The first major salvo in the global chip war has been fired.

On Monday, the Chinese government’s State Administration for Market Regulation announced it was launching an investigation into Nvidia Corp. (Nasdaq: NVDA) and its acquisition of Mellanox.

The agency said the investigation was being launched as it suspected Nvidia violated China’s anti-monopoly law.

It’s also in response to the Biden administration’s announcement last week of a crackdown on exports from 140 Chinese chipmaking companies.

The American crackdown curbs shipments of high-bandwidth memory chips — those necessary for applications related to artificial intelligence (AI) training — to China.

Nvidia had been working to create products to sell to China that would not run afoul of the new regulations.

The market responded to China’s announcement, and NVDA stock was more than 2% lower in morning trading on Monday.

Banks Win November Stock Bump

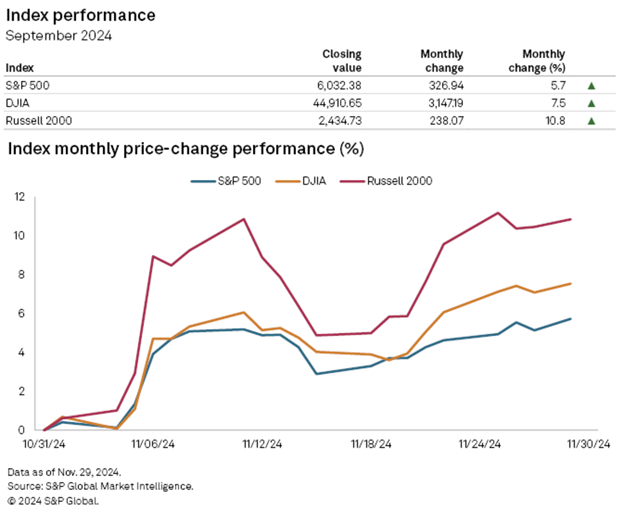

The S&P 500 experienced its best one-month performance in November – rising 5.7% – due to a post-election stock bump that lifted all markets.

In the final two weeks of the month, it was bank stocks that won the day as the KBW Nasdaq Bank Index jumped 3.7% from November 20 to November 27… compared to the S&P 500’s 1.4% rise.

Bank stocks rallied post-election due to market expectations of reduced regulation under the Trump administration in 2025, including increased support for M&A activity.

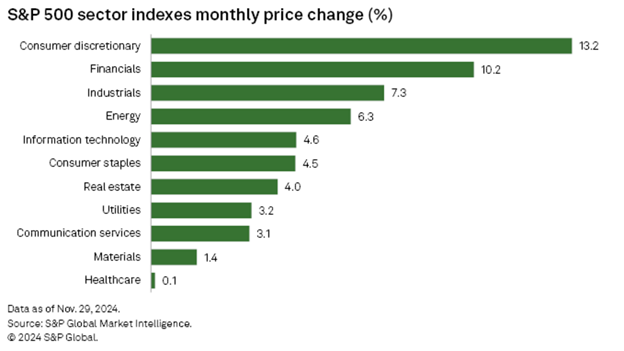

For the entire month, consumer discretionary stocks posted the largest gains, as all but six of the sector’s 50 stocks rose.

Amazon.com Inc. (Nasdaq: AMZN) and Tesla Inc. (Nasdaq: TSLA) rose 11.5% and 38.2%, respectively.

In the financial sector, only four of the 72 sector stocks in the S&P 500 fell during November.

The Largest Sports Contract in History

What if I told you I would pay you $765 million over the next 15 years?

You’d be pretty excited, right?

Well, that’s precisely what the New York Mets did with former New York Yankees outfielder Juan Soto on Sunday.

For reference, Soto’s contract is worth more than the $341.8 million Mets’ owner Steve Cohen shelled out for the entire team roster in 2024.

Under the terms of the deal, Soto will make $51 million per year for the first five years of the agreement. If he does not opt out of the contract after the fifth year, his annual pay will go up to $55 million for the remaining 10 years.

Soto’s former team, the Yankees, did offer a 16-year, $760 million contract with an average annual salary of $47.5 million, but the outfielder elected to move from the Bronx to Queens.

The Mets’ contract surpasses the previous contract record — the 10-year, $700 million deal signed by Shohei Ohtani and the Los Angeles Dodgers.

Home for the Holidays?

How is Christmas a little over two weeks away already?

Thanks to a late Thanksgiving, we’re now in the midst of an incredibly tight holiday season.

We’re wondering how that’s changing your preparations for Christmas, Hanukkah, Kwanzaa or any other festivities you’re planning for.

This week, we’ll focus on the travel side of the equation with another Money & Markets Daily poll.

We want to know: Are you traveling for the holidays, or are you staying put?

Participate in our latest poll below.

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets