Russia’s military prepared for its invasion of Ukraine for some time.

But the war isn’t proceeding as it planned.

Now, we know to expect this in military operations.

A Prussian field marshal noted in the 1800s that no plan of operations extends with certainty beyond the first encounter with the main enemy forces.

Military units know they’ll have to adapt once the battle begins.

However, bankers may not understand that.

Russian bankers seemed well prepared.

In recent years, Russia built up more than $640 billion in foreign currency reserves.

It intended for this pile of money to help stabilize the economy after the U.S. and EU imposed economic sanctions.

But the sanctions exceeded expectations.

According to The New York Times:

Americans are barred from taking part in any transactions involving the Russian central bank, Russia’s National Wealth Fund or the Russian Ministry of Finance.

Any Russian central bank assets that are held in U.S. financial institutions are now stuck, and financial institutions outside the United States that hold dollars for the bank cannot move them. Because the United States has acted in coordination with European allies, Russia’s ability to use its international reserves to support its currency has been curbed. Japan joined with Western allies in imposing the central bank sanctions, freezing Russia’s yen-denominated foreign reserves.

Now, Russia faces military and financial setbacks.

China Learns From Russia’s Setbacks

This lesson isn’t lost on China.

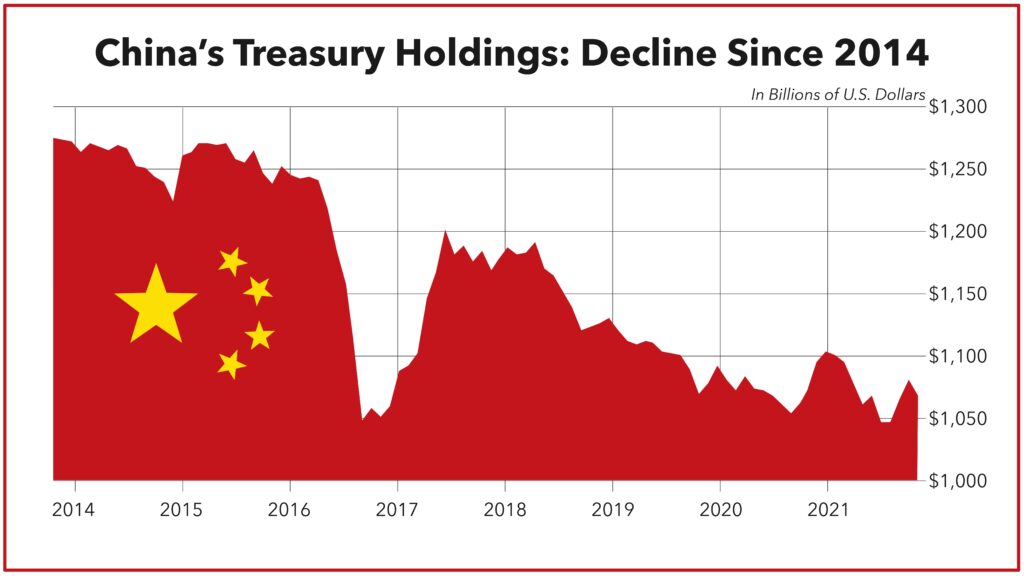

The chart below shows the amount of U.S. Treasury securities China holds.

Source: Treasury Department.

China’s holdings grew from about $59 billion in 2001 to almost $1.3 trillion by 2014.

Since then, even as Chinese exports increased, its holdings of Treasurys have decreased.

This chart shows the results of a deliberate decision: China has reduced its exposure to the dollar for almost eight years now.

Takeaway: It’s important that we watch this data in the coming months.

If China accelerates the trend, lower demand for Treasury securities will cause U.S. interest rates to spike.

Michael Carr is the editor of True Options Masters, One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.

Click here to join True Options Masters.