Some defense experts worry that China could threaten the interests of the United States in the Pacific. This threat is based on China’s growing military and economic capability.

Others worry that China’s diplomatic initiatives in Africa and South America are a growing threat in those regions. This threat comes from China’s ability to finance and complete large infrastructure projects.

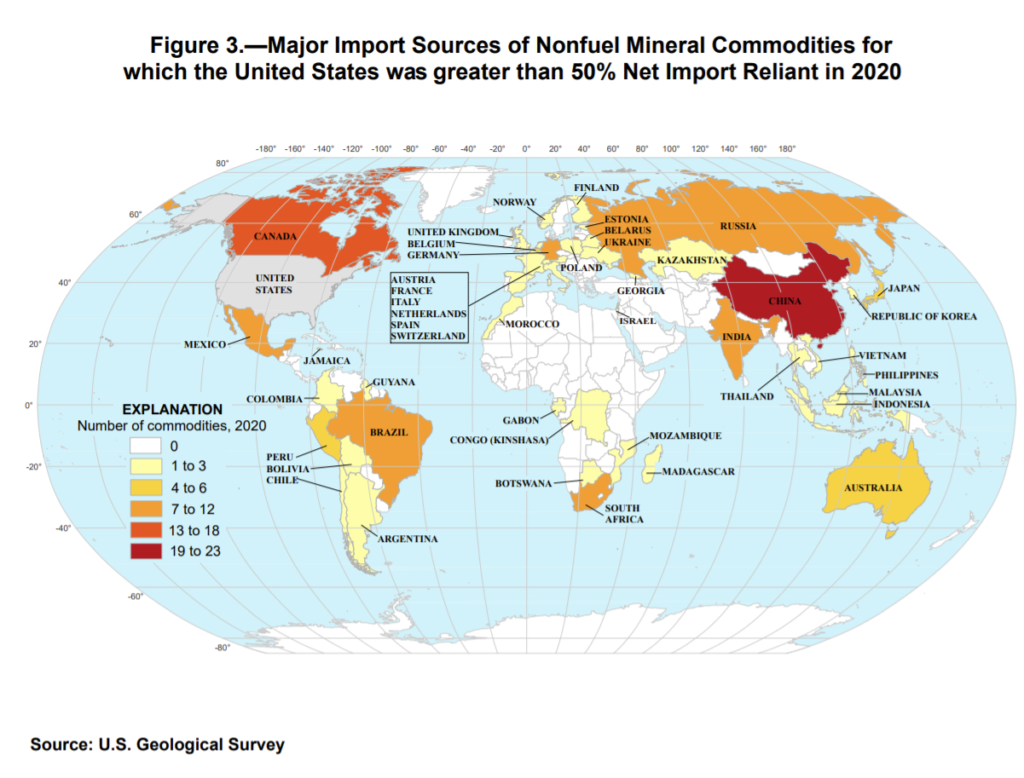

These are traditional and long-standing threats. But China could threaten the United States in other, more subtle ways. In its latest report, the U.S. Geological Survey (USGS) noted that the U.S. is dependent on China for almost two dozen minerals — arsenic, importantly, amongst them.

The chart below shows that no other country presents a similar threat to national interests.

U.S. Mineral Imports by Country

Source: USGS.

China Is in a Stronger Position Than Many Realize

These subtle threats related to mineral imports are not widely understood.

The U.S. has not produced arsenic since 1985 but used more than 10,000 tons of the metal last year. China provides the U.S. with 91% of the high-quality arsenic imports. Substantial quantities of lower quality metal are available from Morocco. But arsenic is relatively rare in the world.

Arsenic is primarily used in pressure-treated lumber. It’s also used in batteries, lasers and solar panels. There are substitutes for most of these uses.

Importantly, the USGS notes, “In many defense-related applications, gallium-arsenide (GaAs)-based integrated circuits are used because of their unique properties, and no effective substitutes exist for GaAs in these applications.”

In the case of arsenic, China can restrict imports to the U.S. and adversely affect national security.

Arsenic is just one of 14 critical materials that the U.S. needs to import. And there is no solution in many cases. China controls the flow of many minerals to the U.S.

This demonstrates the need for the Biden administration to find a way to work with China. Time will tell if such a way can be found.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.