Some of the smartest economists in the world set interest rate policy for the Federal Reserve. At least, we hope the Fed includes some smart economists.

But some top economists are worried it’s already too late for the U.S. economy.

Being smart isn’t enough. As investors and consumers, we need the Fed to be decisive and aggressive when fighting inflation. With the consumer price index at 7.5%, we have reasons to doubt the Fed’s effectiveness.

Another top economist is worried that the Fed waited too long to begin its fight.

El-Erian’s Stark Warning on Interest Rate Hikes

Mohamed El-Erian is the former CEO and Co-Chief Investment Officer of the bond management giant Pimco. Now the Chief Economic Adviser to Allianz, El-Erian wrote that the Fed’s delay means it will be forced into a tight spot.

El-Erian believes there is just a 10% probability the Fed can now raise rates without hurting the economy.

El-Erian’s most likely outcome for interest rate hikes is “that economic growth is severely damaged by a late Fed that is forced into slamming on the policy brakes in response to persistently high inflation.” He assigns this outcome a 40% probability.

Seeing the challenge that lies ahead, El-Erian believes there’s a 30% chance that the Fed gives up on its inflation target and goes back to saying inflation is transitory.

He also warned of a 20% probability that the Fed creates stagflation, the high-inflation, low-growth environment that persisted in the late 1970s and early 1980s.

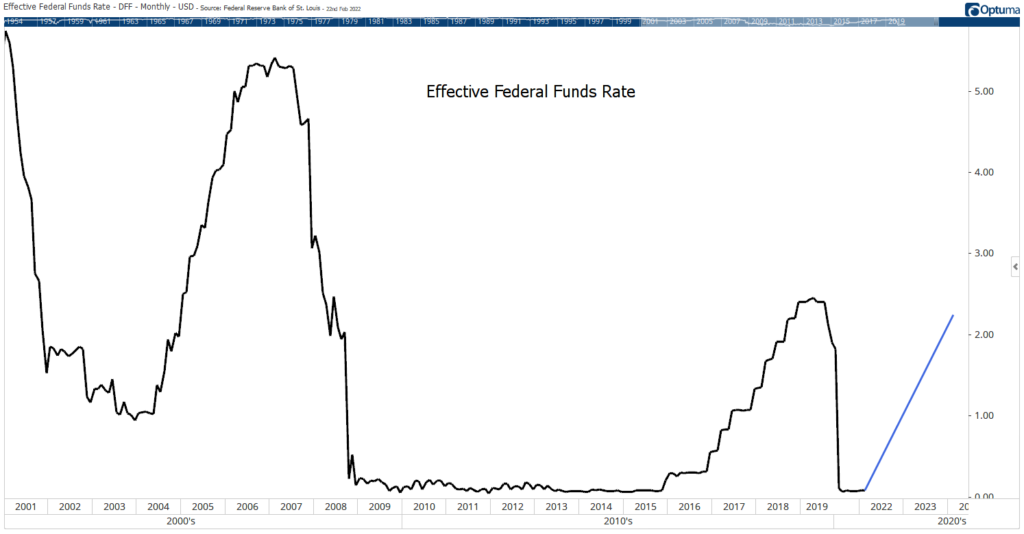

After creating the chart below based on JPMorgan research, I am confident the Fed will damage the economy.

Interest Rate Hikes: Too Far, Too Fast

Analysts with the central bank expect the Fed to announce rate hikes after each of its next nine meetings. That would put short-term interest rates at about 2.5% by March 2023.

Charting that allowed me to visualize the rate hikes. The economy would slow with the yield curve rising that fast.

With the low probability of the Fed engineering a pleasant end to inflation, we need to consider the worst-case scenarios and investing accordingly.

Click here to join True Options Masters.