottom line: If you’re looking for explosive growth, mortgage REITs aren’t for you. But if you’re looking for a solid dividend yield in a stock that’s trending higher, consider making some room for Chimera in your portfolio.

To safe profits,

Charles Sizemore

Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.